The US has maintained a significant trade deficit for decades, but imposing the new President Trump tariffs will unlikely lead to improving the situation.

The trade deficit is the result of years of industrialisation and the shift of manufacturing elsewhere, and simply imposing tariffs is unlikely to reverse the long-term decline. Further, even if companies do return, manufacturing is increasingly automated, meaning this will not guarantee wider economic stimulus through mass employment.

They will most likely antagonise rivals, as well as allies, with the potential for serious escalation.

Tariffs will not reverse trends toward automation

The US balance of payments has been in deficit for decades, with the last recorded surplus in 1975.

Deindustrialisation took its toll, as free trade agreements and globalisation saw many manufacturing firms relocate elsewhere. While production may come back as a result of protectionism, advances in automation mean jobs aren’t likely to be restored in the same number.

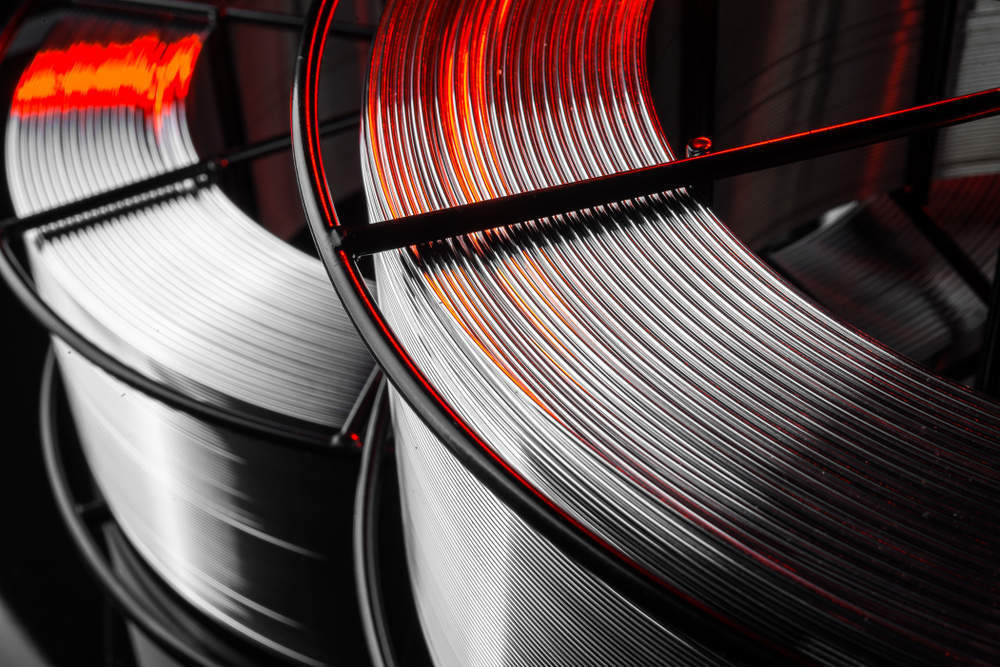

In 2017 Austrian producer Voestalpine opened its Donawitz mill, which employs only 14 people but produces 500,000 tons of steel wire annually. Any significant investment in the industry will likely result in further automation, but even investment isn’t guaranteed. Companies may be reluctant to invest, as there’s no guarantee that the tariffs will still be in place after 2020.

US manufacturing lacks capacity for domestic demand

The US is the largest importer in the global economy, but falls behind China and the European Union (EU-28) in terms of exports. The steel and aluminum tariffs Trump is imposing affect nine of its top 15 trading partners in the year-to-date for 2018.

China’s position as the second largest economy and world’s largest manufacturing base has seen it become the largest reason for the US’ trade deficit. The Bureau of Economic Analysis estimated in 2017 that the US’s trade deficit with China is $335.7bn, with the second largest trade deficit, Mexico, at $68.7bn. According to Eurostat figures, China was the largest exporter in 2016, accounting for 17% of global exports.

Trump’s steel and aluminum tariffs have some merit in not exempting its North American Free Trade Agreement (NAFTA) partners and the EU, as these countries accounted for 40.2% of US steel imports. Canada and the EU are the largest and second largest respectively.

China, often cited as the alleged cause of the US’ steel industry woes, accounted for less than 2.1% of steel imports in 2017.

Allies have imposed retaliatory tariffs

The knock-on effect of targeting allies is they have also responded in kind. They have also targeted other industries, which mean any merits delivered to the steel industry may be outweighed by the damage done elsewhere.

Canada has targeted steel, yoghurt and whiskey, while Mexico announced tariffs on whiskey, cheese, fruit steel, bourbon, and pork. 34.3% of US exports go to its NAFTA neighbours.

The EU has targeted goods such as bourbon and Harley-Davidson. Harley-Davidson’s largest export market includes Europe, representing 16.1% of its motorcycle sales in FY2017.

A related MarketLine report can be found here.