What is 5G actually for? The use cases most commonly cited include autonomous vehicles, the Internet of Things (IoT), and smart cities, but these all require more than just fast, responsive networks if they are to become pervasive. What is 5G in business and what are the main considerations?

The term ‘5G’ does not refer to a single specific technology. While the fifth generation of mobile technology will be based on the IMT-2020 standards, developed and approved by 3GPP, 5G is perhaps best understood as a marketing concept, similar to the way that previous generations (3G, 4G) were loosely mapped to IMT specifications.

Why does 5G matter for business?

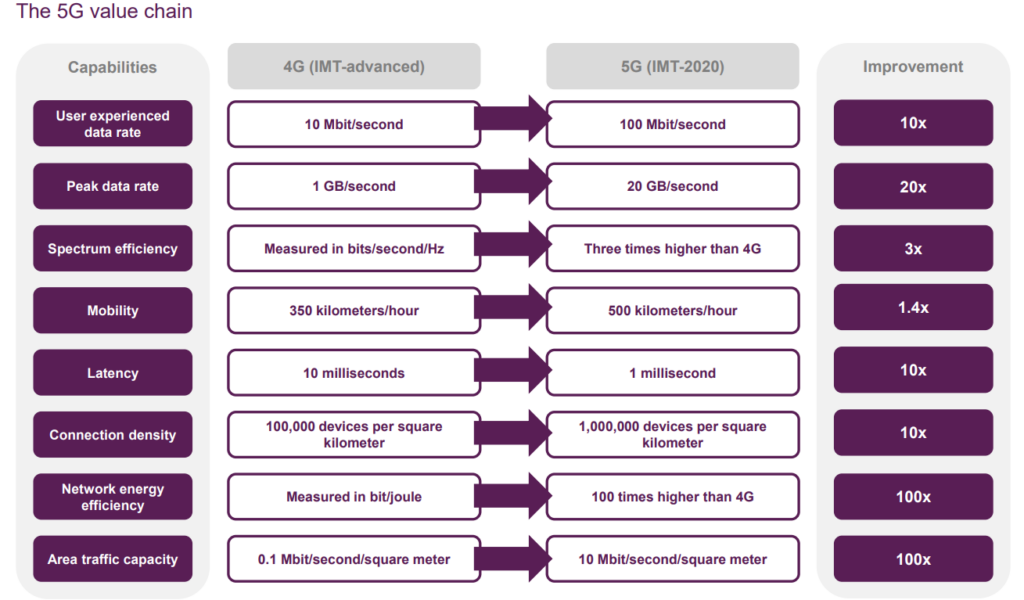

Previous wireless generations have delivered increased bandwidth and capacity but 5G will go further, adding low latency, high density and improved reliability. These capabilities will be fundamental to the provision of emerging technologies such as autonomous vehicles and augmented reality, which will have a major impact across industries. In recent years, telecom operators have struggled to turn growing demand for mobile data services into revenue growth, but 5G will open up a range of fresh revenue streams, particularly in vertical markets like energy and utilities, manufacturing and healthcare. A 2017 study from Ericsson estimated that the 5G-enabled revenue opportunity for operators would be worth around $582bn by 2026.

The race to be a leading player in 5G is well underway, with governments eager to harness the economic benefits of the technology, which include GDP growth and job creation, while at the same time ensuring they avoid the negative implications of falling behind.

What are some of the big themes around 5G?

The range of possible frequencies gives operators options

5G is capable of supporting a wide range of frequency bands, from sub-1 gigahertz through to 40 GHz and above, as well as shared and unlicensed spectrum. Consequently, operators can choose from a number of different deployment strategies.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFixed wireless is an oft-overlooked 5G use case

The International Telecommunication Union (ITU) splits use cases for 5G into three main categories: enhanced mobile broadband, with high-definition video and augmented/virtual reality (AR/VR) as notable early applications. Massive machine-type communications, enabling the growth of the IoT by supporting the rapid growth in the number of connected devices and ultra-reliable and low-latency communications, most commonly discussed in relation to autonomous vehicles but also important for the application of IoT in verticals such as healthcare and manufacturing. Initial 5G deployments will involve an often overlooked use case, namely fixed wireless broadband.

Network virtualization supports the 5G business case

The shift to 5G will require a significant capital outlay, due to the need to deploy many more cells to ensure adequate propagation of higher frequency spectrum, associated high capacity backhaul requirements and assorted other costs like new spectrum licenses. Operators will, therefore, be looking for strategies that allow them to deliver cost-savings and increase efficiencies while, at the same time, supporting new 5G-enabled service lines and revenue streams.

What is the history of 5G?

There were just over half a billion 4G subscriptions worldwide in 2014, equivalent to about 7% of the total, nearly 60% of global subscriptions were 2G in 2014. By 2018, the number of 4G subscriptions is expected to have grown to 3.6 billion, at a compound annual growth rate (CAGR) of 62%, giving 4G a 43% share of all mobile subscriptions. In several markets, 4G penetration is much higher – in the US, for example, 80% of all mobile subscriptions are forecast to be 4G in 2018, and the ratio is similar in South Korea.

The impact of 5G on mobile subscriptions is set to be even more dramatic, once the technology becomes available. The first 5G subscriptions will appear in 2019, but there will be fewer than 5 million worldwide. However, by 2023 the total will have increased to nearly 850 million, at a phenomenal CAGR of 271%. The share of mobile subscriptions that are 5G is expected to jump from 0.05% in 2019 to more than 8% by 2023.

It should be noted that, while much of the attention over the coming years will be on 5G, the number of 4G subscriptions will continue to rise for the foreseeable future, hitting 6.3 billion by 2023, with a CAGR between 2018 and 2023 of 12%. 4G will account for 63% of all subscriptions by 2023, up from 43% in 2018, having gained from the decline in 2G and 3G subscriptions – 2G will make up just 9% of the market in 2023, down from 30% in 2018.

While 2G has largely been surpassed by newer generations of cellular technology in countries such as the US, where it is expected to make up less than 2% of subscriptions in 2018 and Japan, just 1% of 2018 subscriptions, it has shown greater resilience in less-technologically advanced regions. In the Middle East and Africa, for example, 2G will account for 45% of all subscriptions in 2018, while in Emerging Asia, a regional subcategory that incorporates 35 countries including Bangladesh, China, India, Indonesia, Malaysia, Myanmar, Pakistan, Philippines, Sri Lanka, Thailand and Vietnam, 2G is expected to make up nearly 35%.

However, these numbers will start to collapse over the coming years as 3G and, more significantly, 4G penetration increases. By 2023, 4G will have a 41% share of subscriptions in the Middle East and Africa, while in Emerging Asia 4G is forecast to command 71% of mobile subscriptions in 2023, with the total number of 2G subscriptions in the region expected to fall by nearly 1 billion in the five years between 2018 and 2023.

The last few years have witnessed an explosion in the amount of data transmitted across mobile networks. Indeed, the need for greater capacity to cope with this increased volume is one of the reasons why 5G has developed significant momentum. Global mobile data traffic will hit 208 million terabytes (TB) in 2018, up from just over 30 million TB in 2014 with a CAGR of 62%. Growth is expected to continue over the five years to 2023 although the CAGR will be lower, at 26%.

5G will not begin to make an impact on data traffic until 2019 and, even then, its use will be dwarfed by other, more established technologies. 5G data traffic will make up 0.09% of the total in 2019, compared to 4G’s 77% and 3G’s 22%. However, the use of 5G is expected to increase rapidly until, by 2023, it is used for more mobile data traffic than 3G, 5G will account for 13% of mobile data usage in 2023, compared to 11% for 3G. 4G will continue to be the most-used technology, securing three-quarters of all data traffic in 2023.

The 5G story… … how did this theme get here and where is it going?

- 2012: The ITU-R starts work on a program to develop International Mobile Telecommunications (IMT) systems for “2020 and beyond”.

- 2012: Plans are announced for a “5G Innovation Centre” at the UK’s University of Surrey.

- 2013: The European Commission pledges €700m in funding for 5G networks as part of its Horizon 2020 program.

- 2015: The ITU-R publishes its “vision”, including a set of requirements for IMT-2020 (5G).

- 2016: Verizon announces the completion of its own 5G radio specification and reveals that pre-commercial testing is underway.

- 2016: The EU publishes its “5G for Europe Action Plan”, a roadmap for public and private investment on 5G infrastructure.

- 2016: In the US, the FCC approves new rules opening up high-band spectrum for 5G wireless services.

- 2017: The 3GPP signs off first 5G specification, a major step towards the establishment of commercial 5G networks.

- 2017: China’s three major operators pilot 5G technology in several cities during the second half of the year.

- 2018: The Winter Olympics in Pyeongchang, South Korea features demonstrations of 5G applications.

- 2018: South Korea completes its 5G spectrum auction, with rollout expected to be in December.

- 2018: The 3GPP agrees to standalone 5G specifications, allowing for deployment in places that may lack existing infrastructure.

- 2018: UK mobile operators spend a combined £1.4bn in an auction of 2.3 GHz and 3.4 GHz spectrum.

- 2018: AT&T announces plans to offer mobile 5G to customers in a dozen US cities by the end of the year.

- 2019: First 5G-ready mobile devices expected to launch.

- 2019: Next iteration of 5G standards – Release 16 (NR Phase 2) – expected to be completed by the end of 2019.

- 2020: At the Summer Olympics, host city Tokyo is expected to use 5G technology to enable “smart city” applications.

- 2023: There will be more than 800 million active 5G mobile subscriptions worldwide.

This article was produced in association with GlobalData Thematic research. More details here about how to access in-depth reports and detailed thematic scorecard rankings.