The US consumer service market entered the year feeling inverted, with both the cable operators and the national wireless heavyweights having just reeled off quarter after quarter of headline-generating success in the other group’s backyard.

Both those trends persist as we hurdle into the final month of Q3 2024.

If anything, events over the summer have hastened the struggles for the US cable players in the broadband market, and much of that hurt comes at consumer service Fixed wireless access’s (FWA) gain. Moreover, it’s those very same internet struggles for Comcast and Charter – the US market’s two cable behemoths – that increase the necessity for the companies’ mobile virtual network operator (MVNO) outfits to remain aggressive throughout 2024’s denouement, thus ensuring the home stretch of 2024 will look as upside down as the rest.

FWA players remain the hot new kids in home internet consumer service

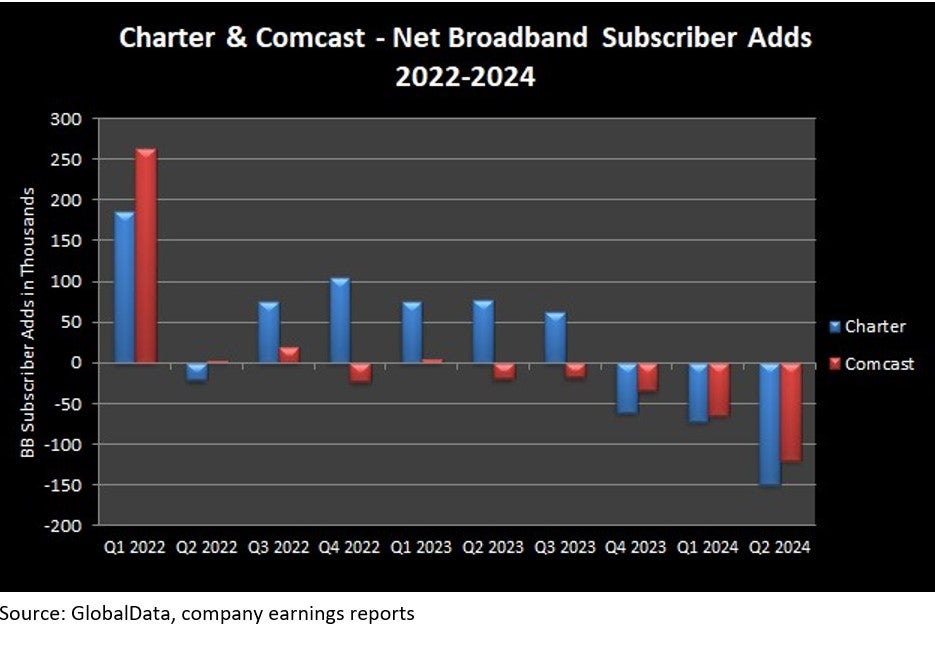

Comcast and Charter registered a combined 264,000 net broadband subscriber losses in Q2 2024. This marks an escalation of a troubling trend, with the companies seeing a combined subscriber loss in the space over each of the last three quarters.

While the cable operators’ ability to notch year-over-year growth in their broadband revenue (+1.9% for Charter and +3% for Comcast) speaks to how pricing actions and incentivized upward service migration can mask problems in the balance sheet in the near term, keeping up the annual drumbeat of billing increases in order to maintain ARPU growth isn’t a sustainable long-term strategy. In fact, one could argue that the US cable operators’ long legacy of persistent bill increases stoked negative consumer sentiment to the point of driving some customers to make a switch once a reasonable alternative became available.

In the other corner, the three nationwide US wireless operators – T-Mobile, Verizon, and AT&T, in order of their FWA subscriber counts – reeled in another 933,000 net subscriber additions among them. Furthermore, while T-Mobile and Verizon will slow their acquisition cadence as they close in on their initial FWA targets, AT&T is only just getting started, expanding its Internet Air FWA offer into 67 new markets just last week.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataMobile is the silver lining on cable’s balance sheet

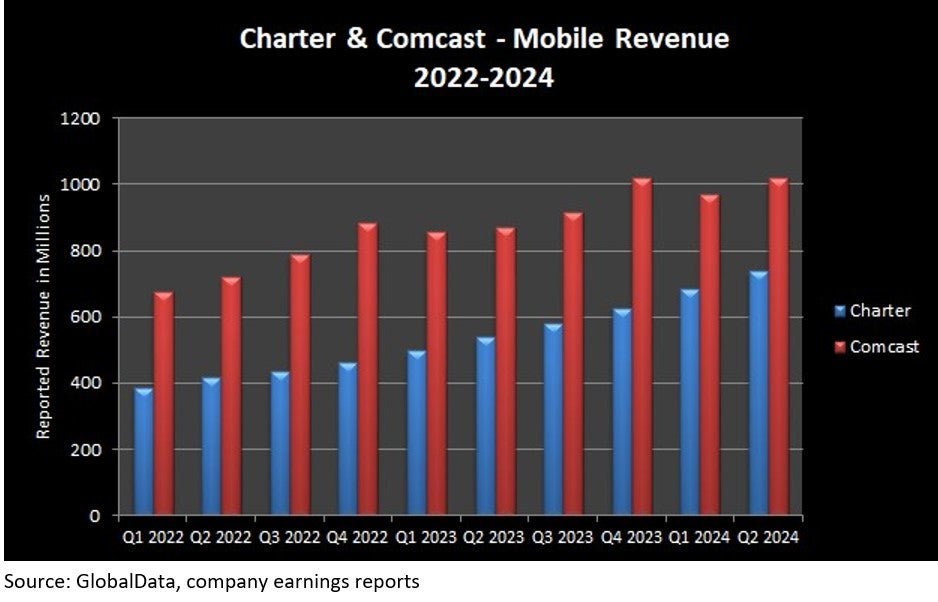

While the net mobile line add counts from Charter (577,000) and Comcast (322,000) were no doubt considerable comfort given the bleeding elsewhere in their service portfolios, it’s the 37% revenue increase Charter saw from Spectrum Mobile that will make investors’ socks roll up and down.

Market watchers far and wide have put a tremendous amount of scrutiny on Charter’s ability to convert its bonanza of free-line mobile additions from 2023 into paying customers. Consequently, Charter’s Q2 mobile revenue figure carried a little extra weight during the earnings season post mortem.

Comcast, too, saw significant mobile revenue growth during the quarter (+17%), and its mobile line adds represented Xfinity Mobile’s best tally in over a year. Most importantly, its mobile revenue once again crested a billion dollars, as Comcast’s more measured approach to mobile subscriber acquisition and convergence discounting continues to make the most of the beneficial margins enjoyed by its MVNO.

Cable’s mobile aggression is just getting cracking

Moving forward, Charter aims to begin prying loose multiline mobile accounts at wireless rivals tied to device contracts and, in doing so, add more premium, revenue-generating subscribers to its mobile mix. Recent moves along that line would include the ‘Anytime Upgrade’ feature added to Spectrum Mobile’s top-tier Unlimited Plus plan in early April 2024 and the device payoff program launched in May 2024 for customers switching to Spectrum Mobile.

Meanwhile, on the device promo front, Comcast’s Xfinity Mobile remains the most active of the US cable MVNOs by a considerable margin, offering over twice the number of smartphone deals as Charter’s Spectrum Mobile in Q2 2024. That activity is likely to intensify; the higher-ups at Comcast see leaning into its handset promo activity and trade-in program as avenues toward poaching more mobile switchers from among the existing broadband base.

That last part is the name of the game as the US consumer space continues toward convergence. Building a substantial and sustainable base of subscribers for a holistic consumer service proposition demands addressing asymmetries – or, to put it more bluntly, taking some more real estate from your rivals’ backyard.

Related Company Profiles

Comcast Corp

Charter Hall Group

T-Mobile US Inc

Verizon Communications Inc

AT&T Inc