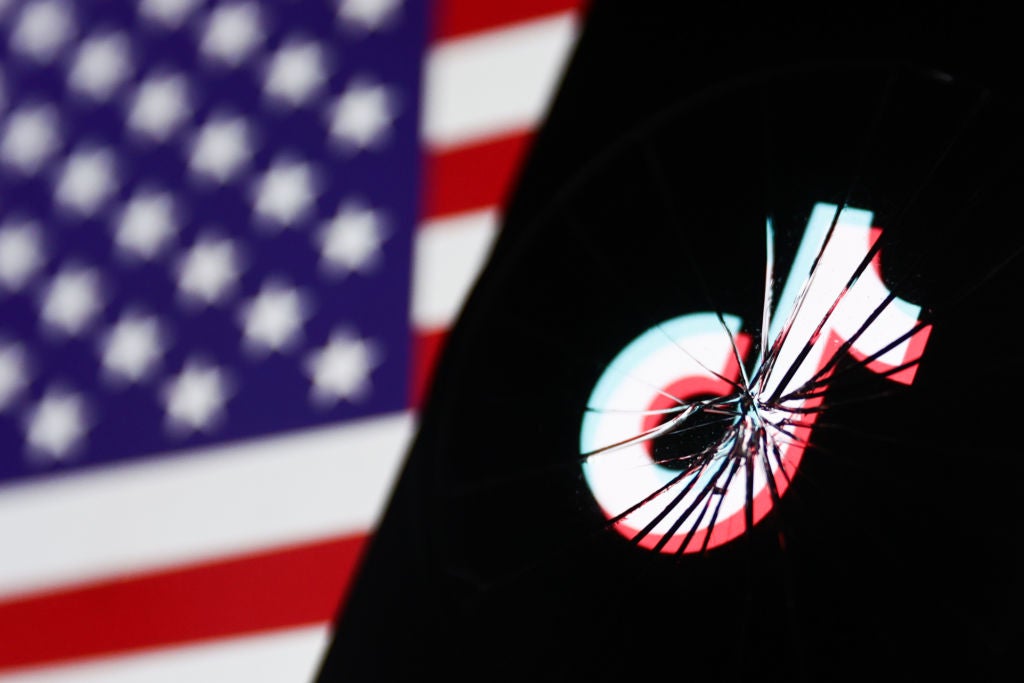

Bitcoin prices jumped by 13% on Tuesday on the back of new Western sanctions on Russia for its invasion of Ukraine. Cryptocurrencies are becoming a more mainstream part of the global financial system – and therefore a part of international conflict too. In the current crisis, bitcoin is serving as a conduit for millions of dollars of aid to Ukraine and an alternative to traditional banks, free from government control. It could also help Russia sidestep sanctions.

Once a niche activity, Bitcoin mining became mainstream news when it took down Kazakhstan’s national power grid in January 2022. Home to one-fifth of the world’s Bitcoin mining activity, the country’s state electricity provider cut the supply to Kazak bitcoin miners following power outages across three countries in Central Asia.

Bitcoin is not new to controversy, from its association with crime and money laundering to facilitating trade in contrabands on the now defunct dark web equivalent of eBay – Silk Road. However, there are real-world indicators that cryptocurrency, along with its associated mining activities, has become a legitimate prospect for mainstream investors. In a landmark decision on 7 February 2022, Nasdaq approved crypto asset manager Valkyrie’s application to list its exchange-traded fund (ETF), offering exposure to stocks in Bitcoin mining companies. The Valkyrie Bitcoin Miners ETF will invest at least 80% of its net assets in securities of companies that derive a minimum of 50% of their profit from Bitcoin mining, according to the Securities and Exchange Commission’s filing.

Yet at the same time as both mainstream and institutional investors acknowledge the investment potential of Bitcoin mining, the industry faces another perhaps more significant hurdle: its undeniable increasing energy consumption.

Energy intensive and highly lucrative, global Bitcoin mining operations have sprung up in locations with favourable (or else a vacuum) of regulation and an abundance of cheap power. High-profile cases such as Kazakhstan’s energy crisis mean the sector can no longer slip under the radar of policymakers. In fact, Bitcoin mining is facing increasing regulatory scrutiny, as shown by the Chinese government’s blanket ban in May 2021, which shifted the global centre of gravity of Bitcoin mining elsewhere, a ripple effect that saw countries such as Kazakhstan and Russia pick up the slack.

However, the scrutiny of policymakers follows the sector wherever it moves. Russia’s central bank issued a consultation paper in January 2022 recommending the ban of production, trading and investing in cryptocurrencies. Policymakers have voiced concerns in countries as disparate in legislation as Georgia, Iceland, India, Iran, Kosovo and Sweden. Environmental concerns, in particular, have been cited by high-profile detractors including Erik Thedéen, the vice-chair of the European Securities and Markets Authority, and US senator Elizabeth Warren.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataDespite the hurdles linked with politics and energy consumption, the value of Bitcoin continues to increase over time, albeit with quite spectacular spells of volatility – as demonstrated by a $1trn crypto market loss between November 2021 and February 2022. The current conflict too, has only highlighted Bitcoin's volatility – before rebounding on Tuesday, Bitcoin fell, along with the S&P500, when Russia invaded Ukraine.

Volatility aside, Bitcoin mining remains a highly profitable business. For example, US company Riot Blockchain is the single largest Bitcoin mining and hosting facility in North America. The company increased its revenue to $64m for the three-month period ending on 30 September 2021, representing a 2,532% increase from the same period in 2020, when the figure stood at $2.5m. Returns such as these mean investors are unlikely to give up on the lure of today’s equivalent of digging for gold.

What exactly is Bitcoin mining?

Bitcoin began the way of many a bright idea: with a white paper. 'Bitcoin: A Peer-to-Peer Electronic Cash System', written by the elusive Satoshi Nakamoto, was published on 31 October 2008, the name Bitcoin a compound of a computer ‘bit’ and ‘coin’. The open-source software for Bitcoin was released in January 2009 and to this day Nakamoto’s identity is hotly debated.

An origin shrouded in mystery only adds to the allure of Bitcoin. A cult following of early adopters imagined themselves pioneers of a libertarian financial system offering trading freedoms to the masses. In the intervening years some have reaped rewards beyond their wildest imaginations, while others have lost fortunes – and while cryptocurrencies have made their way into mainstream investor portfolios, the same attention is not afforded to the sometimes gritty business of where this novel financial asset comes from. Until now.

Bitcoin mining is the equivalent of the existing financial system’s central bank process of printing money. The difference is that in a decentralised cryptocurrency ecosystem this is done through the so-called meritocratic process of ‘mining’. This is essentially an open competition in which the first ‘miner’ to solve a complex computational puzzle is rewarded in Bitcoin.

Bitcoin’s source code launches a new puzzle approximately every ten minutes. Miners all over the world race to solve it with the winning miner rewarded with 12.5 freshly minted Bitcoin. These computational tasks serve the dual purpose of creating new currency as well as processing and verifying the transactions, which go into forming a block on the blockchain. This verification process of transactions is called proof-of-work and each completed block contains about 2,500 verified transactions.

In the early days of Bitcoin, a lone miner with a laptop anywhere in the world could earn themselves Bitcoin. As more miners entered the fray, mining operations, or ‘rigs’, have grown to the size of entire warehouses full of computers and huge amounts of computational power. Bitcoin’s source code has an inbuilt mechanism for adjusting the difficulty of the computational puzzle required to mine Bitcoin so that the rate of new puzzles launched remains about one every ten minutes – but here’s the kicker: Bitcoin’s source code only allows for a finite 21 million Bitcoins. At the rate of one puzzle every ten minutes, all 21 million Bitcoins will be mined by 2041.

With sufficient energy resources, computer hardware and intellectual capital there are still significant sums to be made. Mining operations have become increasingly sophisticated and (ironically when considering the decentralised dream of its pioneers) centralised. Major global hubs for Bitcoin mining have emerged, as have large-scale operations, and there are a raft of competing coins to be mined including Ethereum, Solana and Cardano, to name a few.

While critics are keen to point out that if Bitcoin were a country, it would rank in the top 30 worldwide for energy use, research from digital asset investment company CoinShares suggests Bitcoin mining’s impact on carbon emissions is minimal, especially when compared with the global financial system. Bitcoin mining is responsible for less than 0.1% of global emissions and “the emission costs of Bitcoin are dwarfed by its benefits”, says the report.

The Cambridge Bitcoin Electricity Consumption Index warns against apples-to-oranges comparisons, however. For instance, contrasting Bitcoin’s electricity expenditure with the yearly footprint of entire countries with millions of inhabitants gives rise to concerns about the cryptocurrency's energy hunger spiralling out of control. On the other hand, these concerns may, at least to some extent, be reduced upon learning that certain cities or metropolitan areas in developed countries are operating at similar levels. In practice, however, such a balanced approach is often impractical due to the difficulty of finding reliable comparative datasets, according to the organisation.

Bitcoin goes green

Kim Grauer, director of research at cryptocurrency analyst Chainalysis, says the growing scrutiny of Bitcoin’s energy consumption comes from within the crypto industry as well as from detractors. “For the financial institutions increasingly taking notice of crypto as an asset class – the very institutions that helped fuel 2021’s Bitcoin rally – there have been questions about how that sits alongside their ESG commitments,” she adds.

Many within the industry, including Grauer, believe blockchain technology will continue to innovate and seek solutions to its own problems. “Given the fact that it has become a serious priority in the industry, progress could happen on a relatively short time frame,” she says.

[Keep up with Energy Monitor: Subscribe to our weekly newsletter]

Grauer posits that lawmakers and regulators could step in to require miners to use renewable energy. Or perhaps investors, particularly institutional investors, will begin to favour crypto mined from renewable sources. Exchanges could also make an environmental assessment part of the due diligence process they already conduct with mining partners. “You could see a situation where it becomes a competitive advantage for exchanges and miners to be able to demonstrate the environmental sustainability of their operations,” Grauer adds.

Oklahoma-based crypto specialist Nakamotor Partners uses Bitcoin mining as a mechanism to monetise, transport and preserve energy digitally rather than physically. The energy in this equation comes before the currency. The idea is this creates an incentive structure to acquire the cheapest sources of energy, agnostic to geography, leading to the development and conversion of economically feasible energy into monetary energy.

CEO and founder Charlie Spears says his teams’ collective experience in oil and gas helps them to secure joint ventures with companies in these fields to negotiate and monetise energy that would otherwise go to waste. “I am a realist; I view the future of oil and gas, specifically in the US, as headed towards a period of extreme scrutiny," he says. "I think that this allows a positive narrative as well as a profitable option, in response to increased regulation, and environmental compliance.”

Spears sees Nakamotor’s role as providing a mechanism to monetise existing energy at multiples above the current market rate. “We are specifically targeting energy and gas that either can't get to market or is actually a huge liability for the producer. There is a lot of gas that is burned and flared which is unproductive, and extremely damaging to the environment,” he says.

The energy footprint of what goes into building the status of the dollar should be viewed as the energy footprint of the entire US economy, not solely limited to data centres that run and log the specific financial transactions, according to Spears. “By that metric, Bitcoin is fractions of energy consumption,” he adds.

Non-fungible token (NFT) lead at Crypto Breeds Henry Warner says if the long-term incentive for Bitcoin miners is to seek out cheap energy, which is typically waste or green, then over time the carbon footprint should decrease, even if the total energy requirements of the network grow.

Carbon-neutral mining is why Canadian Bitcoin mining company Argo Blockchain selected Texas and Quebec for mining activities, as both jurisdictions hold an enormous amount of renewable power, according to CEO Peter Wall. In addition, Bitcoin mining also happens to have an incredibly flexible load that is very rare at industrial-scale power use. “Very few industries can shut down within a minute and give all their power back to the grid, or the majority of their power, or 50% or even 10%,” says Wall.

January 2022 was a very cold month in Quebec, and Argo Blockchain turned off a portion of its machines for 100 hours in the month to relieve pressure on the power grid. In Texas, there are programmes for miners who voluntarily shut down to sell power back to the grid, or earn discounts off future power costs. “It is a really interesting opportunity for miners to not only play with a balancing load, but also to be financially incentivised to do so – and I think we are going to see a lot more of that,” says Wall.

What would Satoshi say?

However, for Bitcoin mining to become green, there needs to be a shift in both its public perception and a revaluation of the industry’s existential purpose. “At its core, you are basically turning energy into a currency,” says Wall. One can’t help but wonder what Nakamoto would say about this in light of his utopian dream of Bitcoin being a decentralised global currency.

In his white paper Nakamoto makes no reference to Bitcoin’s energy requirements, but in August 2010, Nakamoto made a rare comment on a crypto forum clarifying his position on what would become his creation’s biggest challenge: “The utility of the exchanges made possible by Bitcoin will far exceed the cost of electricity used. Therefore, not having Bitcoin is a net waste.” A few months later, on 12 December 2010, Nakamoto posted his last public message to date. It read: “There’s more work to do.” Indeed, there is.

In the meantime, it is hard to know how, on balance, cryptocurrency will help shape international conflicts like the current war in Ukraine. There are other ways to raise and move money, and other ways to sidestep sanctions. But Bitcoin is part of the picture now and regardless of its carbon footprint, it will leave its mark as a new way for people to operate outside of the traditional financial institutions.

Editor's note: This article was originally published on our sister site Investment Monitor under a different headline on 14 February 2022. It has been updated with a reference to the Ukraine-Russia war.