The UK’s financial watchdog, the Financial Conduct Authority (FCA) wants to overhaul the way banks implement unplanned overdraft charges.

In its review of high-cost credit, the FCA has said that there needs to be “fundamental changes” in the way that unplanned overdrafts are provided.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

It said vulnerable customers can rely on unplanned overdrafts, which can lead to costs higher than that of payday loans.

Andrew Bailey, the FCA’s chief executive, said:

“The nature and extent of the problems that we have found with unarranged overdrafts mean that maintaining the status quo is not an option.”

How much do UK banks make from overdraft charges?

Unplanned overdraft charges vary from bank to bank and can be confusing to understand. For instance, HSBC customers can be charged between £10 and £80 for having an unplanned overdraft. The bank is implementing a new cap on unplanned overdraft fees of £5 a day from 1 August 2017.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFunds from overdraft fees have fallen over recent years, yet it still remains significant. According to the FCA’s research, in 2007, over one third (36 percent) of revenue from personal current accounts was from overdrafts. Banks were making £2.4bn annually from unauthorised overdraft charges.

Four years later in 2011, overdraft charges made up 34 percent of revenue, and around £1.7bn was from unauthorised overdraft fees.

This is thought to be down to £1.2bn now.

Banks are already banning overdraft fees

Ahead of the FCA’s ruling on overdraft fees, some banks have already decided to ban them.

Barclays led the way in 2014 when it announced it was banning unauthorised lending meaning customers couldn’t go overdrawn by accident.

Earlier this year, Lloyds announced that it was removing unplanned overdraft charges for its 20m customers, starting from November. It said it may continue to block payments from the account however until the overdraft is paid off.

It is also dropping a monthly fee it charges its customers with a planned overdraft, currently £6. Instead, interest will go up on the amount of the overdraft, which will amount to 1p a day for every £7 borrowed.

A Lloyds Banking Group spokesperson told Verdict:

“We agree that fundamental changes are required to the way unarranged overdrafts are provided across the industry. By removing all fees and charges relating to unplanned borrowing from November this year, we’re making overdrafts simple and clear, giving our customers far more control over their finances.”

The bank expects to see a reduction in income from overdrafts as a result of these changes but won’t publish exact figures.

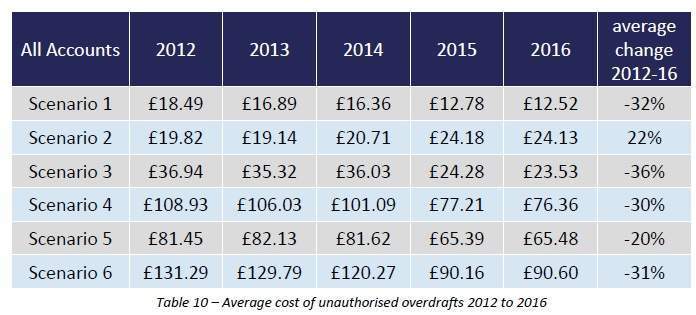

Banks, in general, have seen reductions in incomes in this way as the cost of unauthorised overdrafts has fallen on average by around 30 percent in recent years, according to a report published last year by the financial services company Defaqto.

“For most of the overdraft scenarios the average cost has fallen by around 30 percent since 2012. If we take into account the effect of inflation over the four year period then the fall is even more significant,” said the report.

Learning from the payday lender cap

If the FCA does move to ban the unplanned fees, it could be very successful. In 2014, the watchdog introduced a price cap for payday lenders, such as Wonga.

The new rules meant that interest and fees for the high-cost loans could not exceed 0.8 percent per day of the amount borrowed. As well, it said default charges for people who couldn’t repay the loans could not exceed £15.

The FCA has said that 760,000 borrowers in the UK were saving a total of £150m per year thanks to the price cap.

The Citizens Advice Bureau, an independent charity that offers advice to consumers across the UK, says that the FCA is right to turn its focus to overdraft fees after success with the payday loan cap.

Gillian Guy, the Citizens Advice chief executive, said:

“It’s good to see the FCA recognise this and the need for action, we think applying a similar cap would help protect consumers – so strongly recommend the FCA considers this as part of its options for other forms of high cost credit.”

Revenues are falling for UK banks

If UK banks cannot raise extra funds through overdraft fees, it will affect their balance books alongside other charges.

For instance, the PPI scandal is still having an impact as UK banks continue to pay out to customers mis-sold the insurance. The scandal is thought to have cost the industry at least £40bn.