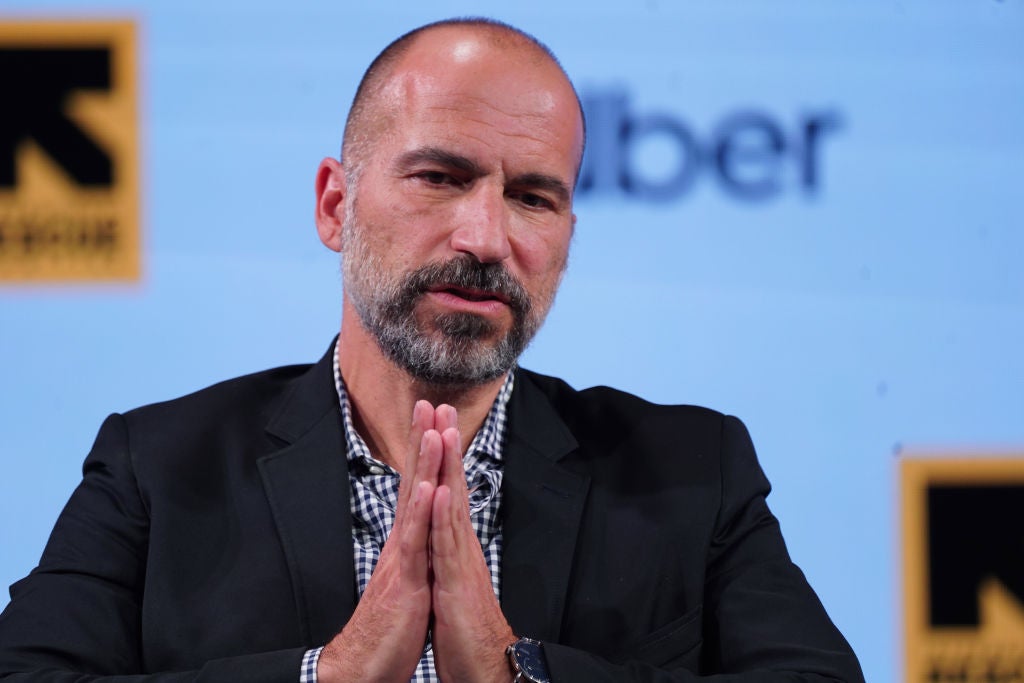

US based ride-hailing giant Uber is looking to sell stakes in non-strategic assets, including its shares in Chinese ride-hailing app Didi Chuxing, CEO Dara Khosrowshahi said on Tuesday. He also said the Chinese market was tough, with little transparency.

“Our Didi stake we don’t believe is strategic. They’re a competitor in China,” the Uber CEO said during a virtual fireside chat with a UBS analyst.

Khosrowshahi added that the company was in no rush to sell the shares.

“Those kinds of stakes we look to monetise smartly over time.”

The CEO explained that many of the companies in which Uber has a stake have gone public recently, meaning they are still subject to a lockup period – when investors cannot sell stock. He also added that Uber would continue to hold some stakes for strategic reasons.

Uber pulled out of China in 2016 after it burned over a billion dollars a year in a fierce price war with Didi. It eventually decided to sell its China operations to Didi in exchange for shares. Uber currently owns 12.8% of Didi, according to a filing by the Chinese company in June.

Uber had around $13.1bn tied up in investments in other companies as of the end of the third quarter, including $4.1n in Didi.

Some investors have argued that Uber holding on to these investments sends a signal to the market that shares in other entities are more attractive than putting freed-up capital into its own operations.

Khosrowshahi also said on Tuesday that “China is a pretty difficult environment with very little transparency.”

The Chinese ride-hailing industry experienced a turbulent year, with market leader Didi Chuxing being the most notable victim.

On 30 June, China’s largest ride-hailing platform raised a record-setting $4.4bn on the New York Stock Exchange (NYSE). However, a mere three days after its debut, China’s main internet watchdog launched a probe into the company, citing illegal collection of users’ personal data and cybersecurity concerns. Following the probe, Didi lost about $15bn of market value in one day.

Recently, the company said it would delist from the NYSE and move to Hong Kong instead.

Chinese regulators have tightened their grip on the ride-hailing industry, citing excessive data collection and unfair pricing policies. The Ministry of Transport, in cooperation with the Cyberspace Administration of China (CAC), recently summoned eleven ride-hailing executives for questioning. The Transport Ministry and CAC claimed the companies in question had used illegally collected data and their dominant market positions to implement unfair and opaque pricing techniques.

In May, Didi announced that it would make its pricing policy more transparent after a national backlash in China.

In an open letter addressed to the platform’s drivers, Sun Shu, the head of DiDi China’s ride hailing business and DiDi Driver Protection Committee, said that the company would launch a new feature that would provide drivers detailed data about their pay and commission rates.

In August, the company launched a pilot version of its “transparent driver income report” in seven cities across China, intending to eventually expand the function to all its drivers in the country.

Meanwhile, Uber is strapped for cash. Although the company made a profit in the quarter ended September 2021 for the first time since its inception in 2009, the results still came as a disappointment to analysts.

According to GlobalData’s intelligence centre, gross bookings grew 57% year-over-year, with mobility gross bookings growing 67% and gross delivery bookings growing 50%.

Uber posted an adjusted profit of $25m to $75m for the last quarter of 2021. On average, analysts had expected $114m.

As a comparison, smaller US rival Lyft reported its adjusted profit for the third quarter at $67.3m and said it expected adjusted EBITDA of between $70m and $75m in the fourth quarter.

“While we recognise it’s just a step, reaching total-company Adjusted EBITDA profitability is an important milestone for Uber,” said Nelson Chai, Uber’s CFO, following its third-quarter results. “Not only did our Mobility business recover to pre-covid margins this quarter, our core restaurant delivery business was profitable on an adjusted EBITDA basis for the first time as well, bringing the full delivery segment close to breakeven.”

Uber’s shares rose 4.3% after Khosrowshahi’s remarks on Tuesday. He also added that Uber last week had its best week ever in terms of company-wide gross bookings at its ride-hail and food delivery operations.

Yet, in general, ride-hail bookings remained around 10% below pre-pandemic levels, the CEO said.