Twitter, the micro-blogging service with about 319m active monthly users, is considering whether to introduce a subscription option for a monthly fee of $19.99.

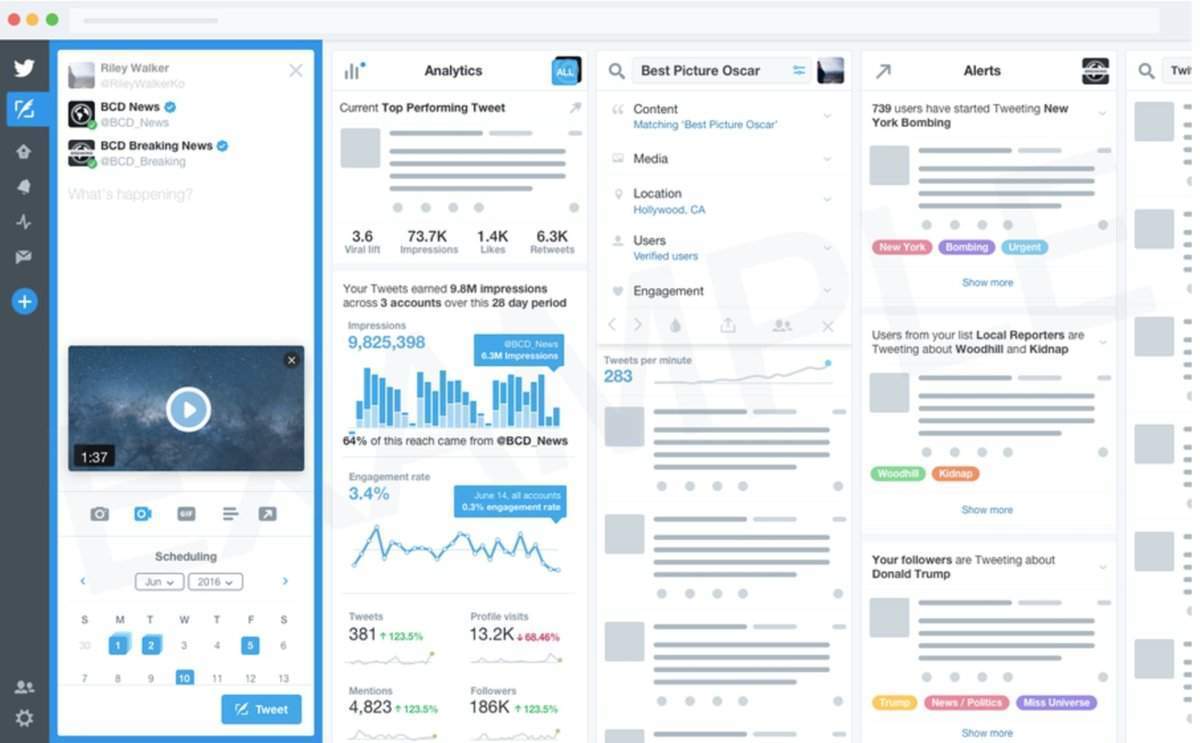

Scoop: Twitter is developing an ‘advanced TweetDeck’ that would be available for monthly subscription fee & feature a range of new features: pic.twitter.com/MlKw8xZlVS

— Andrew Tavani (@andrewtavani) 23 March 2017

The premium service would offer “valuable viewing, posting, and signalling tools like alerts, trends and activity analysis, advanced analytics, and composing and posting tools all in one customisable dashboard,” Twitter explained in an email to selected users.

“It will be designed to make it easier than ever to keep up with multiple interests, grow your audience, and see even more great content and information in real-time.”

Paying members would get access to an enhanced version of Tweetdeck, which currently allows users to view multiple columns featuring their timeline, mentions, lists, search results and more.

The proposed new tool would provide Twitter with a new source of revenue, as the platform faces competition from the likes of Facebook.

2 more notes on ‘advanced TweetDeck’: 1. Monthly subscription fee Twitter is exploring in the survey is $19.99. 2. Complete list of features pic.twitter.com/YEOf9AQ9bt

— Andrew Tavani (@andrewtavani) 24 March 2017

The company’s main source of income comes from advertising, which it can no longer rely on.

According to Twitter’s earnings report for the final three months of 2016, the social media platform generated $638m in ad revenue in the period, down from $641m in the same period of last year.

“We haven’t made the progress we anticipated over the last year in some direct response ad formats,” Twitter said in a stock market filing at the time.

Although Twitter’s user base is growing, progress has been slow. The social network had 319m monthly active users in the last quarter of 2016, compared to 305m the year before — an increase of just four percent.

In a call to investors after Twitter’s 2016 fourth quarter financial results were published, chief executive Jack Dorsey said the company’s journey had “been hard” and “it will continue to be hard,” in a blog post.

Twitter has accumulated losses of almost $2.8bn since it floated on the stock market three years ago.

Facebook’s latest figures published last month, said the website has 1.86bn users in December – a 17 percent year-on-year growth.

The social media giant’s annual revenue and earnings per share have both increased about sevenfold since the company went public in 2012.