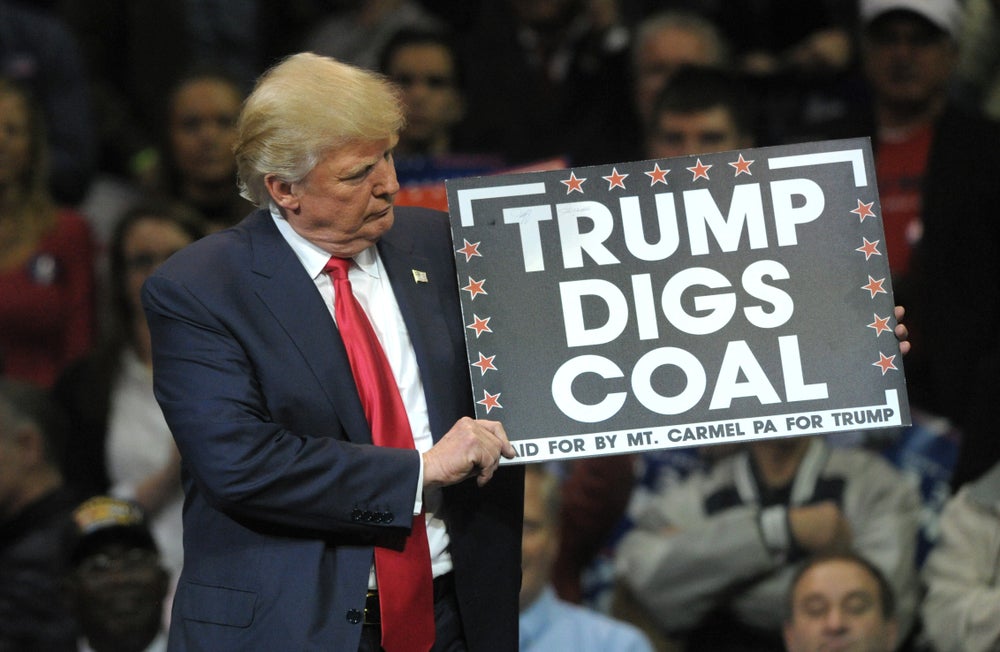

Donald Trump’s election is catastrophic for global climate action, among many other things, as an increasingly fraught US relationship with ESG agendas will have a global impact and will be replicated.

International efforts to address climate change, like COP, will be undermined as they navigate increasingly murky geopolitical waters.

Going forward, the imperative for ESG must be to become undeniable. Trump, among other nefarious actors, will do their best to prevent this through a variety of means.

Welcome to a new kind of tension

Unfortunately, the pace and direction of ESG agendas for companies, organisations, and nations are set by leadership. Similarly to how climate change mitigation is most effective when it is as cooperative and widely accepted as possible, actively climate-damaging leadership is often replicated, gaining momentum to undermine future climate action.

COP29 has already suffered from absent attendance from private sector institutions. The Bank of America, BlackRock, and Lloyd’s of London, among many others, did not attend, prizing unity on these issues.

Going forward, essential global climate solidarity will be further undermined by reduced engagement, enhancement of the fossil fuels industry, and misinformation surrounding climate change.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAn abject lack of consensus surrounding climate action is troubling, especially from a logistical sense, as COP29 struggles to confirm the transition away from fossil fuels and make key climate finance available for developing countries. COP29’s chief executive, Elnur Soltanov, has even openly discussed investment opportunities in the COP29 host, Azerbaijan’s state oil and gas company, at a climate summit predicated on discussing how governments can mitigate and prepare for climate change.

‘Do’ the propaganda and sing along to the age of paranoia

Under Trump, the ESG movement globally will be made more erratic, directionless, and slow. In the first year of his first term as president, Trump withdrew the US from the landmark Paris Agreement. This sets a dangerous precedent for what will certainly be a period where, ‘climate action will be put on the backburner’, according to Joe Biden’s outgoing top climate advisor, John Podesta.

Similar abandonments of global climate talks are already being discussed, with Argentina heavily considering following suit.

Environmental deregulation will be a significant impact of Trump 2.0. Emission reduction obligations and expectations will be diminished, as will the bodies responsible for monitoring and regulating such performance.

Much of the regulation improving due diligence surrounding companies’ climate-related performance will be undone, while simultaneously facilitating investment and promoting policies that entrench fossil fuels further.

The Environmental Protection Agency will have much of its emissions rules cut, while the Securities and Exchange Commission’s climate disclosure rules will likely never go into effect. Such efforts will confirm the US as the most globally significant outlier in its approach to climate and sustainability issues.

One nation controlled by the media and the sound of hysteria

ESG-related paranoia and scepticism are problematic and difficult to remedy, especially when the largest and direct benefactors of what Trump calls the ‘new green scam’ are ardently averse to it.

Despite roughly three-quarters of Inflation Reduction Act green spending being directed into Republican-dominant states, these states have seen the largest surge in addressing and limiting ESG agendas. The paradoxical relationship between the societal benefits of climate mitigation and other ESG agendas and its contradictorily associated negative publicity is a global issue that policymakers must contend with.

Climate change misinformation is a significant global issue and must be prevented outright. How climate solutions are discussed and the benefits they provide need to be more carefully communicated. It is unlikely, however, that the caution and enthusiasm desperately needed to achieve adequate climate action will occur when led by disruptive figureheads like Donald Trump. Unfairly, action will instead have to come from those who possess the least power to affect the necessary change.