GlobalData, a leading data and analytics company, has revealed its league tables for top 10 legal advisers by value and volume in technology, media and telecom (TMT) sector for Q1-Q3 2022.

A total of 8,480 merger and acquisition (M&A) deals worth $739.3bn were announced in the sector during the period.

Top advisers by value and volume

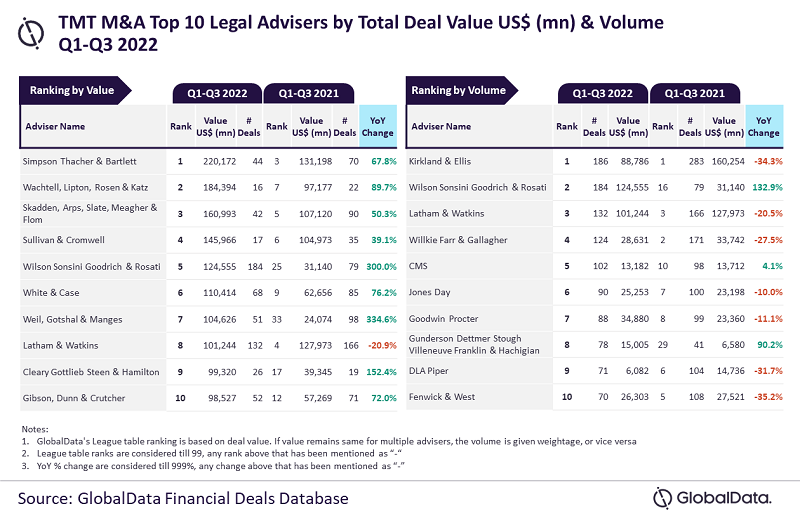

According to GlobalData’s ‘Global and Technology, Media & Telecom M&A Report Legal Adviser League Tables Q1-Q3 2022’, Simpson Thacher & Bartlett and Kirkland & Ellis have emerged as the top M&A legal advisers in the TMT sector for Q1-Q3 2022 by value and volume, respectively.

Simpson Thacher & Bartlett advised on $220.2bn worth of deals, while Houlihan Lokey advised on a total of 186 deals.

GlobalData lead analyst Aurojyoti Bose said: “Although Kirkland & Ellis managed to lead by volume it faced strong competition from Wilson Sonsini Goodrich & Rosati, which was shy of just two deals from occupying the top position by this metric.

“In contrast, Simpson Thacher & Bartlett, which led in terms of value, outpaced its peers by a significant margin by this metric. It was the only firm to surpass $200bn in total deal value.”

According to the financial deals database of GlobalData, Wilson Sonsini Goodrich & Rosati took second place with 184 deals, followed by Latham & Watkins with 132 deals, followed by Willkie Farr & Gallagher with 124 deals, and CMS with 102 deals.

In terms of value, Wachtell, Lipton, Rosen & Katz took the second spot with $184.4bn worth of deals, followed by Skadden, Arps, Slate, Meagher & Flom with $161bn, Sullivan & Cromwell with $146bn, and Wilson Sonsini Goodrich & Rosati with $124.6bn.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.