With price comparison sites offering more diversified services, one could be forgiven for wondering to what extent insurance is still a focus.

However, while mature, insurance is still bringing in the lion’s share of revenue.

For some time there has been little differentiation between the so-called big four price comparison sites — Money Supermarket, Compare the Market, Go Compare and Confused.com — when it comes to their most mature market and cash cow: car insurance.

We’re well beyond the days when a majority of insurance brands listed on only one or two of the sites.

With prices very similar across the board, price comparison sites have continued to follow the same if it ain’t broke price-centric service structures.

Only small personal preference touches would place any one site apart from the others on user experience.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIt’s this level playing field that has driven the large marketing budgets from these businesses, as they have fought to be front of mind.

The other key strategy being played out is an expansion of complementary and diversified services — for example comparison of energy suppliers, broadband packages, as well as strengthened financial services and insurance product services.

If we return briefly to advertising, marketing from the sites is now more generic in focus and pointed to the sites’ general money-saving potential rather than product-specific messaging.

With this broadened one-stop-shop of services, is the focus of these businesses moving away from insurance, a space that may have peaked, with priority shifting to other areas?

In a word: no.

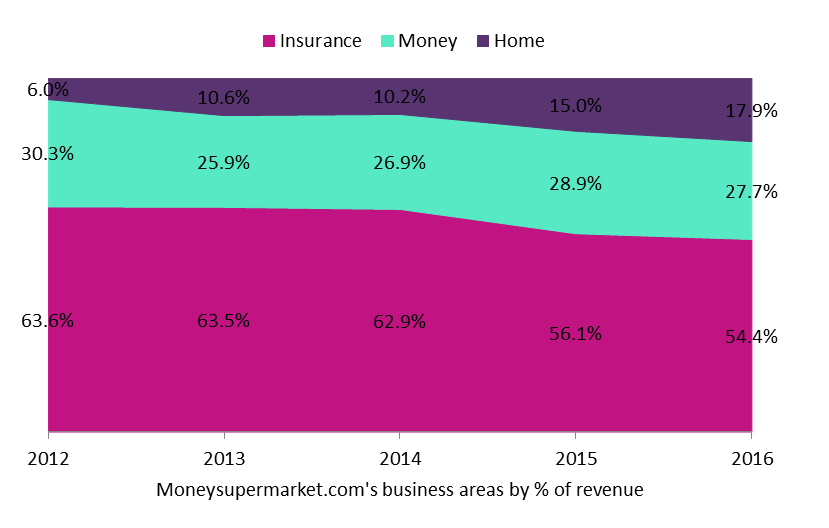

Moneysupermarket.com — perhaps the most successfully diversified site of the “big four” — has seen its ‘home’ arm (e.g. energy, broadband) grow its share of site revenue from 6% in 2012 to 18% in 2016. It continues to see a significant market opportunity here.

Even so, the site has sized – in investor presentations – the potential current comparison market value in this area at only £150m compared to the £1bn up for grabs in insurance.

Deriving more than 54 percent of its revenue from insurance products in 2016 (with its “money” products accounting for just under 28 percent), its car, home, and travel cover services in particular remain core to business.

It should be said, however that, with decent growth in non-financial markets, insurance products with reasonably under-developed aggregation (pet and life insurance etc.) may well take a back seat while quicker wins are available.

Taking a look at the traditionally more insurance-dependent comparison sites of Confused.com and Gocompare.com and the story solidifies.

For Admiral Group’s (Confused.com’s parent) 75 percent of price comparison site revenue depended on insurance in 2016 while it accounted for 94.2 percent of GoCompare.com’s revenue.

Insurance very much remains the engine driving comparison site business.