The global quantum computing sector is still in its infancy. Despite this, its investment potential is hard to ignore. The quantum computing market was valued at $472m earlier in 2021 and is expected to reach $1.7bn by 2026, according to a Markets and Markets projection. A broad consensus of this potential is prompting concerted efforts by governments and regional institutions to harness the benefits of what some have deemed the ‘fifth industrial revolution’.

There are a number of emerging global hubs, all predictably close to universities and institutions with expertise in the field, but according to Douglas Clark, CEO of inward investment consultancy Location Connections, “it is anyone’s game at the moment”. Foreign direct investment in quantum computing is a significant growth area to watch closely over the next five to 20 years, he says.

However, a restricted talent pool of quantum expertise means companies are competing hard for talent. The quantum computing global centres of gravity will depend on how well locations can grow their ecosystems to attract talent and foster start-up growth and investment. For now, there are simply too few people trained for the growing number of available jobs. Academia provides most of the sector’s skills base and the competition for these experts is fierce.

The UK (Oxford)

The UK has pioneered the quantum computing sector since announcing its National Quantum Technology Programme (NQTP) in 2013, which has since grown to what will amount to an estimated public and private sector investment of £1bn by 2024, according the NQTP’s strategic intent 2020.

Oxford has emerged as the UK’s central quantum computing hub. This is demonstrated by a £93m investment through the UK Research and Innovation for a National Quantum Computing Centre, which broke ground in September 2021 and is due for completion in early 2023. Other key Oxford institutions include the Quantum Computing & Simulation Hub, Wolfson Quantum Hub and IBM Q. Oxford University has long been a centre of expertise for quantum sciences and has the largest number of quantum science research groups of all of the UK’s universities.

Alongside the UK’s academic prowess within the sector, UK business investment in quantum computing is expected to triple over the next five years. According to the Confederation of British Industry and Accenture’s 2020 Tech Tracker survey of 160 UK businesses across various sectors, 23.8% of businesses plan to invest in quantum computing over the next five years, compared with just 5.1% that already invest in the technology.

Nationwide, the UK has developed ancillary quantum hubs in London within University College, London; in Cambridge, anchored by the UK’s leading quantum start-up Cambridge Quantum; Bristol University; and the Scottish Universities triad of Glasgow, Edinburgh and Strathclyde. Scotland delivers a quarter of the UK’s quantum research despite accounting for just 8% of the overall population.

The US (San Francisco, North Carolina, Chicago, Maryland, Boston)

The US government pledged its commitment to the quantum computing sector by passing the National Quantum Initiative Act in December 2018 to accelerate research and development through a coordinated federal programme with a five-year budget of more than $1.2bn. In January 2020, the US Department of Energy announced that $625m of the earmarked budget would be used over the next five years to create five new quantum information research hubs, including locations in Chicago, New York, Berkeley and Tennessee.

The US leads the world across most metrics used to assess quantum computing supremacy, including skills, ecosystem growth and funding. Quantum computing deal activity also clearly demonstrates the US’s lead position.

As well as the established Silicon Valley hub around the San Francisco Bay area, ancillary hubs have emerged in North Carolina State Quantum Hub, Berkeley Quantum, Chicago Quantum Exchange, the Quantum Technology Centre at the University of Maryland, the Harvard Quantum Initiative and the Pittsburgh Quantum Initiative.

It is difficult to pinpoint a single hub for quantum computing in the US, according to Connor Teague, North American head of talent consultancy Quantum Futures. “There are trends that are showing areas of expertise; for instance, Trapped Ions in Maryland and the recent funding and partnerships being set up to bolster this," he says. "Our clients have an ever-increasing requirement for high-level quantum computing engineers and researchers and the biggest challenge going forward will be attracting and retaining this talent.” In addition, because the quantum sector is so closely tied to academia, along with educators and the quantum commercial world, the underlying issue is collaboration in addressing the talent pipeline, he adds.

The North Carolina State Quantum Hub at North Carolina State University has emerged as one of the leading university centres of expertise in the US. In 2018, IBM designated North Carolina State’s Centennial Campus as its first university-based quantum hub in North America. The global IBM quantum network is a collaboration between IBM and various Fortune 500 companies, national research labs, start-ups and leading universities designed to explore practical applications for business through industry collaboration. It has been instrumental in fostering the various hubs across the US.

Lewis Cross, the head of Quantum Futures, says the competition for talent is leading some companies, particularly those based in the US, to offer fully remote positions across different time zones. “Our clients have ambitious targets and need to hire the best researchers," he says. "Fully remote is still rare but clients are starting to consider it because of the war on talent.” The expectation pre-Covid was that people needed to relocate for quantum roles, but now it is more accepted and it gives companies a business advantage to offer this option, adds Cross.

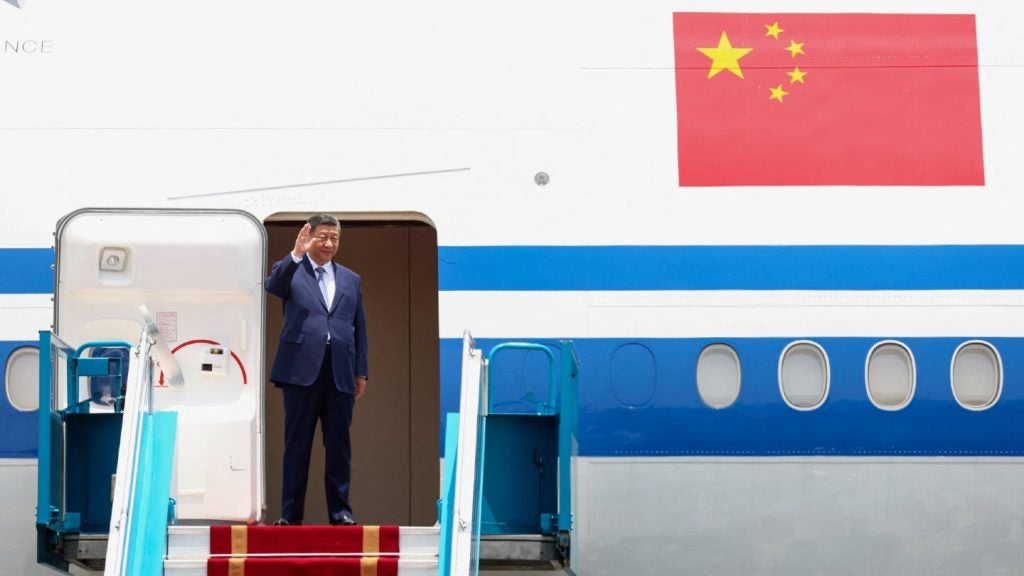

China (Hefei, Beijing)

China leads in quantum communications via satellites and long-path optical fibres, launching the world’s first quantum satellite, Micius, in 2016. An intercity channel to enable quantum key distribution (QKD) has been established between Beijing and Shanghai and Chinese scientists are working on demonstrations of QKD for intercontinental communications.

According to research by GlobalData, the highest number of quantum computing patents to date within China has been filed at Beijing University and ancillary quantum hub Chengdu, home of leading research institution the University of Electronic Science and Technology.

Chinese tech giant Baidu, headquartered in Beijing, has a Quantum Artificial Intelligence research centre focusing on integrating quantum technologies into Baidu’s core business.

Alongside Beijing, the university city of Hefei, home of the Chinese Academy of Sciences, has emerged as a hub for quantum science. A centralised National Laboratory for Quantum Sciences was founded in Hefei, Anhui province, in January 2014.

In 2017, Origin Quantum was established in Hefei as a spin-off from the Key Laboratory of Quantum Information at the Chinese Academy of Sciences. Also based in Hefei is QuantumCTek, founded in 2009 and the first quantum technology company to go public in China.

The quantum computing sector is expected to grow at the highest rate in the Asia-Pacific region between 2021 and 2026, according to Markets and Markets’ Quantum Computing Market report, released in February 2021. Large-scale increases in the use of advanced technologies in the manufacturing sector are fuelling demand for quantum computing services and systems in the region, according to Markets and Markets.

Canada (Waterloo, Toronto)

North America has the highest levels of quantum job opportunities globally. According to GlobalData research, Canada is second only to the US in this regard.

The University of Waterloo was a quantum pioneer, founding the Institute for Quantum Computing in 2002. Other notable institutions are the Mike & Ophelia Lazaridis Quantum-Nano Centre on the University of Waterloo campus and the University of Waterloo’s David Johnston Research and Technology Park, as well as Toronto University’s Creative Destruction Lab, which has a quantum speciality.

A well-established academic reputation for quantum sciences is a good basis from which to extrapolate significant hubs going forward. It is a small sector in which everyone is looking for the same talent, according to Cross. “For example, in hardware there are only about eight different types of roles and everyone is looking for at least two or three of those eight at the same time," he says. "There are so many jobs and so few qualified applicants that the good ones can choose wherever they want to go.”

Australia (Sydney)

In December 2020, the New South Wales government helped launch the Sydney Quantum Academy (SQA) bringing together the region’s four universities (Macquarie University, UNSW Sydney, the University of Sydney and the University of Technology Sydney). SQA is government funded from a $26m quantum computing fund announced in 2017. SQA’s mission to promote collaboration between academia, industry and government retains a key focus on skills development.

Long term, a focus on skills will pay off. Cross sees the skills shortage as the sector’s biggest challenge. “Everyone is looking for the same talent and when a company makes the coup of hiring an eminent professor who makes the leap from academia it means there is one less professor teaching the next generation of quantum students, which is not good for the quantum market in general,” he says.

The concentration of quantum computing scientists within a location and countries that have prioritised national initiatives in the sector are good indicators of whether a global hub is likely to succeed in growing its quantum computing ecosystem. While early contenders seem likely to win the race, most agree it is interesting to watch the progress as there is still all to play for.