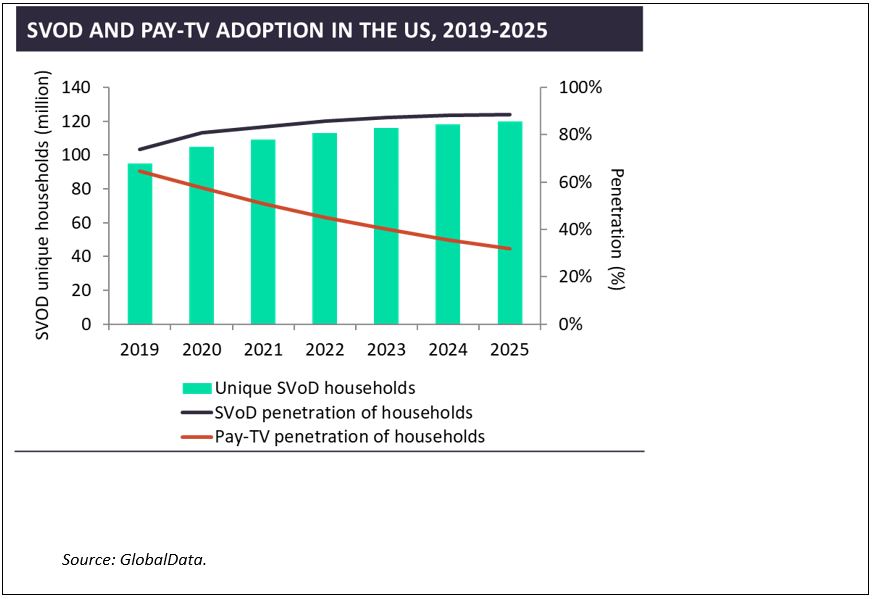

Pay-TV service adoption in the Americas has been declining over the last several years as a result of increasing competition from alternative subscription video on demand (SVoD) platforms in north America.

Over the last three years, the pay-TV market in the Americas region lost a combined 24 million subscriptions, reaching 157.7 million at year-end 2020. The popularity of SVoD platforms, improved access to ultrafast broadband services and the rapid evolution of viewers’ habits from time-scheduled to on demand video have been driving pay-TV disconnections in the region.

This trend is particularly strong in the US and Canada, which account for most of the disconnections in the Americas region. Although this trend is not yet well established in Latin America, it can already be observed at the country level in Brazil, Chile, Peru and Uruguay.

From a regional perspective, North America is the largest and most mature SVoD market worldwide, with the US accounting for an estimated 93.7% of total SVoD subscriptions in the region at year-end 2020. At the end of 2020 more than 79% of households in North America subscribed to at least one SVoD platform.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe arrival of Covid-19 in 2020 acted as a catalyzer for growth in the SVoD market as the stay-at-home measures dictated by most authorities contributed to increased household demand for digital entertainment solutions across the region.