Supply chains have been hit hard by the Covid-19 pandemic over the past two years. Now, as many countries in the developed world move back towards some level of normalisation, GlobalData has put together the Supply Chain Vulnerability Index collating export and import data for 2020 using the UN’s Comtrade database.

Harmonised system codes from all sections were analysed, with 97 used in total for all countries. Our researchers established the trade balance per country, scoring the magnitude of surplus or deficit between 1 and 10, with 1 being the most vulnerable with largest trade deficit, and 10 being the least vulnerable and highest trade surplus. These were then weighted in line with foreign direct investment sector proportions to reach the final index score up to 100.

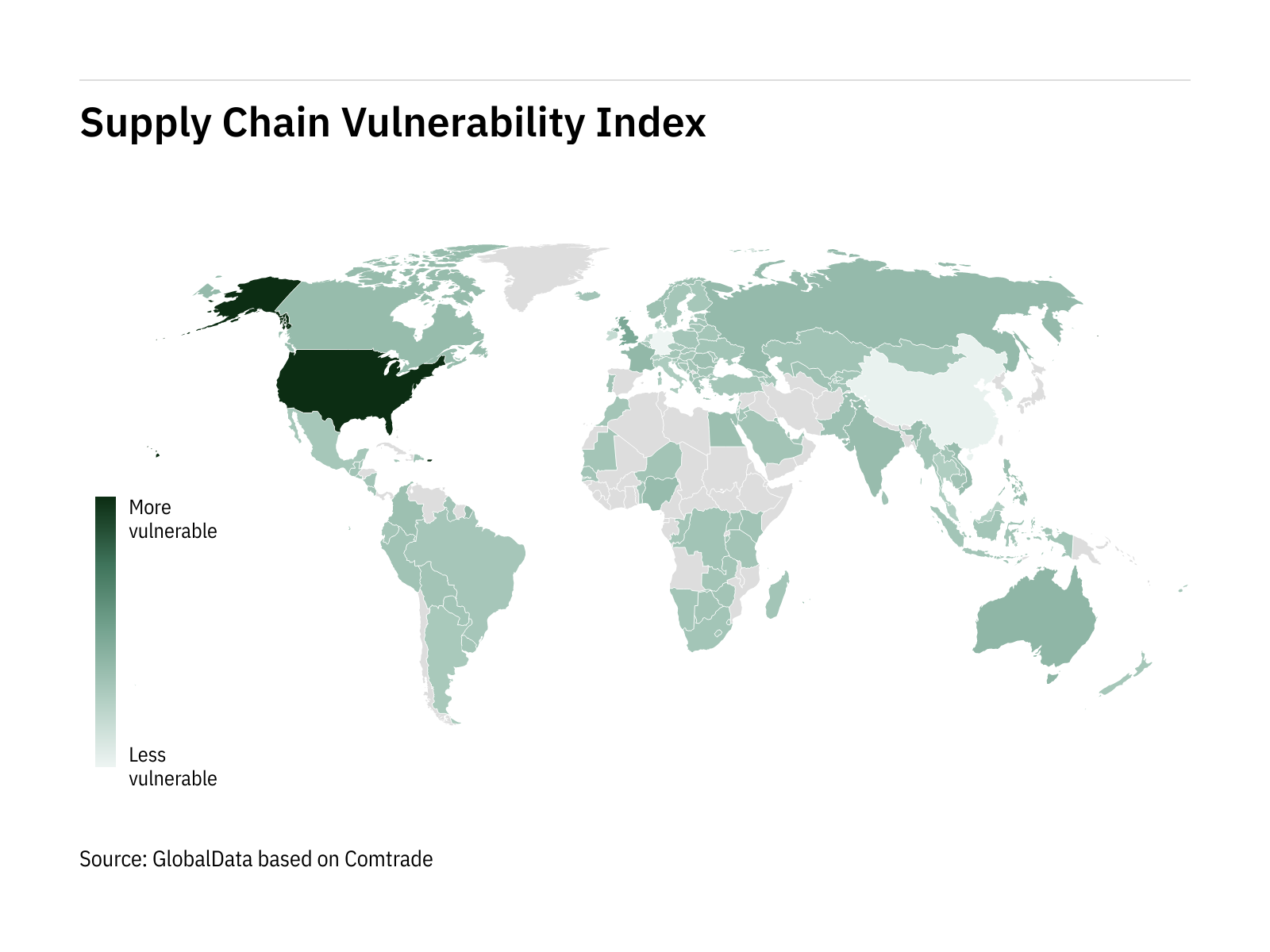

The map below shows how the US was the most vulnerable in the global supply chain, with a score of 38.35. At the other end of the spectrum is Europe’s largest economy, Germany, with a full score of 100, and Asia’s largest economy, China, with a score of 98.65.

“The Covid pandemic has had a huge disruption in most industries," says Investment Monitor chief economist Glenn Barklie. "The US has supply chain issues in both transportation and warehousing. It will continue to experience supply chain problems in 2022, as the demand and supply of goods and labour take time to recalibrate.

“Even before the pandemic, the US had concerns over its reliance on countries such as China. Nearshoring, and in particular reshoring, could help address the US’s supply chain issues as well as investment in its key industries and labour force.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe UK finished in mid-table with a score of 70.33, as the fallout from Brexit compounded the effect of the pandemic to hit supply chains particularly hard.

Aside from Germany and China, below-average levels of disruption to supply chains can be observed across continents, with most countries scoring around the 80 mark.

Canada and Mexico showed more supply chain resilience than their North American neighbour with scores of 77.59 and 81.58, respectively. Similar levels can be seen across economies in South America, Africa and Asia-Pacific.

Sector breakdown

The industrial machinery, equipment and tools sector was a key factor behind Germany achieving its top score, with the country recording a trade balance of $121.6bn (€106.34bn) in 2020 in this sector. The automotive and pharmaceuticals sectors also showed good traction in the country, with a trade balance of $86.9bn and $32.1bn, respectively.

Perhaps unsurprisingly, the table above shows how the textile sector in China proved the most resilient when it comes to supply chains. The country recorded a trade balance of $451.8bn (2.87trn yuan) in this sector, the country's highest, followed by consumer goods at $284.5bn and industrial machinery, equipment and tools at $243.5bn.

At the other end of the spectrum, the three most resilient sectors in the most vulnerable country of the index – the US – were aerospace, food and textiles. The country’s trade balance in these sectors, however, were only a fraction of that of the top three sectors in the two least-vulnerable countries in the index – Germany and China.

The US’s aerospace sector was the least vulnerable to supply chains disruption in the country and it only registered a trade balance of $51.6bn. The food and textile sectors’ trade balances were significantly smaller at $7.7bn and $5bn, respectively.

China's supremacy?

While China and Germany have proven the most resilient countries to supply chain disruption, this is not a guarantee that they will emerge as winners in 2022.

At this stage, experts are divided over the definition of winners and losers in this space, as more disruption is likely to continue throughout the year, with some arguing that China might indeed end up as a loser as issues such as forced labour and lack of attention to talent development are likely to play a pivotal role in the evolution of supply chains.

For more coverage across our publishing network of the issues created by the supply chain crisis, read the following:

- Supply Chain Vulnerability Index shows wide gulf between US and China - Investment Monitor

- Where are industries clustered in the UK? - Investment Monitor

- Who will be the supply chain winners and losers in 2022? - Investment Monitor

- The relationship between trade and investment in the UK - Investment Monitor

- The record profits of shipping companies will contribute to their demise - Investment Monitor

- How supply chains became headline news - Investment Monitor

- Taking ownership of supply chain emissions - Energy Monitor

- Booming EV sales challenge critical mineral supply chains - Energy Monitor

- Filings buzz in oil and gas industry: 37% increase in supply chain and logistics mentions since Q3 of 2020 - Offshore Technology

- The challenges facing food manufacturers on Scope 3 emissions - Just Food

- Preparing for future shocks: supply-chain disruption and food security in the UK - Just Food

- Predicting the unpredictable: The inflationary trickle-down on the food supply chain - Just Food

- Pressing issues for automotive supply chains - Just Auto

- Building supply chains for on-time, on-cost EV manufacturing - Just Auto

- How soon will the chip shortage end? – GlobalData survey results - Just Auto

- China’s resilience shines through in index of world’s most vulnerable apparel supply chains - Just Style

- Steadying the ship: Apparel supply chain pressure points and how to alleviate them - Just Style

- The 3D tools accelerating apparel supply chain lead times - Just Style

- Opinion: When apparel supply chains fail to supply - Just Style

- Direct to patient: rocky road to remote drug delivery in clinical trials - Clinical Trials Arena

- Covid-19 antiviral access: uneven supply patterns hinder US rollout - Pharmaceutical Technology

- Cutting the carbon footprint of pharma’s supply chain - Pharmaceutical Technology

- Molnupiravir supplies dominate in times of Paxlovid scarcity - Pharmaceutical Technology

- The end of the coal supply chain - Power Technology

- Broadcast and live events sector faces a two-year recovery from supply chain delays - Leasing Life

- Supply chain special – what’s the impact on wine? - Just Drinks

- Opinion: Why aren’t investors piling in to build new LNG projects? - Energy Monitor

- EU’s CBAM to impact Russia, China and the UK the most - Energy Monitor

- What the Ukraine conflict means for Europe’s energy crisis - Energy Monitor

- Will hydrogen trucks power the supply chains of the future? - Energy Monitor

- Supply chain tech startups have raised $7bn since 2018: Big winners from the crisis - Verdict

- Supply chain special – What’s the impact on soft drinks? - Just Drinks

- What can digitalisation do for the oil and gas supply chain? - Offshore Technology

- Concerns for mineral supply chain amid booming EV sales - Mining Technology