If you cut yourself shaving, you need to stop the bleeding. This is a lesson razor giant Gillette is seemingly still learning.

After six consecutive years of US market share losses, Gillette recently announced a razor price cut of as much as 20 percent and a renewed focus on cheaper products to try to turn things around.

You can bet that Procter & Gamble did not pay $57bn for razor giant Gillette back in 2005 with the expectation that its core razor and blade business would see market share shrink like a polar ice cap.

Yet that is precisely what has happened over the last half decade or so as consumers have flocked to subscription razor upstarts like Dollar Shave Club and Harry’s.

Gillette’s traditional strategy of launching more sophisticated (and expensive) razors and trading consumers up to them from cheaper versions may have worked too well, creating a price/value gap that upstarts were able to exploit.

“People trust that our pricing is fair” Harry’s co-founder Jeffrey Raider told the Wall Street Journal. “There is significant pent-up frustration among guys that Gillette has been methodically overcharging them for decades.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataJeffrey Raider was able to parlay this feeling into a base of 3m subscribers for Harry’s. Dollar Shave Club did even better as the target of a $1bn acquisition by consumer goods giant Unilever in July 2016.

Gillette sharpens up but its blade has been dulled

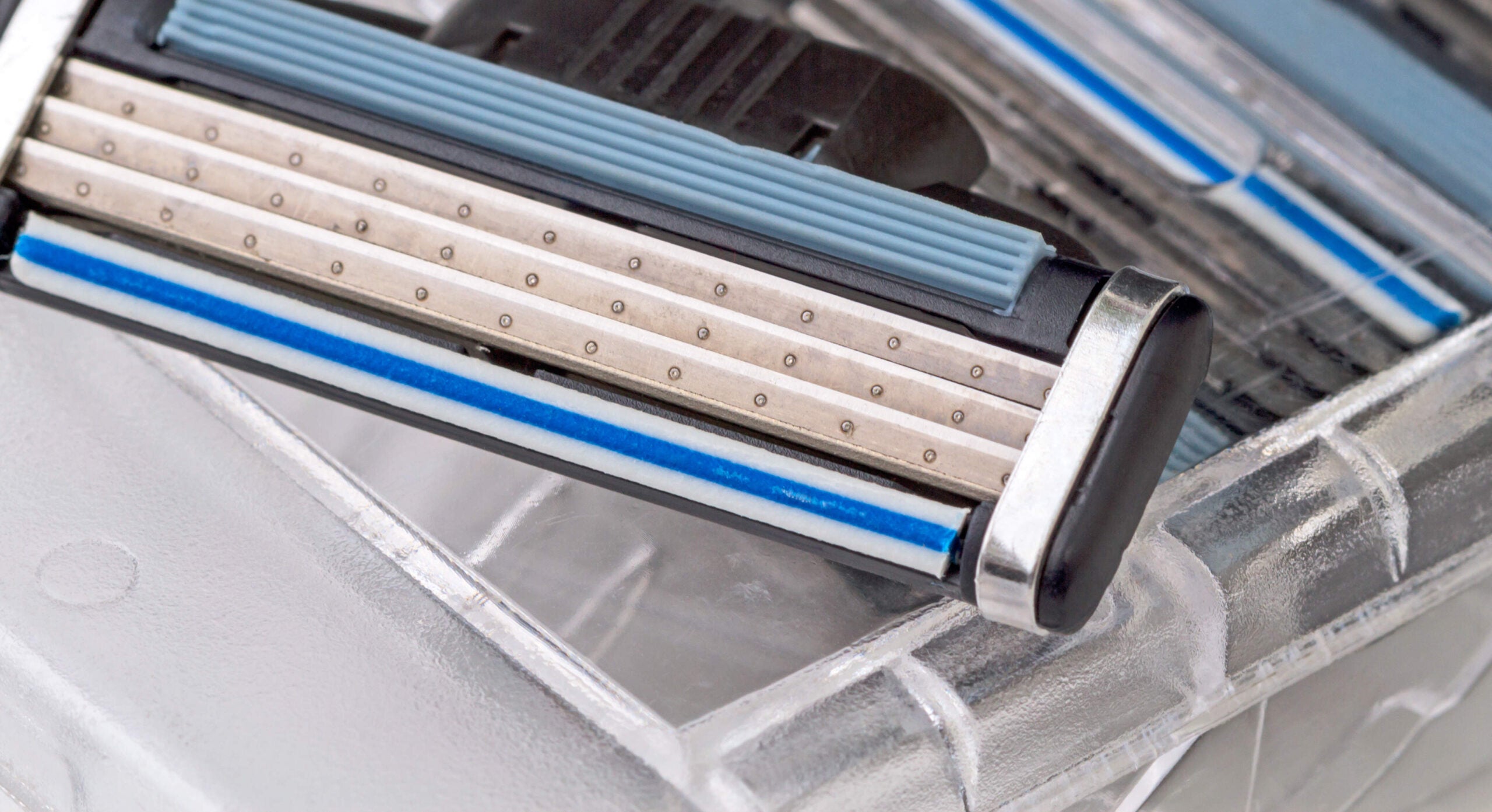

At the beginning of this month, Gillette countered by cutting the prices of its shaving products for men and women by as much as 20 percent. Across its razor and blade lineup, the company is phasing in an average discount of around 12 percent. Price cuts include flagship offerings like Gillette Fusion.

But is it too little, too late?

GlobalData research suggests that the subscription retail tide is unlikely to ebb anytime soon.

A majority – 55 percent – of 25–34 year-old Americans say that they currently purchase beauty and grooming products via subscription, according to GlobalData’s latest consumer survey.

That’s a staggering nine times the percentage of 55–64 year-olds who say the same thing.

Gillette’s shelf dominance is rendered moot by the internet where competitive options are a click away.

The brand is also hampered by a distribution model reliant on middlemen retailers.

Gillette arguably knows less about its actual purchasers and users than subscription retailers like Dollar Shave Club or Harry’s, which collect purchase and usage data directly from their respective subscriber bases.

Expect razor rattling in coming months

Gillette recently launched a marketing campaign and website geared toward winning back consumers lost to subscription upstarts.

And the company claims that over 200,000 consumers have come back to Gillette.

It’s also highlighting the alleged superiority of its razors, trying to brand others as cheap knockoffs.

The campaign shows feature-by-feature comparisons between Gillette’s flagship products and Harry’s and Dollar Shave Club.

Harry’s is criticised for its “1980s technology blades” while Dollar Shave Club is claimed to cause more razor burn and irritation.

With a patent in the works for a razor cartridge that heats up, Gillette clearly thinks the attraction of being first to market with new gimmicks isn’t dead yet.

But with GlobalData research showing 57 percent of 25–34 year-old Americans currently purchase cosmetics directly from brand websites they may find that they have no choice but to do more direct-to-consumer marketing.