Payment processing company Stripe has launched Stripe Identity, a verification tool for businesses to identify customers and help prevent fraud.

Stripe Identity uses machine learning to match a user-uploaded photo of their government-issued ID with a user’s live video selfie. According to Stripe this process takes as little as 15 seconds.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

It launched in beta mode on Monday in 30 countries and has already been trialled by companies including Discord, Peerspace and Shippo.

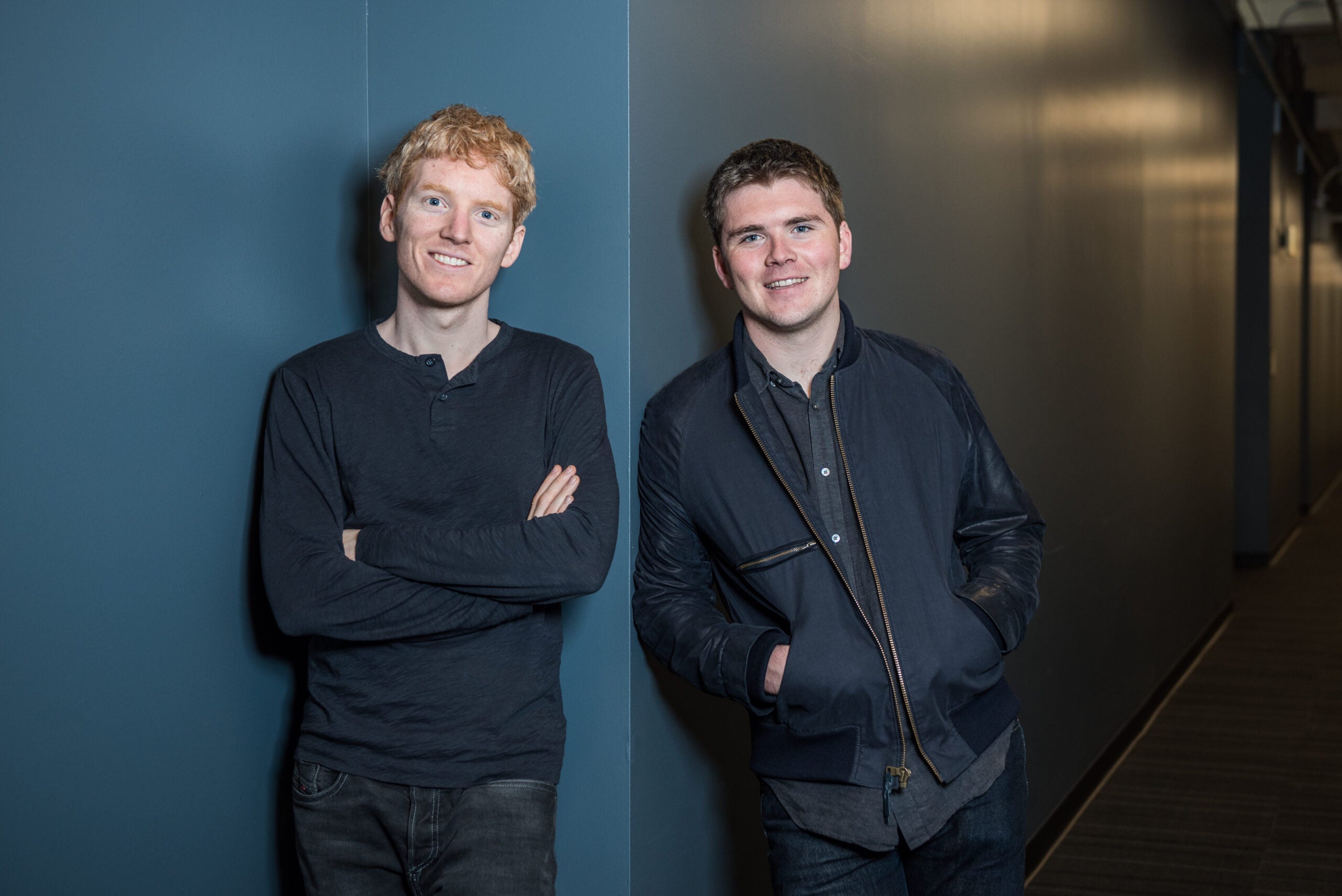

Founded by Patrick and John Collison in 2010, Stripe has become a fintech giant with its payment software powering many of the world’s ecommerce websites including Instacart and Amazon.

Its move into the identity verification market will be closely watched by startups such as Veriff and Onfido, which have launched with the sole purpose of simplifying online identity verification.

For Stripe, it is more of an additional revenue stream than pivot from its core payments business. But it is a move that appears to have required minimal additional investment – Stripe Identity is built on the same infrastructure used by the company for its own verification needs, including onboarding compliance and risk management.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“We know from experience how much work it takes to build a rigorous and secure system for global identity verification,” said Delia Pawelke, head of global risk strategy and onboarding policy at Stripe. “With Stripe Identity, we’re making our advanced compliance infrastructure available to all of our users. For an online business, verifying someone’s identity is now as easy as accepting a payment.”

It is available in a low-code format, which allows organisations without advanced coding skills to set up their own tool based on Stripe’s technology.

An off-the-shelf version is available that requires no coding from businesses and involves fraud and risk teams generating verification links to “assess suspicious transactions or high-risk users”.

The ecommerce boom, turbocharged by the pandemic, has made identity verification an important aspect for many online businesses – especially those regulated by know your customer (KYC) laws.

In March, Stripe raised $600m from investors to give it a $95bn valuation, making it the most valuable privately-owned tech company in the world. It’s a valuation that makes the fintech more valuable than Facebook and Uber before they went public.

According to the Wall Street Journal, Stripe this week secured a further $1bn in funding. The San Francisco and Dublin-headquartered company has remained tight-lipped about plans to IPO.