Symphony Technology Group (STG), a private equity firm, has signed a definitive agreement to buy Avid Technology in a deal valued at around $1.4bn, including debt.

As per the terms of the agreement, STG will offer $27.05 in cash to Avid stockholders for each Avid common stock they own.

Compared with the company’s closing share price on 23 May 2023, the cash purchase price indicates a premium of 32.1%.

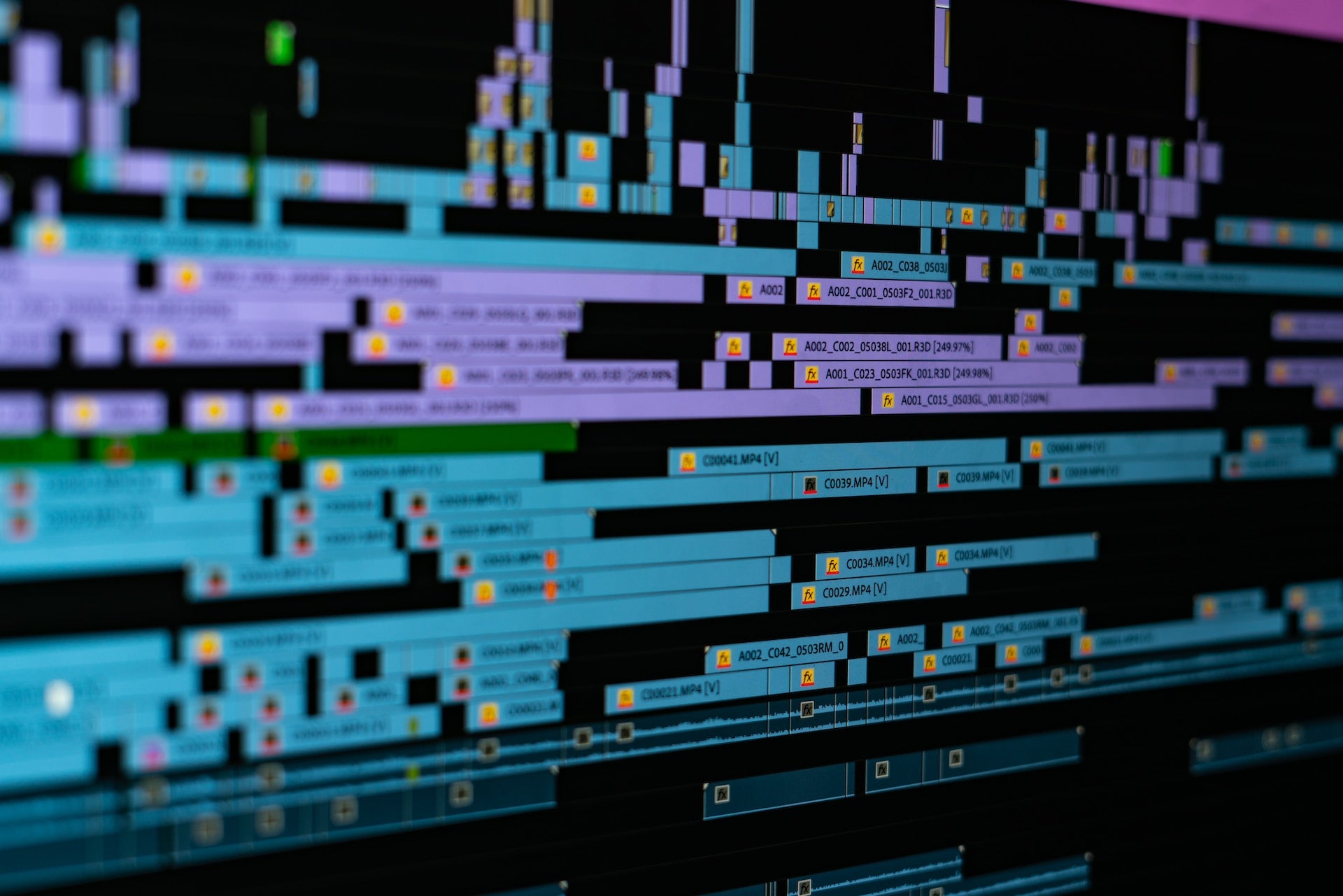

Headquartered in Massachusetts, US, Avid is engaged in developing media editing software and services for the entertainment industry.

Avid’s products, which include Media Composer, MediaCentral, and AirSpeed, have been used in the making of films including “Top Gun: Maverick” and “Avatar: The Way of Water,” according to Reuters.

Subject to Avid stockholder approval, regulatory approvals, and other closing conditions, the deal is anticipated to close during the fourth quarter of 2023.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataUpon completion of the deal, Avid will delist from Nasdaq and become a privately-owned entity.

Avid CEO and president Jeff Rosica said: “STG’s expertise in the technology sector and significant financial and strategic resources will help accelerate the achievement of our strategic vision, building on the momentum of our successful transformation achieved over the past several years.

“This transaction represents the start of an exciting new chapter for Avid, our customers, our partners and our team members and is a testament to the importance of Avid and our solutions in powering the media and entertainment industry.”

STG managing partner William Chisholm said: “We look forward to leveraging our experience as software investors to accelerate Avid’s growth trajectory with a deep focus on technological innovation and by delivering enhanced value for Avid’s customers.”

In May this year, a consortium led by STG acquired software company Momentive Global in an all-cash deal valued at $1.5bn.