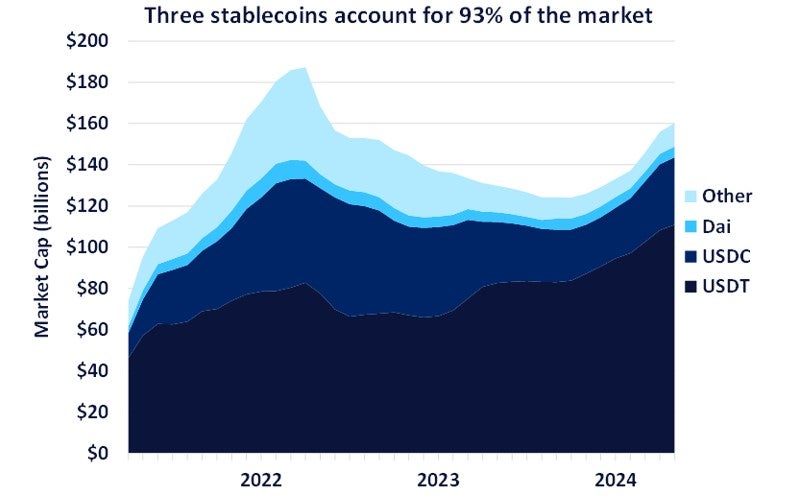

The total stablecoin market cap of $160bn accounts for 7% of the entire cryptocurrency market, which sits at $2.3trn at the time of writing.

A stablecoin is a type of cryptocurrency designed to maintain a stable value relative to assets such as the US dollar. They are generally backed by a reserve of fiat currency and cash equivalents like US treasuries.

Bringing stability to crypto

Stablecoins offer the benefits of cryptocurrency, including access to decentralised finance, without the volatility typically associated with cryptocurrencies. They have also enhanced the global accessibility to the US dollar, gaining traction in regions experiencing high inflation. In Argentina where inflation is shy of 250%, the popular stablecoin USDT accounted for almost 80% of cryptocurrency purchases. Argentina also leads in Latin America with a cryptocurrency transaction volume estimated by Chainalysis of $85.4bn.

Tether dominates the stablecoin market

The market exhibits a winner-takes-all tendency due to the critical role of liquidity and network effects. Tether USD (UDT), the first and largest stablecoin, was introduced in 2014 and has since amassed a market cap of $110bn. Accounting for 70% of the market value of all stablecoins, USDT is 3.5 times larger than its closest competitor.

Issuing stablecoins is highly profitable

Stablecoin reserves are often yield-bearing and with a low overhead, much of this yield is kept as profit for the issuer. In partnership with Circle, Coinbase issued USDC, which is now the second-largest worth $33bn. In just the first quarter of 2024, Coinbase has earned $197m from USDC and its arrangement with Circle.

Mountain Protocol’s USDM: A more equitable approach

In September 2023, Mountain Protocol launched its stablecoin, USDM, which now has a comparatively modest market cap of $152m. Rather than being kept as profit by Mountain Protocol, the yield generated from USDM’s reserves gets passed on to the owners of the stablecoin. Holders of USDM receive an automatic yield of 5% APY. Mountain Protocol hopes USDM will become a market-leader by offering benefits such as yield, transparency, and regulatory oversight.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe future of stablecoins

It is hard to envisage USDT losing its dominant position, given its significant first-mover advantage in an industry where scale is paramount. Nevertheless, should yield-bearing stablecoins gain popularity, this trend could compel Tether to begin sharing its profits with token holders.

However, regulatory oversight of stablecoins is currently lacking. There are no standards requiring issuers to protect reserves or maintain liquidity, nor immediate recourse for investors’ losses. Currently, USDM is not available to US persons, citing a lack of certainty over digital asset regulation.