Juan Espinosa, CEO and co-founder of Sprinque, wants to make it easier for businesses to buy things. The fintech startup has just secured a €1.7m seed round to realise the vision.

Shopping is easy for most people. Online shoppers can buy everything from sweets to TV sets with just a few clicks and swipes on their smartphones. However, the situation is very different for businesses.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Espinosa makes the case that while procurement experiences have grown smoother over the past decade thanks to things like big data and creative entrepreneurs, most companies still struggle with their payments.

“If you think of how B2B payments have been done for decades, those mechanisms were never designed to interact in the digital world,” Espinosa tells Retail Banker International.

Sprinque CEO has Covid-19 to thank B2B payment boom

Businesses have been digitising their services for years, but Espinosa believes the pandemic has considerably accelerated new tech adoption. Lockdowns and social restrictions around the world have encouraged corporate leaders to update their infrastructure.

“We’re now experiencing the next technological wave where B2B commerce will change fundamentally,” the Sprinque CEO says.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIt’s arguably about time. The consequence of B2B payments dragging behind other aspects of the procurement process is palpable. The entire process crawls to a halt when the time comes to pay.

“When it comes to payments everything goes offline,” Espinosa says. “Buyers and sellers go back to creating manual purchase orders or invoices, an endless stream of emails back and forth trying to chase this payment, etc.”

That’s where the Amsterdam-based startup’s solution can make a massive difference, the Sprinque CEO claims.

“What we’re doing [to solve this pain point is that] we’re building the infrastructure for a B2B checkout to be fully embedded online,” he says.

Sprinque: the origin story

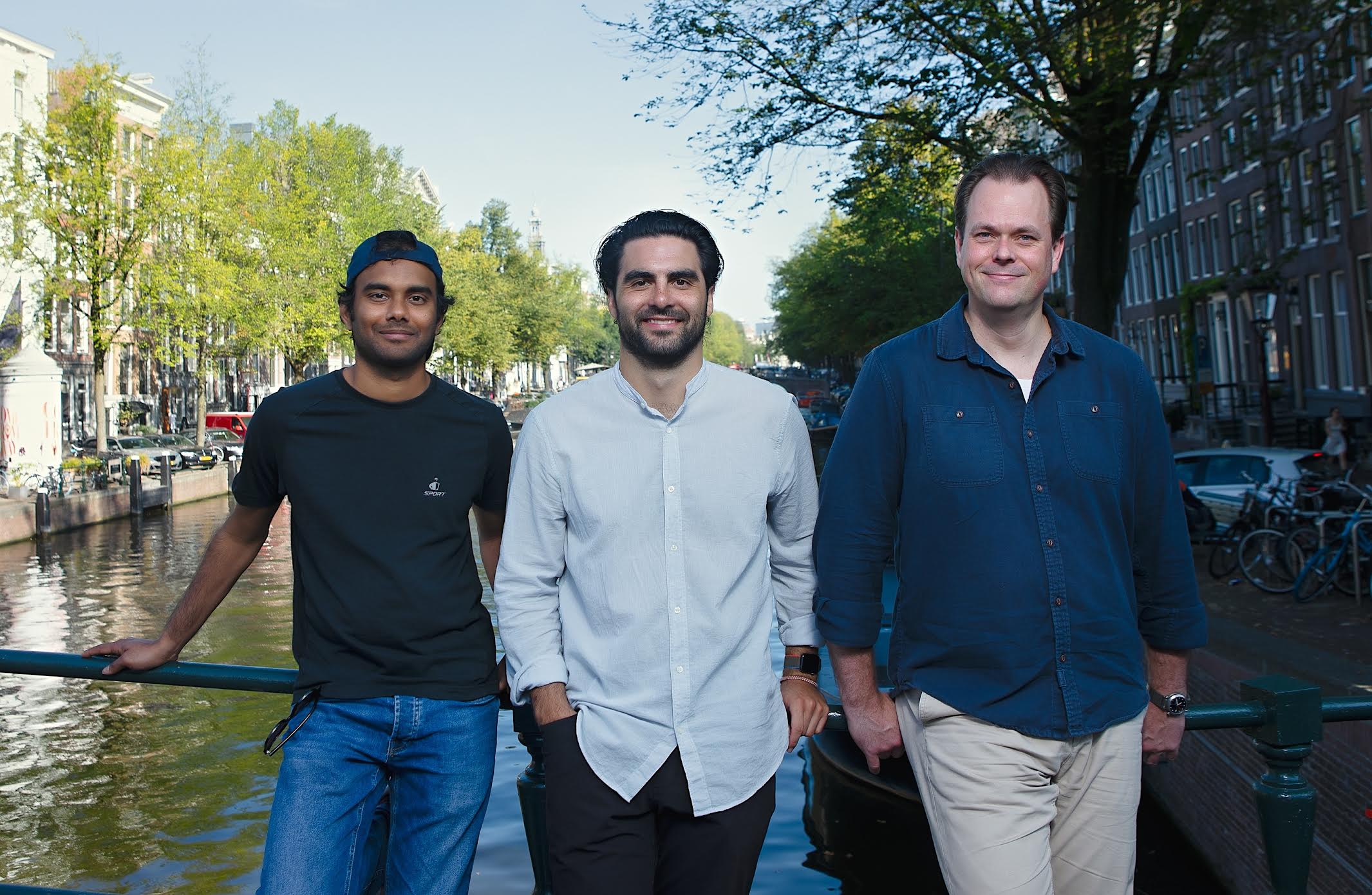

Espinosa met his would-be co-founders when he participated in Antler’s Amsterdam accelerator programme earlier this year.

He had most recently been in charge of strategic relationships at telecommunications services company MessageBird.

Manoj Tutika now serves as Sprinque’s CTO. He has previously clocked up time as an engineer at IBM and Yelp.

Mark Holleman is the Amsterdam venture’s chief product officer. He joined from having spent the better part of the last decade as an executive at Arvato Financial Solutions. It was Holleman who originally came up with the idea that would become Sprinque.

Having seen first hand that even businesses like Amazon – which is ranked as the number one company digital payments company in the world in GlobalData’s recent Digital Payments Thematic Scorecard – needed to outsource their B2B payments to companies like Arvato, Holleman believed there was an opportunity capitalise on.

“If Amazon has a payments team of 1,500 people and they have billions of euros or dollars in resources, yet they still struggle to build the solutions and outsource them to an organisation like Arvato, how about this whole another wave of b2b marketplaces that are up and coming right now, how are they managing payments?” Espinosa says, remembering how Holleman had first breached the subject in a bar.

After a few beers, the three decided that there was something to the opportunity of B2B payments and Sprinque was born.

How does Sprinque work?

Sprinque aims to make B2B transactions as frictionless as buying something from Amazon. Espinosa argues the solution provides three businesses benefits.

Firstly, it enables companies to more accurately measure their service. This is thanks to the Dutch startup’s digital checkout infrastructure that provide access and data from the entire interaction. That overview could be difficult to achieve when one has to swap service providers for different parts of the process.

Secondly, sellers using the solution can cut down on manual labour by automating payment workflows.

At the same time, buyers are given access to a plethora of net terms options. These include pay with net 30-, 60-, and 90-day terms as well as split payments, and pay on milestones. The Sprinque solution is also designed to provide access to multiple payment methods, including Pay by Bank, allowing buyers to settle invoices using their online bank account or mobile bank app.

In the past, handling all that would’ve required a lot of hands on deck. “Our checkout platform is basically eliminating that entire body of work,” the Sprinque CEO says.

Thirdly, the platform is designed to make buyers comfortable to buy by providing a wealth of flexibility.

“We just keep increasing that trust for the buyer within this marketplace ecosystem for them to keep coming back,” Espinosa says.

Still in beta

That all sounds great. However, it is difficult to gauge just how much Sprinque is actually able to deliver. The startup is still in private beta.

That being said, Sprinque already has two live customers and “a growing waitlist.” While Espinosa stays mum on the exact number on that waitlist, only noting that exact figure of customers is “confidential”, he says the startup is “looking to start onboarding them as the product suite matures.”

His bullishness and the company’s accomplishments have already encouraged investors like Volta Ventures, Force Over Mass and a smattering of angel investors and payments industry executives to support the new €1.7m seed round.

“Vendors are spending millions to build online platforms for B2B trading, but their payment processes are often lagging way behind,” Filip Coen, partner at Force Over Mass, says. “Sprinque not only offers a solution for these businesses, but they also have a team that can successfully deliver. There’s a clear vision on how end-to-end business payments should work, and together, we can see them take their product international.”

The fintech will put the money towards growing the team to roughly a dozen in total by the end of the year and to improve the product. The plan is to exit beta in Q1 2022.