The global cloud and data centre market has been in boom mode since the pandemic years prompted an unprecedented digital transformation across sectors and industries. Between 2019 and 2023, a mass shift to cloud computing and surging demand for AI saw the sector grow by 45%, GlobalData analysis reveals.

A pivot to remote work, advancements in digital services and a shift to hybrid business operations have all fuelled this growth. Edge computing – demand from businesses and governments for secure low-latency cloud solutions and data sovereignty – and more recently the goldrush of AI has been a key driver.

“Lockdown restrictions on regular activities during the pandemic prompted organisations to upgrade their IT infrastructure and fast-track their transition to omnichannel enterprises, replacing traditional processes across their operations to embrace the new digital era,” says Tom Hopgood, FDI Economist at GlobalData. “The rapid pace of developments in Generative AI, large language models (LLMs) and applications powered by them has also been energising investors.”

AI infrastructure key to future growth

LLMs, like OpenAI’s ChatGPT and Microsoft’s Bing, need thousands of GPUs – incredibly powerful computer chips – to train and deploy AI models, and these need to be connected to thousands of servers in the network to generate the spectacular computing speed necessary for fast calculations.

As more enterprises look to experiment with AI-powered tools and services to access perceived productivity gains, the more hyperscale data architecture is needed to bridge the gap seamlessly between the physical and the digital. Research firm JLL projects that consumers and businesses will generate twice as much data over the next five years as all the data created during the previous decade. To meet that demand, total storage capacity must increase to 21 zettabytes (ZB) in 2027, from 10.1 ZB in 2023, JLL says.

The size of the opportunity has arrested the attention of US Big Tech players like Amazon, Google parent firm Alphabet, Microsoft and gaming firm turned AI chipmaker Nvidia. These and other companies, like co-location US data centre providers Equinix and EdgeConneX have been investing billions of dollars in big data centre projects around the world and particularly in lower-cost emerging markets displaying favourable characteristics in terms of policy commitments.

In 2023, GlobalData can reveal that the leading source of greenfield investment in this still emerging asset class is a $38 billion global infrastructure investment fund called I Squared Capital. Founded by ex-Morgan Stanley bankers in 2012, the private equity firm backed 16 data centre FDI projects last year in a dramatic market debut.

“Between 2019 and 2022, the GlobalData FDI database shows there were year-on-year increases in the number of global data centre FDI projects as company reliance on faster, more secure and more reliable internet access and exchanges of data were heightened. But then in 2023, it seems the wider macroeconomic effect on corporate expansion activity took its toll on the data centre market.”

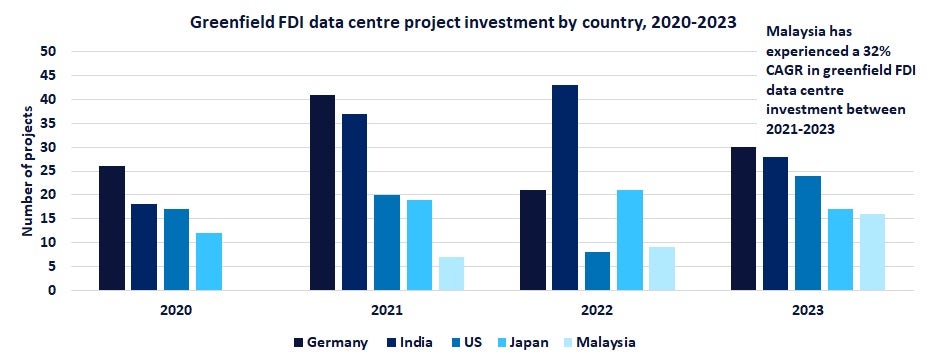

In 2023, exclusive GlobalData numbers show that FDI in data centre projects declined by 25% from 417 to 314. Some of the hottest spots for recent data centre investment were most affected.

India, which attracted the second highest number of FDI projects in cloud and data centre infrastructure between 2019 and 2023, saw 35% fewer projects developed in 2023. South East Asia (SEA) is home to some of the fastest growing digital economies in the world and an emerging hub for domestic high-growth digital innovations but most of the region saw foreign capital in data centre projects tail off from the previous year.

Only a few locations saw growth. Of those Barklie points to Malaysia as being the most noteworthy.

Malaysia a beacon for data centre investment

“Malaysia almost doubled the number of data centre FDI projects between 2022 and 2023,” Barklie says. “This helped the country grab a top five spot of leading data centre FDI destinations worldwide, jumping past Australia, Canada, the UK, Brazil and Mexico.”

Many of these investments came from regional neighbours, particularly Singapore. Nxera and ST Telemedia Global Data Centers (STT GDC), both Singapore-based data centre operators and subsidiaries of Singapore investment fund Temasek announced plans to develop large data centre projects in the city of Johor Bahru, which data centre intelligence company DC Byte predicts to become the leading data centre market in the SEA region from a base of essentially zero just a few years ago.

China and the US are also eyeing up Malaysia’s strategic support for digital enterprise growth and commitment to developing a responsible AI ecosystem through its National Artificial Intelligence Roadmap 2021 to 2025 (AI-Rmap) and AI Untuk Rakyat programme, which aims to get one million people prepared for the jobs and skills of the digital and AI economy.

Malaysia Digital (MD), formerly known as Multimedia Super Corridor (MSC), was set up by the Government in July 2022 as a national strategic initiative to develop Malaysia’s digital economy by attracting high value digital investments, drive digital adoption and grow local tech companies. MD is driven by the Malaysia Digital Economy Corporation (MDEC), a high-powered implementation agency for tech and digital economy under the purview of the Ministry of Digital.

Nvidia was clearly won over.

In a bombshell move near the close of 2023, Nvidia said it would develop AI infrastructure in Malaysia in a $4.3 billion deal in partnership with Malaysia’s YTL Power International.

Under the deal, the companies will collaborate on building Malaysia’s fastest supercomputers using Nvidia AI chips and with YTL Power International using Nvidia’s AI cloud computing platform to build a large language model in Malay, the national language of Malaysia.

Momentum continues

Earlier this year, Google announced that it will invest $2 billion in Malaysia to establish its first data centre and ‘cloud region’ there to “unlock new possibilities for businesses, educators and every Malaysian” the company said in a blog post. Microsoft also said it would invest a little more than $2 billion in AI and cloud infrastructure in Malaysia, a move it said would provide education and training for 200,000 people.

Raymond Siva, senior vice president of the digital investment office, MDEC, says: “Malaysia is increasingly becoming a magnet for AI investments, with significant interest coming from diverse regions – including from countries like the United States and China. Our country is investing heavily in education and training programmes to equip our citizens with critical AI skills. A prime example is the establishment of Malaysia’s first AI Faculty in Universiti Teknologi Malaysia (UTM) when Budget 2024 was tabled.

“When it comes to positioning Malaysia as a regional AI hub, our unique selling proposition lies in our trade accessibility via free trade agreements like RCEP and CPTPP, the availability of digitally savvy and multilingual talent, and the advantage in terms of having a strategic location, robust digital infrastructure, and a vibrant ecosystem of startups and tech companies. We are also looking at supporting the development of region and country relevant large language models that are trained on the major languages we speak in Malaysia and SEA and account for cultural nuance, which will have tremendous potential for businesses and governments to create accurate local experiences.

He concludes: “Our ASEAN neighbours like Singapore have their strengths, but Malaysia offers a compelling mix of value driven investment location and market potential that makes it an ideal AI investment destination.”

A robust digital ecosystem

Malaysia has positioned itself as a compelling digital investment destination by prioritising the development of a robust digital infrastructure, ensuring high-speed connectivity and reliable networks – all of which have, over the past 25 years, supported the emergence of an ecosystem of digitally-oriented businesses, both local startups as well as foreign businesses. National programmes and initiatives have been nurturing homegrown deep-tech innovation.

In terms of future trends in Generative AI, Isabel Al-Dhahir, a principal analyst in GlobalData’s strategic intelligence team covering emerging disruptive technologies says while there is a lot to iron out, including how regulation and governance will develop to protect basic human values in the wake of a technology renaissance that has profound ethical questions at its root, one thing is for sure: relative to where we are going with AI, we are at “a rudimentary stage”.

“Within six months or a year, we will be amazed at the developments powered by AI technologies as well as the level of comfort businesses will have to use it,” AL-Dhahir says.