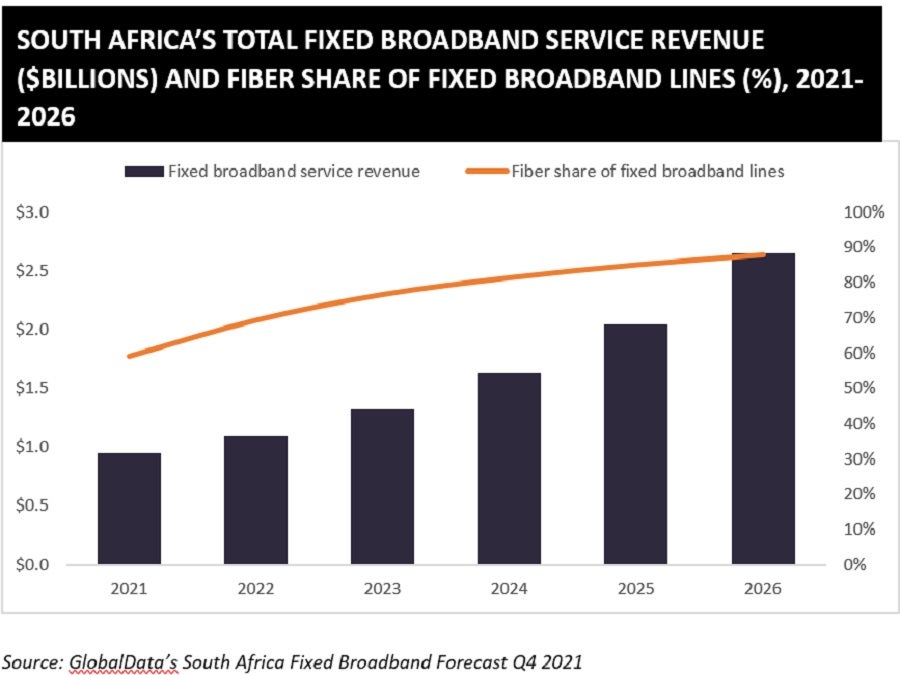

The fixed broadband services market in South Africa is set to increase from $1 billion in 2021 to $2.7 billion in 2026, on the back of robust growth in the fiber market with operators and fibercos expanding coverage and rolling out their networks to new areas.

For example, the fixed broadband market leader Telkom has been investing in expanding its fiber network. In September 2021, the operator’s fiber network passed 700,000 homes and had 332,000 homes connected. The operator invested heavily in achieving this goal with 45% of its CAPEX in the 6 months ending September 2021 being dedicated to fiber.

Vodacom expands South Africa fiber network

Another player that has been expanding its fiber network is Vodacom. Vodacom is the market leader in the South African mobile market, but falls behind Telkom, Liquid Telecom (Neotel), Atec Systems, and Super Sonic (Smart Village) in the fixed broadband market. As such, Vodacom has been making moves to strengthen its fixed broadband offering, specifically fiber. Vodacom has been expanding its fiber network and made strong headway in 2021, reaching 146,401 homes and businesses in March 2021 and investing in a new InfraCo.

In November 2021, Vodacom acquired a 30% stake in a newly formed InfraCo combining Community Investment Ventures Holding’s (CIVH) and Vodacom’s fiber assets. Vodacom will pay SAR6 billion ($376 million) in cash and contribute with its fiber assets valued at SAR4.2 billion ($263 million) into the new InfraCo. The move improves Vodacom’s ability to deliver fixed broadband, particularly fiber broadband, in the country through access to the fiber networks of fibercos Vumatel and Dark Fiber Africa (DFA) which are both owned by CIVH.

The fiber market is expanding rapidly in South Africa with telecom operators and fibercos rapidly expanding their coverage. As such, fiber lines are set to grow from 59% of total fixed broadband lines in 2021 to 88% in 2026.