South Korea’s Doosan Robotics will make its market debut on Thursday (5 Oct) after raising 421 billion won ($310m) in South Korea’s biggest initial public offering (IPO) of the year as global robotics M&A deals have fallen steadily since 2021.

Doosan Robotics, the country’s largest maker of service robots, saw retail interest in its stocks soar to the top of the marketed range setting a record for the year, according to the company.

The Suwon-based company is said to specialise in robotic arms that can work alongside human staff as service robots in scenarios from serving food to handling luggage at an airport.

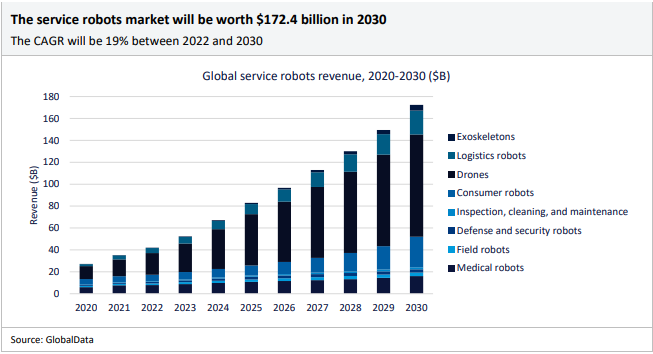

According to research analyst GlobalData, the robotics market is a rapidly growing sector valued around $45.3bn in 2020 and expected to grow at a compound annual growth rate (CAGR) of 29% to $568bn by 2030. A significant portion of this market will be service robots.

These service robots will be designed for deployment within service industries, hospitals and homes. According to GlobalData the service robot market alone will be worth $172.4bn by 2030 growing at a CAGR of 19% between 2022 and 2030.

GlobalData research indicates that not all sub-segments in service robots will grow at the same pace. For example, the exoskeleton market will grow at a 39% CAGR between 2022 and 2030, while more established areas, such as defense and

security robots, will experience more moderate growth (a CAGR of 10% between 2022 and 2030).

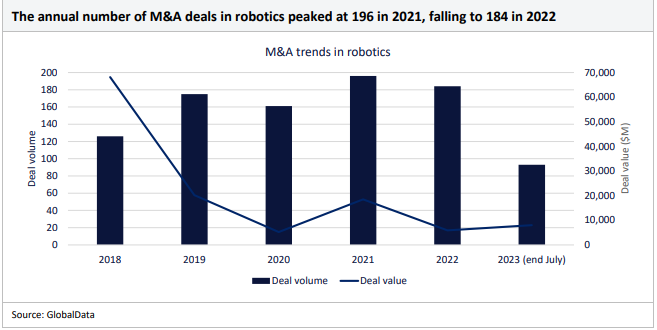

Doosan Robotic’s IPO comes at a time when M&A activity within the robotics market has fallen, according to GlobalData. The research company’s Robotics thematic intelligence 2023 found that the annual volume of M&A transactions in robotics grew from 126 in 2018 to a peak of 196 in 2021.

Robotics saw a decline in M&A activity in 2020, most likely due to COVID-19 disruptions, but volumes have since recovered though not to the same level as 2021.

In addition, while forecasts show the robotics market growing exponentially, GlobalData recorded that hiring within the sector fell during 2023. Global hiring peaked in February with 2,810 new hires falling to 1,389 by August 2023.