Huawei is hoping to increase its smartphone shipments up to 70 million units by 2024, two industry insiders have revealed to Nikkei.

According to the report, Huawei has also requested that its only US 4G chip supplier, Qualcomm, speed up its full year shipment of hardware months earlier fearing further US export controls.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Since the introduction of the US Science and CHIPs Act in 2022, Huawei’s presence abroad has been under tighter constraints.

Just this August the Biden administration introduced a blanket ban on all US investment towards Chinese companies that manufactured or designed what it described as “sensitive technologies” citing national security concerns.

In response, the Chinese government has asked the US to “carefully consider” this ban and its use of national security as a motive behind the move.

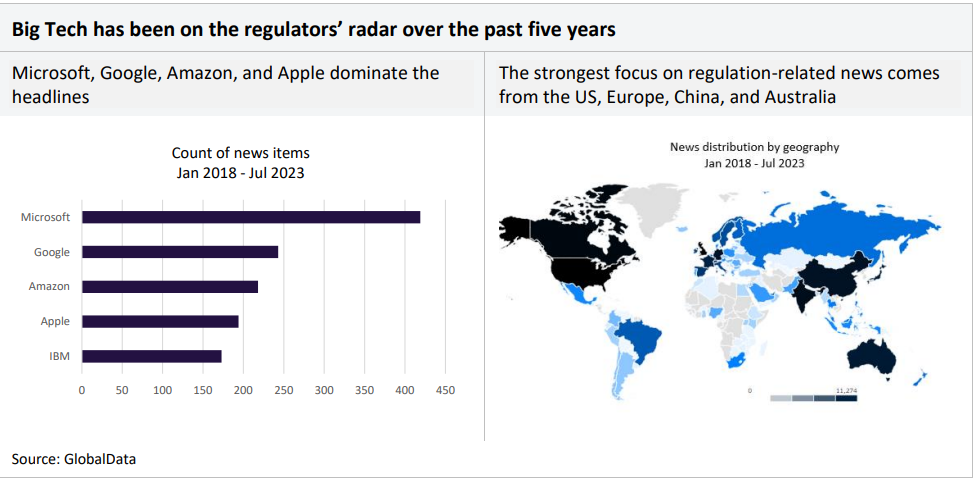

News coverage of tech regulation has become increasingly common, with the US and China at the forefront of discussion due to an ongoing trade dispute.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

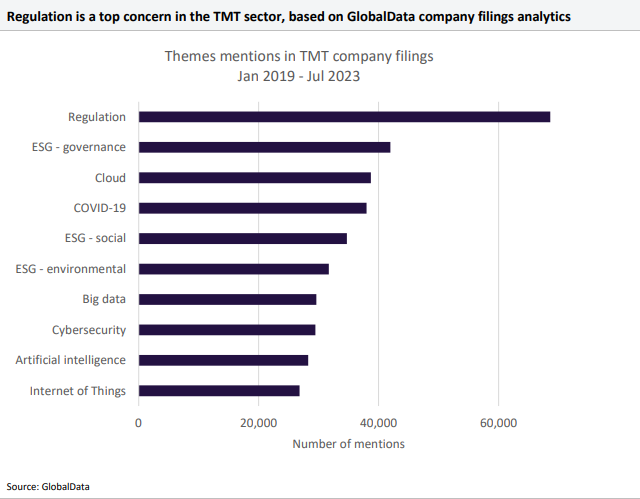

Tech regulation was the most frequently mentioned theme in company filings between Jan 2019-Jul 2023.

According to research analyst GlobalData, the US has become increasingly concerned about the potential economic and military precedence.

Global Data’s 2023 thematic intelligence report into tech regulation, notes how Huawei was affected by this dispute after the US placed it on its entity list. Placing Huawei on this list did not ban US companies from working with Huawei but required such companies to apply for licenses to do so.

According to GlobalData, a weakening chip leadership is what underpins the US legislation against China.

Whilst Chinese companies, like Huawei, are posed to lose out in the short-term future thanks to US actions against them, GlobalData states that the longer-term future may be more complicated.

Multinational corporations based in the US that also trade within China, such as Apple or AMD, could be negatively affected by their own country’s restrictions.