Chinese AI startup 01.AI stockpiled NVIDIA chips in anticipation of further US import curbs against China, according to the startup’s CEO Kai-Fu Lee.

The news comes after 01.AI received a $1bn valuation just eight months after its creation.

In a TV interview with Bloomberg, Lee stated that the startup bought enough AI chips to last around 18 months but remained sceptical over whether China could recreate the technology locally.

Lee stated that he wanted 01.AI to become a global company, stating that it employed both Chinese-trained and US-trained employees.

“We have a single goal,” explained Lee, “which is to make the best large language model and bring higher productivity and GDP to the world.”

01.AI’s LLM Yi-34B, which is open source, has been reported to outperform Meta’s Llama2 model in common sense reasoning, coding ability and reading comprehension.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataDuring his interview with Bloomberg, Lee stated that it was regrettable that the US and China had strained tensions in technology, likening the two countries’ tech sectors to “parallel universes”. But despite this attempted decoupling, Lee questioned whether the US and China would ever truly compete with each other.

“Americans will supply their products and technologies to the US and other countries, and Chinese companies will build for China and whoever else uses Chinese products,” Lee stated, “The reality is that they will not compete very much in the same marketplace.”

The US has already restricted the sale of Nvidia chips to China and the Middle East citing national security fears. But this has not hindered Chinese internet companies ordering over $5bn worth of chips from Nvidia, states research company GlobalData, in its Artificial Intelligence – Executive Briefing (Second Edition) report.

The total semiconductor industry is worth over $600bn, having grown at a compound annual growth rate of 8.3% between 2017 and 2022, according to GlobalData. The industry’s manufacturing is currently dominated by the Asia-Pacific region.

Whilst classical non-AI chips are positioned to only grow under 5% annually, production of AI chips is set to consistently grow over 20% each year according to figures from both GlobalData and World Semiconductor Trade Statistics.

Soon AI-specific chips will begin to dominate the chip market, accounting for 40% of the global market as soon as 2030.

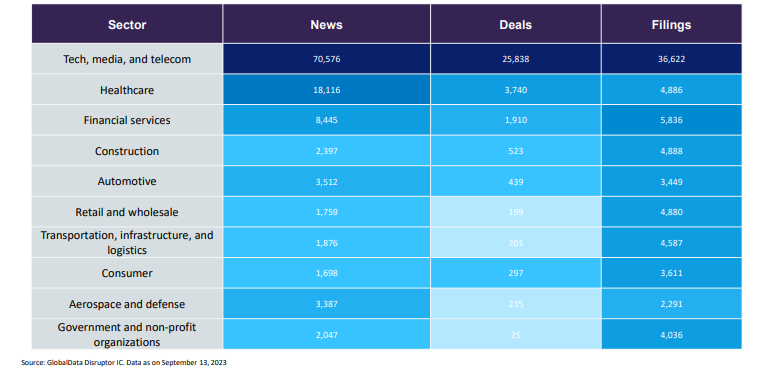

GlobalData’s news, deals and filings databases has continuously tracked a surge in AI interest. In GlobalData’s 2023 Q3 tech sentiment survey, AI was ranked the most mentioned topic throughout the year with over 70% of respondents stating that they believed AI would disrupt their industry.

This was despite a slight wane in confidence over the technology. Only 53% of respondents believed that AI would live up to its promises, which was 10% lower than recorded in Q2 2023.

Despite this, interest and conversation over AI appears to be steady. As AI continues to disrupt industry across the world, pressure on China to create its own answer to Nvidia chips will peak.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.