China’s Ministry of Transport has released safety guidelines for autonomous vehicles (AV) used for public transport.

The guidelines state that any AVs used for public transport must be registered as market entities and have appropriate insurance.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

AVs must also be in accordance with national safety and technical standards, preventing the risk of accidents or traffic. A Road Transport Certificate will also be a requirement to show that an AV meets these requirements and has complied with system updates.

China’s ministry of transport stated that any AV used as public transport must also have a safety personnel or driver on board.

Consultant analyst at research company GlobalData, Michael Orme, spoke to Verdict on China’s stance towards AVs.

“Baidu and Pony.ai lead the pack,” Orme stated, “and in geofenced zones in Beijing and Guangzhou now provide limited robotaxi services involving vehicles sans a human safety driver in the vehicle, albeit with emergency remote controls in operation.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAccording to Orme, Chinese AV companies Baidu, Pony.ai and AutoX were technologically competitive with US companies Waymo, Cruise and Tesla.

“China, via an all-nation approach, aims to do in AVs what it has done in EVs (electric vehicles), which is lead the pack,” Orme said.

China has already created a vast EV infrastructure within the country with around 70% of the total number of EV chargers in the world are situated in the country.

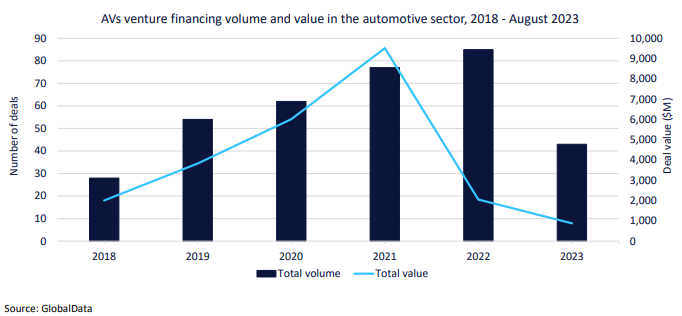

Venture financing in AVs, however, could be a sticking point for further movement in the technology.

After experiencing a boost in financing between 2020 and 2021, AV venture financing has declined according to GlobalData’s 2023 thematic intelligence report into the technology.

Both the number of deals being made and their value have decreased.

Whilst this implies a decreased investor interest in high-risk financing, GlobalData concluded that it may also signal a coming maturity within the technology, leaving fewer startups and companies to invest in.

Out of 16 deals identified by GlobalData as key investments within AVs, eight of them were made by Chinese companies. The other companies were located in the US, UK and Sweden.

Safety continues to be a hurdle for AV companies worldwide after numerous crashes and traffic incidents by Cruise’s AV robotaxi fleet received coverage in October.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets – patents, jobs, deals, company filings, social media mentions and news – to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.