There is increasing evidence that standalone automated financial advisors, or robo-advisors, will not attract affluent investors on their own, but can provide a competitive edge if included by traditional wealth managers.

A survey of wealth managers by GlobalData found that just 10% of private managers worried that they would lose market share to robo-advisors over the next 12 months.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The reports of many automated financial advisors show that their clients are only entrusting small portfolios to the digital-only platforms.

Robo-advisor ElleVest, aimed at women, has investors for $7,400 on average.

Hedgeable, an avant-garde robo-advisor called it quits last week, closing with $47,000 per account on average, despite marketing itself as high net worth-ready.

The New York based advisor closed just short of its 10-year anniversary, following in the steps of WorthFM, SheCapital and Owners Advisory.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

“Robo-advice is a volume play, not a margin play”

Users of these platforms are either not high net worth (HNW) investors or they are not willing to have their main assets managed by an algorithm.

“When a key selling point of the service is its low costs, you have to have a mass market strategy. In other words, in order for any robo-advisor to be successful, it must be attracting assets under management in the billions of dollars,” said Andrew Haslip, financial services analyst at GlobalData.

“Robo-advice is a volume play, not a margin play, so the boutique specialist angle is not practical. Wealthfront, Betterment and a few other major brands such as Acorns are strong enough and broad enough to attract enough clients. Start-ups with little brand awareness and targeted addressable markets are not.”

Robo-advisors as wealth management tools

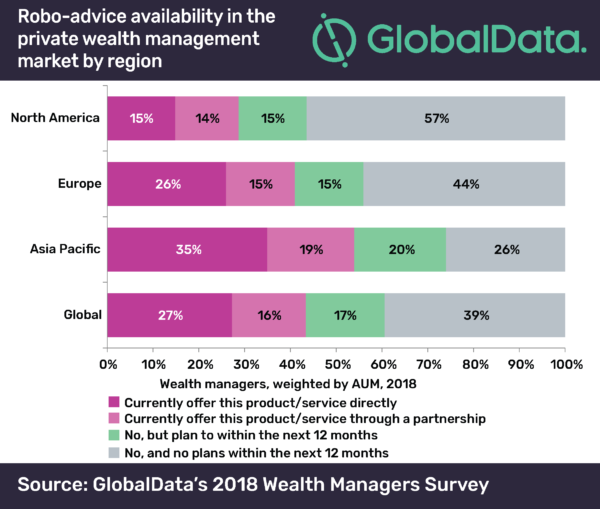

GlobalData’s survey found an enduring and growing demand for robo-advice, with 40% of private wealth managers noticing strong demand for the technology from their clients, particularly in the Asia-Pacific region.

Investors are looking at robo-advice as a tool, which every wealth manager should be using on their behalf, in addition to their traditional services.

“Despite some drawbacks, robo-advice is a competitive advantage that all traditional wealth managers must acquire. They are not about to lose their best HNW clients to a start-up robo-advisor, no matter how slick the digital interface,” said Haslip.

“But they might just lose out to a competitor that has adopted the technology and integrated it into its overall private wealth management proposition. Although ultimately the human element will remain prominent in the world of financial advice, the industry will continue its technological advancement.”