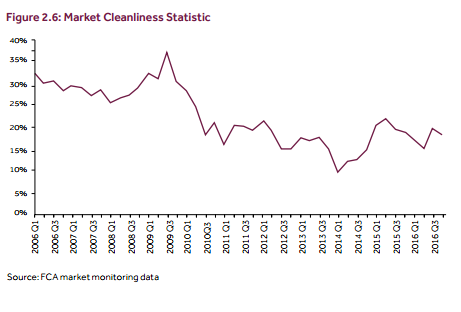

Suspicious trading activity ahead of public takeover announcements remained at a high of almost 20 percent in 2016, according to data published the UK financial watchdog.

In its annual report the Financial Conduct Authority (FCA) said it wanted to:

Support a healthy and successful financial system, where financial markets are fair, efficient and transparent, firms can thrive and consumers have trust in open and transparent markets.

However, last year, as many as 19 per cent of UK takeover announcements were preceded by abnormal price movements (APPMs), which can be a sign of market abuse.

The figure shows no improvement on 2015.

In 2014, the APPMs figure hit a low of 14.3 per cent, following a crackdown on insider trading by the FCA and its predecessor, the Financial Services Authority (FSA).

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIt was not until 2008 that the FSA started prosecuting insider trading.

Although 19 percent is low compared to the four years before 2009, when the figure was as high as 30 percent, the FCA is keen to bring it down.

The FCA makes clear that market abuse is not the only possible cause for price spikes, but APPMs can be good indicators of suspicious trading activity. Its report said:

Many other factors could cause an abnormal price movement before a takeover announcement. For example, factors such as financial analysts or the media correctly assessing which companies are likely takeover targets or significant, but normal trades that just happen to fall before an announcement.

The FCA has made targeting insider trading a key priority.

Last year, a high-profile £14m case dubbed Tabernula brought by the regulatory body culminated in a number of convictions after a 12-week trial.

A former Deutsche Bank managing director and an ex-finance director at Topshop were found guilty of “persistent, prolonged, deliberate, dishonest behaviour” in May 2016.

Since then, there have been smaller cases of insider trading.

Mark Lyttleton, a former BlackRock trader, was sentenced to a year in prison after pleading guilty to using inside information to trade in the securities of EnCore Oil and Cairn Energy in December.

Last month, a former UBS compliance officer Fabiana Abdel-Malek was charged with five counts of insider trading. The alleged wrongdoing took place in 2013 and 2014.

The FCA’s report concluded:

We will continue to monitor the results and gather market intelligence to enable us to draw robust conclusions about the underlying trend in insider trading activity.

The FCA brought 70 insider-trading cases in 2016, the highest on record. The crime of insider-trading carries a maximum seven-year sentence.