In August 2020, mobile operator Orange Romania signed a preliminary agreement with the country’s Ministry of Transportation, Infrastructure and Communications to take over the fixed-line operations of incumbent Telekom Romania.

The move from Orange comes after Vodafone Romania, Orange’s closest competitor in the mobile segment by subscriber share, acquired cableco UPC Romania in July 2019 to become a converged operator. The acquisition will allow Orange to become a fully converged operator with important fixed assets.

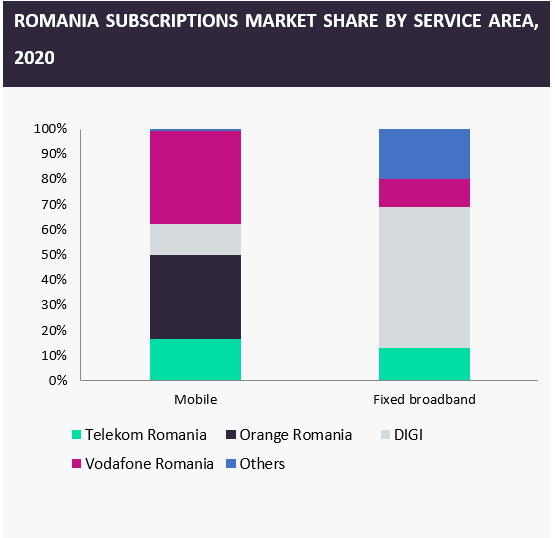

With a 33% subscriber share in 2020, Orange Romania is the second-biggest player in the mobile segment behind Vodafone (37% subscriber share).

This acquisition will enable Orange to gain an important foothold in the fixed market, taking over Telekom Romania’s 13% subscriber share in the fixed broadband segment. Furthermore, this will open up new up-selling and cross-selling opportunities for Orange across the mobile and fixed customer bases.

Fixed mobile convergence (FMC) will help the telco reduce churn rates, increase residential ARPU and offer more services to households.

On a different note, it is important to highlight that in 2019, DIGI Communications, the largest Romanian fixed operator, expressed interest in acquiring Telekom Romania’s mobile assets. The potential acquisition could help DIGI strengthen its position in the mobile segment and be more aggressive in the convergence segment.

The changes in the competitive landscape in Romania will consolidate the industry, intensify the competition in the country while accelerating the uptake in FMC packages adoption.