Graphical computing giant Nvidia has announced that it will reduce the hash rate further in its new line of graphics cards, meaning it’s going to get even harder for bitcoin miners to use them. Hash rates refer to the processing power of the card. The higher the hash rate, the more digital dosh miner can mine.

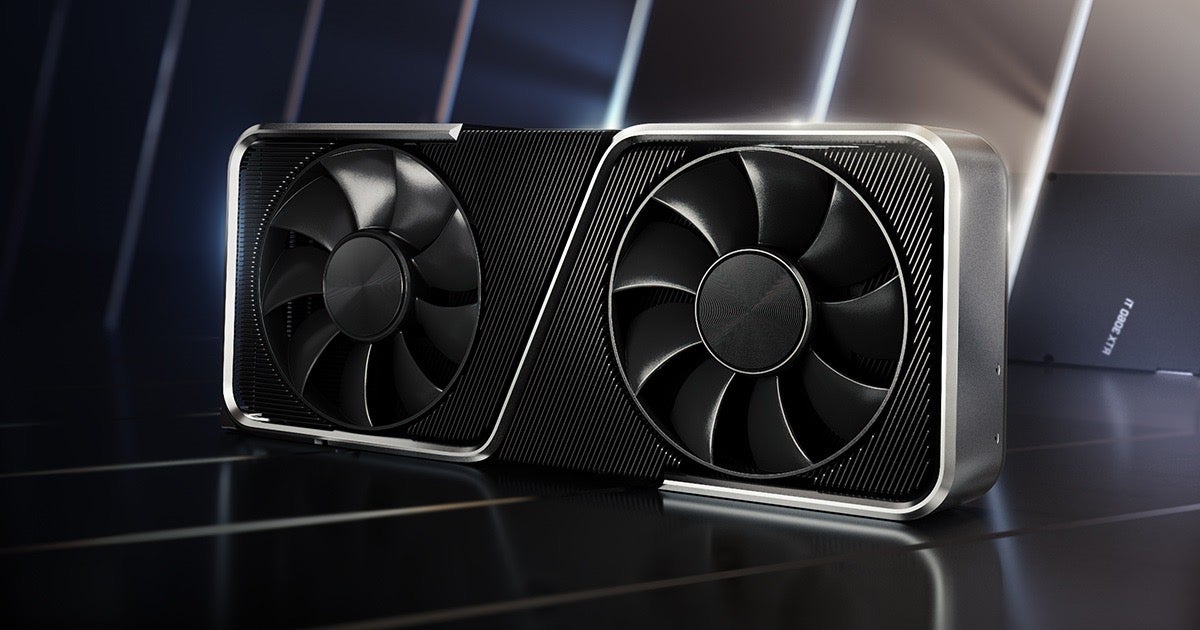

By halving the hash rate in its RTX 3080, RTX 3070 and RTX 3060 Ti cards, which Nvidia refers to as making them “Lite Hash Rate” or “LHR”, these graphics cards are less likely to be used in crypto mining.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

This is not the first time that Nvidia has done something like this. It had already halved the hash rate of its GeForce RTX 3060 graphics card.

“GeForce products are made for gamers – and packed with innovations,” Nvidia explained in blog announcing the news. “Our RTX 30 Series is built on our second-generation RTX architecture, with dedicated RT Cores and Tensor Cores, delivering amazing visuals and performance to gamers and creators.

“Because NVIDIA GPUs are programmable, users regularly discover new applications for them, from weather simulation and gene sequencing to deep learning and robotics. Mining cryptocurrency is one of them.”

The bad news is coming hard and fast for cryptocurrency enthusiasts. Bitcoin has fallen by 44.5% from its all-time high in April and is currently trading at $35,319. Tesla has stopped people from buying cars with crypto – if they ever did – and Beijing is turning the screws on digital currencies.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBitcoin’s month-long tumble started just after cryptocurrency exchange Coinbase made its public debut in April. The price drop has been linked to a number of factors, chief among them concerns that regulators plan to introduce new legislation to prevent cryptocoin being used for criminal activities like money laundering and ransomware payments.

Another factor initially linked to the bitcoin price shock was a power outage in the Chinese Xinjiang region in April. The blackout was caused by maintenance work after a recent flooding in the region, which is home to much of the world’s bitcoin mining.

Despite the tumble, a GlobalData thematic research report from April noted that financial industry incumbents are increasingly accepting bitcoin, ether and other digital assets.

For instance, Goldman Sachs has launched a new crypto-trading team, Fidelity Investments is preparing to launch its own bitcoin fund, and Morgan Stanley has provided wealth management clients access to two crypto funds.

“When the mysterious Satoshi Nakamoto launched bitcoin over a decade ago, it divided investors into cryptocurrency sceptics and cryptocurrency enthusiasts, groups that still exist to this day,” GlobalData analysts wrote.

“Needless to say, many financial institutions fell into the first category. However, in line with the digital transformation the wealth industry is experiencing, many large financial institutions who once slammed the concept, despite having found use cases for the blockchain technology which underpins cryptocurrencies, have now changed their tune and the asset class is no longer being put to the side.”

In other news, Nvidia is one of the companies hit by the global semiconductor shortage. Its CEO Jensen Huang said in April that he believes the chip crunch will last for two years, adding that a fresh approach is needed for chips in automotive systems and supply chains.

“Instead of thousands of components it really wants to be a few centralised components because you could keep your eyes on four things a lot better than you can keep your eye on 10,000 places,” Huang said, understandably as his company makes powerful, advanced silicon rather than basic semiconductors.

Soaring demand and shrinking supply in semiconductors because of Covid-19, severe weather and factory fires have forced automakers including Ford, General Motors and Hyundai to halt or interrupt production of cars and trucks.