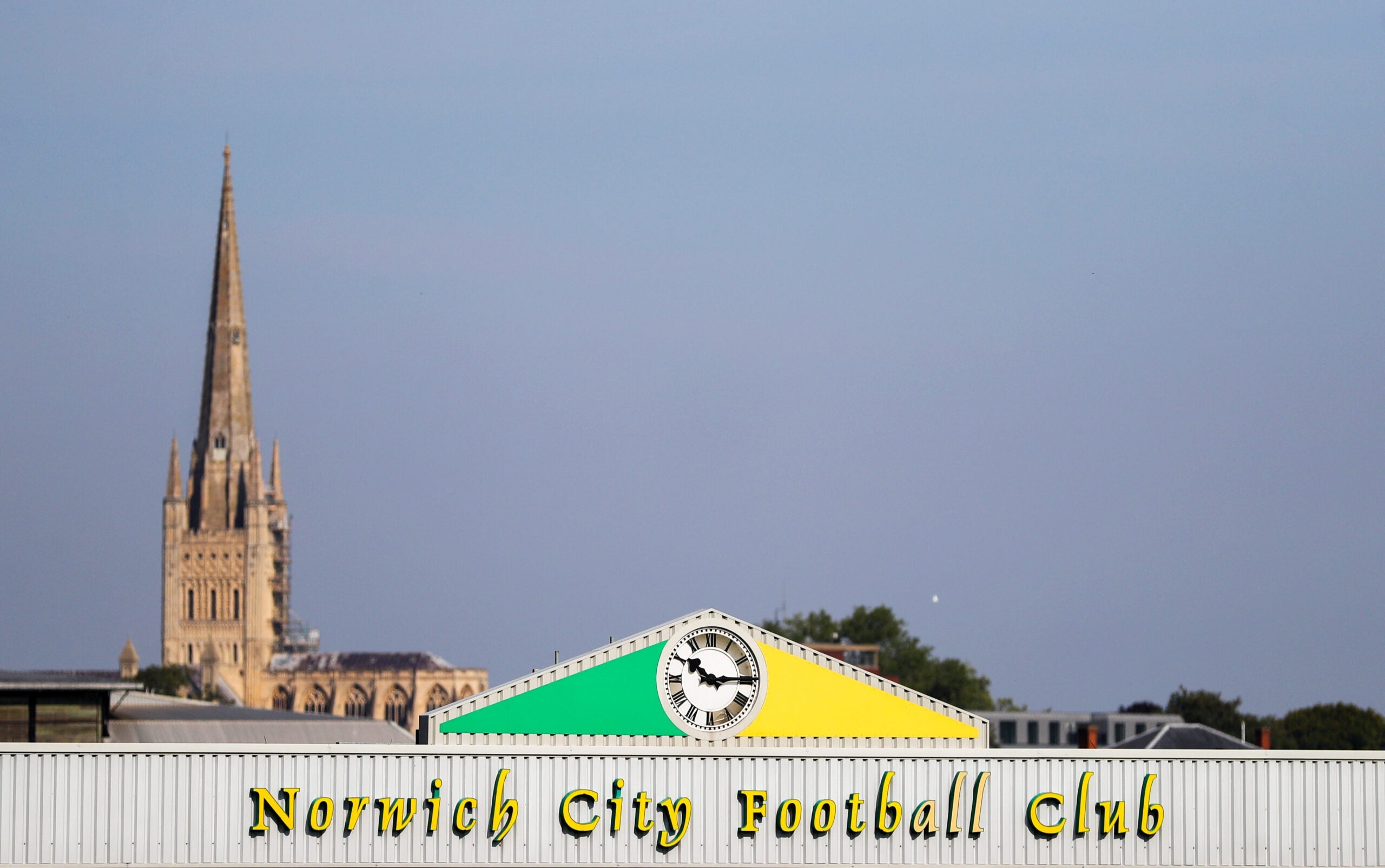

Approximately 160km north-east of London sits Norwich, an urban centre that became a city more than 800 years ago. With cobbled streets, ancient buildings and half-timbered houses, it is considered one of the most medieval cities in the UK.

Norwich is picturesque, sitting as it does upon the River Wensum, which flows towards Norwich Castle, but it has also long been a major centre for business and trade in the UK.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Until the late 20th century it had been an industrial city with a particular penchant for shoemaking, Nestlé chocolate and mustard – Colman’s was founded there in 1814 and only closed its factory doors in 2019.

These local industries and the city’s longevity are central to its civic pride, according to Norwich City Council leader Alan Waters. “Norwich is constantly reinventing itself – that is built into the dynamic of the city,” he says. “People in Norwich are very proud.”

As a popular tourist destination, the city’s economy has been hit hard by the global travel restrictions imposed as a consequence of the Covid-19 pandemic. Like other UK cities, its leaders are having to steer a course through economic waters made choppier by Brexit.

While it no longer makes mustard, Norwich is the home of food and life sciences, advanced manufacturing, digital and financial services. All play a part in the city’s strategy for confronting the twin challenges of Brexit and the pandemic.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataNorwich looks comparatively resilient to Brexit

Norwich City Council has published a paper entitled ‘The Emerging Impacts of Brexit on Norwich and the Wider Region’, which anticipates an increase in redundancies and insolvencies in 2021.

The paper cites previous predictions from the MetroDynamics January 2020 report that: “If a deal were secured, Norfolk and Suffolk’s GDP would face an average reduction of 4% by 2030 and the UK an average reduction of 3.5%. New Anglia Local Enterprise Partnership believes that this impact on the economy is still likely to remain true.”

Digital and tech is a growing sector in Norwich. It is a spin-off in part because of the university and the financial services sector. Alan Waters, Norwich City Council

More positively, the New Statesman Brexit Vulnerability Index ranks Norwich 311st out of 379 locations in the UK, suggesting the city will be one of the least-impacted areas in the country.

In 2018, the city council launched its Norwich 2040 vision, which set five key themes for the next two decades; creative, fair, liveable, connected and dynamic. From this, a recovery group was more recently created to address the impact of Covid-19 on Norwich.

Waters says of the recovery group: “There is a particular focus on the city centre. In the city centre, we have one big department store, Debenhams. Now Boohoo has bought that brand and will leave the building – so the question is how do we reinvest in the city centre?”

Norwich has successfully applied for funding via the UK government’s Towns Deal. Waters says: “We are a city, but for £25m, we are happy to be called a town.”

The deal is part of a wider £3.6bn government scheme that aims to level up local economies and stimulate job markets in transport, infrastructure and skills. Norwich was one of the first of seven locations to secure the funding.

Universities in Norwich are driving growth

Norwich lags behind both the wider region of East England and the UK in education levels, and also has a higher percentage of the population with no qualifications.

This comes despite the city being home to the University of East Anglia (UEA), the Norwich University of the Arts, and City College Norwich.

While education levels are below average, the city’s educational institutions make an outsized contribution to its economy.

An economic and civic impact report published by the UEA in 2019 showed that roughly 9,800 jobs are supported by the university across the UK, with more than 4,500 of these being based in Norwich. It also estimated that the UEA contributed approximately £468m to the Norwich economy on an annual basis.

In fact, education provides more gross value added (GVA) growth to the city than any other sector. Norwich’s education sector grew 113% more than the average across all sectors between 2000 and 2018.

Digital and tech sectors show promise

Part of the £25m towns deal will be used to nurture Norwich’s digital tech sector. Both a digital hub – a central workspace for digital businesses and a digitech factory, a £9m skill facility providing courses in digital tech, engineering and design – are set to be developed.

Waters explains: “Digital and tech is a growing sector in Norwich. It is a spin-off in part because of the university and the financial services sector.”

Aviva, Handelsbanken, Marsh, KPMG, Swiss Re and The One are among the finance and insurance companies to operate in the city. It is one of the largest general insurance markets in Europe and the biggest cluster in the UK, outside of London.

The financial and related professional services sector employs approximately 11,500 workers locally and contributes roughly £1bn to the local economy – according to Invest in Greater Norwich.

Digital businesses are supported through initiatives such as Greater Norwich and East Anglia’s tech cluster, which contains more than 100 high-tech information and communications technology companies.

Alongside this is the Cambridge Norwich Tech Corridor, an initiative that combines the two East England cities along a 100km stretch. Its objective is to form closer links between existing tech clusters in the region and, as a result, promote investment.

Food, science and sustainability

Norwich Research Park is one of Europe’s largest single-site concentrations for research in food, health and life sciences. It is home to a number of institutes conducting research and development (R&D) in this field, including the John Innes Centre, the Institute of Food Research, the Genome Analysis Centre, the UEA, and Norfolk and Norwich University Hospital.

The park is home to more than 80 science and IT-based businesses employing approximately 12,000 people, and sees an average annual research spend of more than £100m. The site is also home to the Norwich Institute for Sustainable Development, which focuses on developing solutions for farmers to build resilience to unpredictable rainfall and extreme weather events.

Waters highlights the synergies between the council and the research park. “It influences our thinking as a council in terms of shaping our environmental strategy for the city and, of course, to attract businesses that can spin-off from that sort of environmental work,” he says.

The institute launched with £750,000 in funding from the John Inness Foundation. A new UK centre of excellence focused on improving global food security is now set to be established at the research park.

Norwich’s strength in construction and engineering

While Norwich’s traditional industries of mustard, chocolate and shoemaking have disappeared as part of a wider industrial decline in the UK, the city now boasts advanced manufacturing and engineering companies focused on the electronic, auto, aircraft and marine sectors.

Based in a cluster near Norwich airport, Hethel Engineering Centre acts as a manufacturing hub for the East of England. The centre offers workshops, office space, conferences and business support.

If you said to me you have an investor interested in Norwich and they were going to drop by on Friday, I would be able to get all of the key players around the table for that. Alan Waters

Norwich’s engineering and manufacturing sector includes global brands such as KLM and Group Lotus. The latter launched a new facility in Norwich in January 2021, which will employ 125 highly skilled workers to manufacture aluminium chassis. This move is part of a bigger expansion project by Lotus in the area.

Funds from the £25m towns deal will also be used for the development of an advanced construction and engineering centre. The centre would act as a training facility to support the adoption of advanced technology in Norwich’s construction, manufacturing and engineering sectors.

Real estate was second only to education as a contributor to Norwich’s GVA growth in recent years, with a notable increase between 2017 and 2018.

Norwich also has a strong track record in housing construction, according to Waters. “Norwich has very high standards of public housing,” he says. “We won the Sterling Prize for architecture for our council housing developing [on Goldsmith Street]. It was the first time it had ever been given to public housing.”

Attracting investment to Norwich

Norwich’s clusters of tech and advanced manufacturing companies, as well as its strength in R&D, may help to explain the city’s expected resilience to Brexit in contrast to other urban centres.

This will help the city to continue to attract businesses because of its favourable operating environment. According to Invest in Greater Norwich, the area has operating costs 45% cheaper than London or Cambridge.

Waters says another advantage for business in Norwich is the opportunities for cooperation. “If you said to me, you have an investor interested in Norwich and they were going to drop by on Friday, I would be able to get all of the key players around the table for that.”

Waters also highlights how Norwich is a living wage city and key priorities for the council are “improving sustainability and equality”. “It is a very creative city,” he says. “It has got a diverse economy. If you are going to put a workforce here, it is a happy place they are coming to.”

For more of Investment Monitor’s coverage of the UK’s cities, read through our Future of British Cities series:

- Aberdeen

- Belfast

- Birmingham

- Bradford-Leeds

- Brighton

- Bristol

- Cardiff

- Coventry

- Dundee

- Edinburgh

- The East Midlands

- Glasgow

- Hull

- Kent

- Liverpool

- Manchester

- Newcastle and the North East

- Norwich

- Plymouth

- Portsmouth

- Reading

- Sheffield

- Southampton

- Stoke-on-Trent

- Swansea

- Wolverhampton