TikTok has plans to expand its e-commerce presence in the US, encroaching on Amazon’s lead, as the sector is set to be worth over $9trn by 2030.

According to original reports from Bloomberg, which references sources familiar with the matter, TikTok’s parent company ByteDance has increased its sales target after achieving $20bn last year in sales.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

TikTok originally responded to Bloomberg’s report stating that the goals were “inaccurate” in representation.

TikTok Shop was introduced November 2022 and allows users to buy products whilst browsing the platform. Content creators on the site can directly link to products on the shop in videos and live streams.

Research and analyst company GlobalData forecast in its 2023 thematic intelligence report into e-commerce that the sector is on track to be worth over $9trn by 2030 worldwide.

Convenience was named as the number one reason for growth in this report by GlobalData, which is a major feature of TikTok Shop’s design as it allows users to buy impulse purchases after seeing products linked in content on the site.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataTikTok Shop is also part of a growing trend of diversification by social media companies’ industry wide as user data becomes more tightly regulated which means that companies can no longer rely on targeted advertising to drive profits.

Mobile devices have also transformed e-commerce according to GlobalData, whose research found that 53% of all online purchases made in 2022 were on mobile phones or tablets.

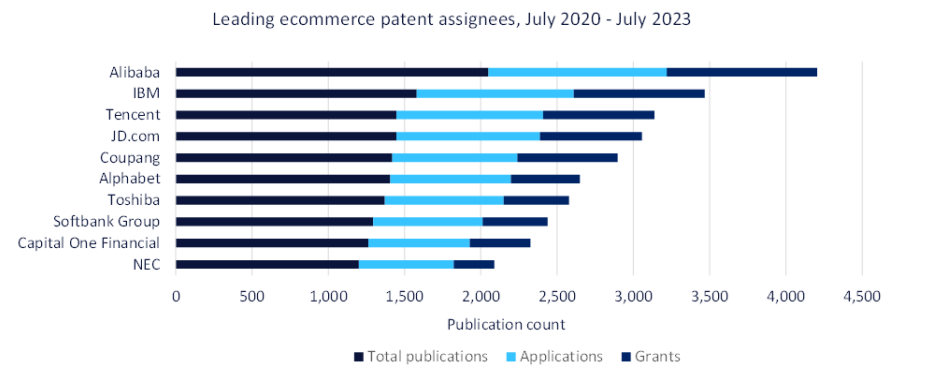

Patent activity in the e-commerce sector has also been dominated by companies in Asia, with Chinese companies like Alibaba and Tencent publishing more than 1000 patents between 2020 and 2023 alone.

Amazon does not make the list for patents; however, this could be due to it being a leader in e-commerce for several years and already maturing its technology in this area.

Overall patent activity tracked by GlobalData suggests that all companies globally saw a notable decline in patent activity from 2022 after a burst in publications and applications after 2020. GlobalData suggests that this burst may have been caused by worldwide lockdowns during the Covid-19 pandemic which forced many consumers to shop online.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets – patents, jobs, deals, company filings, social media mentions and news – to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.