Indian maps data company MapmyIndia could significantly challenge Google Maps’ dominance in the country after recent growth in its share price.

MapmyIndia shares have risen 104% from the beginning of March 2023, putting its consumer app Mappls in direct competition with Google Maps.

MapmyIndia began collecting map data in 1995 and provides digital map and geospatial services to consumers and businesses through its maps app Mappls.

Despite global uncertainty rocking economies, India continues to harbour a resilient economy according to GlobalData’s 2023 macroeconomic report on the country.

Describing India’s market as a “shining star”, analyst GlobalData forecasts that India’s GDP is set to grow by 5.8% in 2023 due to private investment and government initiatives to support local growth.

India’s tech market has already seen some growth after its government tightened import controls on tech hardware in an effort to promote in-India manufacturing of laptops and tablets.

GlobalData stated that this growth is still lower compared to the 7% rise that India saw in 2022, however both private and public expenditure both saw acceleration in 2023 at 2.8% and 2.3% respectively.

According to GlobalData’s deal database, venture capital in India’s technology market has weathered the global economic downturn remaining relatively steady against harsh macroeconomic conditions.

Aditya Shah, an analyst at the Stocks and Exchange Board India (SEBI) took to X (formerly Twitter) back in August this year to explain why MapmyIndia may challenge Google Maps’ dominance.

Shah points out that whilst Google Maps is predominantly a consumer focused business, MapmyIndia provides digital maps and geospatial software to many companies. This means its potential customer base is broadened across businesses as well as consumers. This also allows MapmyIndia to reach across several industries such as the automotive sector and financial service providers like HDFC Bank.

Additionally, Shah states that Google sells its data to advertisers, whilst MapmyIndia has claimed that it never advertises customer data to third parties and maintains confidentiality.

“That’s a huge difference,” Shah writes, “Something every enterprise would want!”

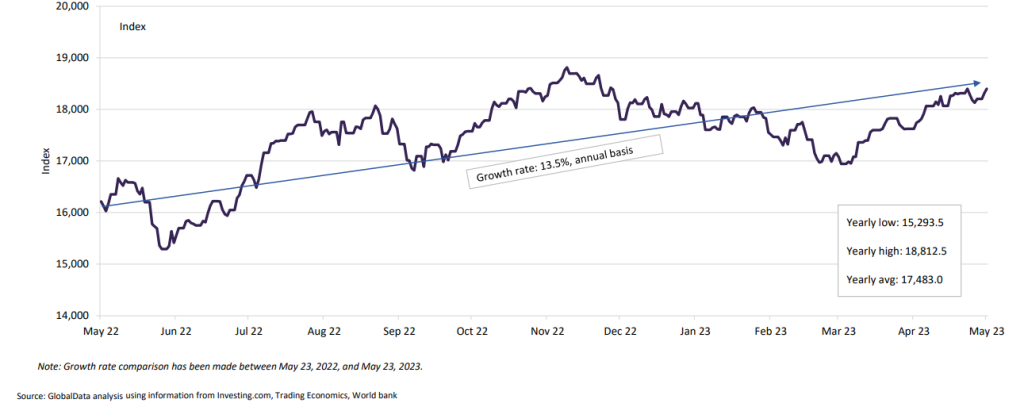

However, amongst this optimism it is important to note the volatile nature of India’s stock market this year.

India’s NIFTY index growth between May 2022 and May 2023.

Groww, a financial services platform, explains that NIFTY is a benchmark-based index measuring the growth of sectors including information technology.

Volatile growth patterns create forecasts that are harder to guess, meaning that whilst MapmyIndia is currently experiencing a buzz around its potential as a Maps competitor, it could struggle to maintain this momentum.