Leading cryptocurrency Bitcoin climbed to over $30,000 on Friday (20 Oct) for the first time in two months, amid a turbulent period for cryptocurrencies.

The reasons for the jump were not obvious – which is in keeping with Bitcoin’s characteristic volatility and lack of transparency.

In August 2023, Bitcoin logged its biggest one-day drop since November 2022. The cryptocurrency fell 7.2% on the 17th August before hitting a two-month low on the 18th August.

The collapse of stablecoins Terra and Luna in May 2022 followed by exchange FTX filing for bankruptcy in November 2022 plunged the crypto market into an extended bear market, known as the ‘crypto winter’.

Macroeconomic events such as the war in Ukraine and increased regulatory scrutiny, from the US SEC and Europe’s Markets in Crypto Assets, have stifled the global crypto market’s recovery in recent months.

In June, the SEC filed lawsuits against Binance and Coinbase, both cryptocurrency exchange platforms, for failing to register.

JPMorgan’s UK digital banking subsidiary, Chase UK, stopped customers from purchasing crypto assets on 16 October 2023 due to rising numbers of fraudsters using digital assets to target victims.

In March, NatWest limited the daily and monthly amounts of crypto customers could exchange while Santander moved to ban UK customers from sending real-time payments to crypto exchanges in an effort to tackle a growing number of crypto scams.

TSB instituted a block on crypto assets in 2021 due to the high levels of fraud and HSBC placed restrictions on cryptocurrency purchases with credit cards in February this year.

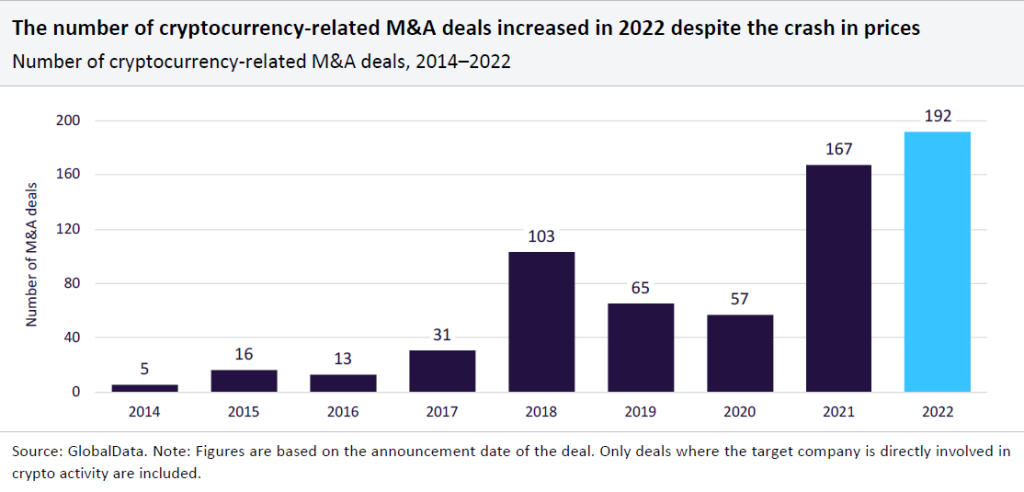

Data from research firm GlobalData’s Thematic Intelligence: 2023 Cryptocurrencies Report found that, as of May 22, 2023, there were 60 M&A deals in the crypto industry in 2023, which is a decline of 17% compared to the same period in 2022.

The crypto industry’s dominant players, the large, centralised exchanges such as Coinbase, Binance, and Kraken, lead the way with the most M&A deals.

GlobalData predicts that a drop in crypto prices, lower valuations, and liquidity challenges in the industry will lead to a rise in M&A activity.

As of May 24, 2023, there have been 224 fundraising deals worth $2.5bn in the crypto space in 2023, which is a decline of 25% in volume and 68% in value compared to the same, record-breaking, period in 2022.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.