Apple announced on Monday (18 December) that it would be pausing the sale of its Series 9 and Ultra 2 smartwatches in the US, as it works through a patent dispute over the technology used in the devices’ blood oxygen feature.

An October order issued by the US International Trade Commission (ITC) is currently under review by President Joe Biden which could ban Apple from importing the two devices.

The order came after the ITC found the watches to have violated medical technology company Masimo’s patent rights.

President Biden has until 25 December 2023 to decide on the order but Apple said it is working on ways to keep the devices active if they are found in breach of patent rules.

The ban could go into effect as early as 26 December.

Ambassador Katherine Tai, part of Biden’s Office of the US Trade Representative, said she “is carefully considering all factors in this case.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataApple said sales of the two Apple watches would be paused from its website on 21 December and from retailers on 24 December.

Masimo released a statement about the ITC decision on Monday, stating it “should be respected, protecting intellectual property rights and maintaining public trust in the United States’ patent system and encouraging US industry.”

Apple accused of stealing from Masimo

Masimo, a US health technology and consumer electronics company, accused Apple of hiring its employees and stealing its pulse oximetry technology.

Masimo’s allegations were heard by a jury in a federal court trial which ended in May.

Separately, Apple has sued Masimo for patent infrigement in a federal court. The iPhone maker slammed Masimo’s legal actions as a “manuever to clear a path” to compete with its own smartwatch.

Apple’s requests to review the validity of the patent issue was rejected by the US Patent and Trademark Office.

According to a Bloomberg report on Monday (18 Dec), citing people familiar with the work, Apple engineers are looking into making changes in the algorithms of the smartwatches and how the technology determines oxygen saturation.

“The patents in question cover hardware. Masimo believes that Apple needs to change the hardware,” a Masimo spokesperson told Reuters.

The US is leading in wearable tech patents

The wearable tech industry was worth $99.5bn in 2022 and will reach $290.6bn by 2030, expanding at a compound annual growth rate of 14.3% between 2022 and 2030, according to GlobalData forecasts.

According to GlobalData’s Thematic Research: Wearable Tech 2023 report, enterprises will be a key market for wearable tech devices over the next three years, outpacing the consumer segment.

Healthcare, particularly patient monitoring, remote training and support, and telehealth services, holds significant promise for the future of the industry, GlobalData stated.

Creating devices that can be used for longer, are lightweight, and have practical use cases will help companies generate demand and revenue.

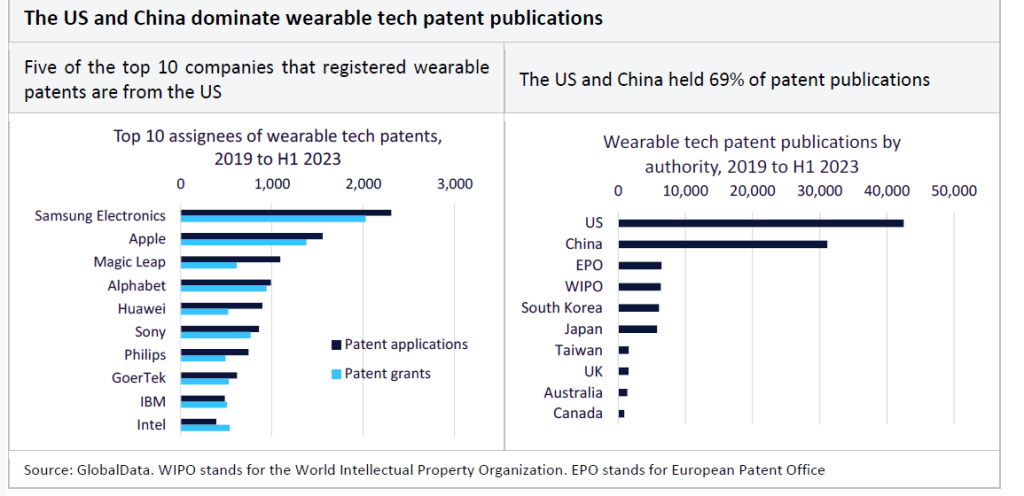

The news comes as patenting activity was driven by was driven by the US and China, accounting for 69% of patent publications between 2019 and H1 2023, according to GlobalData’s patent database.

Samsung Electronics leads in wearable tech patents, having registered over 2,000 since 2019, followed by Apple (1,555), Magic Leap (1,090), and Alphabet (988).

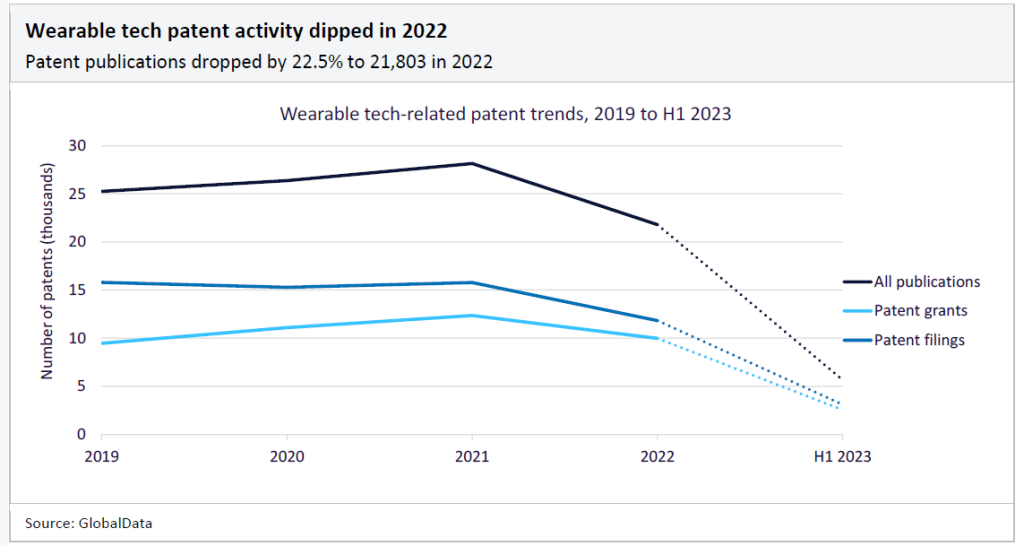

Apart from Samsung Electronics and Magic Leap, all other assignees saw a dip in

patent activity in 2022. Samsung Electronics has filed patents around AR wearable devices and health features such as predicting maximal oxygen uptake and estimating blood pressure.

Patent filings for wearable tech dropped by nearly 25% in 2022 compared to the previous year, as the number of filings from top patent offices in the US, China, Europe, South Korea and Japan declined due to uncertain economic conditions.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.