Japanese chip technology company Kokusai Electric has raised Y108bn ($724.4m) in its initial public offering (IPO), reported Reuters.

The company set its IPO price at Y1,840 per share, which valued it at Y423.9bn.

According to two sources aware of the development, the component of the IPO open to foreign investors was more than ten times oversubscribed.

If a domestic investor’s overallotment option is implemented, the offering would raise about $833m.

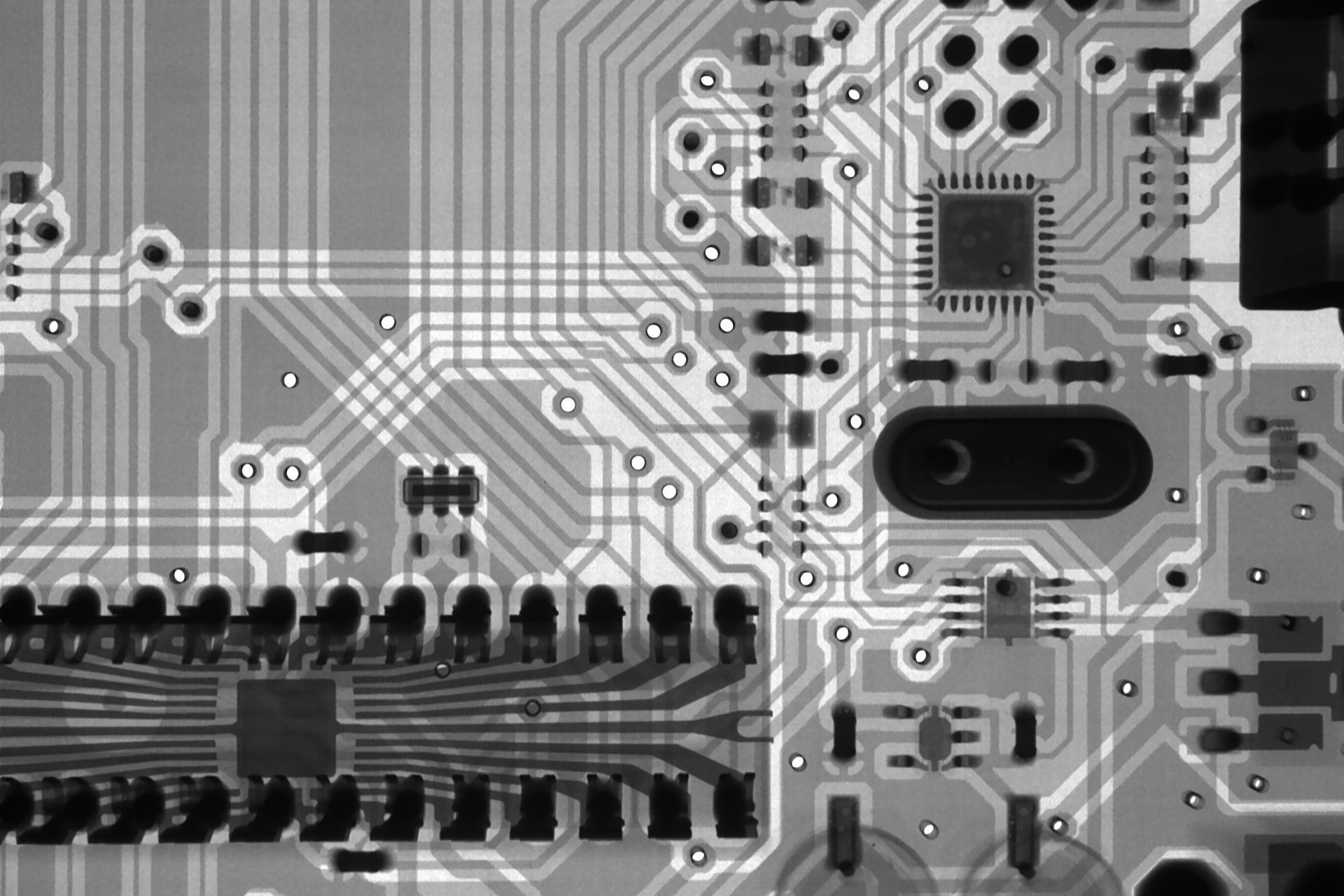

Kokusai, which is owned by US private equity firm KKR, develops and manufactures equipment used in semiconductor manufacturing.

The chip equipment company was carved out of Hitachi Kokusai Electric after the latter was acquired by KKR through a tender offer in 2018.

Kokusai’s IPO comes amid talks about the strength of demand in the chip business and a slump in the market for electronics such as smartphones and personal computers that has muted excitement about artificial intelligence (AI).

Last week, citing feedback from institutional investors and the status of the stock market, Kokusai reduced its indicative pricing from an initial price of Y1,890 per share to a range of Y1,830-1,840.

The decision was made in part as a result of chip creator Arm’s underwhelming share price performance since its debut last month, a source said.

Without a potential overallotment, KKR’s stake in Kokusai will drop from 73.2% to 47.7%.

The shares are slated to start trading on the Tokyo Stock Exchange’s Prime Market on 25 October 2023.

Samsung Electronics, Taiwan Semiconductor Manufacturing Company (TSMC) and Micron Technology are Kokusai’s top customers collectively accounting for more than 40% of its revenue.