As the console and personal computing (PC) gaming market suffers a wave of studio closures and layoffs following aggressive cost cutting by leading companies, the global mobile gaming market is continuing to see strong growth, according to GlobalData forecasts.

On Tuesday (14 May), Japanese PlayStation 5 maker Sony said it expected an operating income of $8.2bn, missing analyst expectations on both profit and sales. At the same time, shares in Japanese game studio Square Enix fell 16%, marking its largest decline in 13 years.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The results come as console and PC gaming revenue is expected to remain below pre-pandemic levels until the end of 2026, according to gaming research company Newzoo.

Gamers are reportedly recording fewer hours of game time, as quarterly playtime fell 26% from 2021 to 2023, according to a report from the company.

“Slower player growth rates will impact the industry’s capacity to ‘expand the pie’ via net organic growth,” Newzoo said.

The lack of PC and console playtime is expected to continue throughout 2024 due to a weaker slew of gaming release schedules, according to the report.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

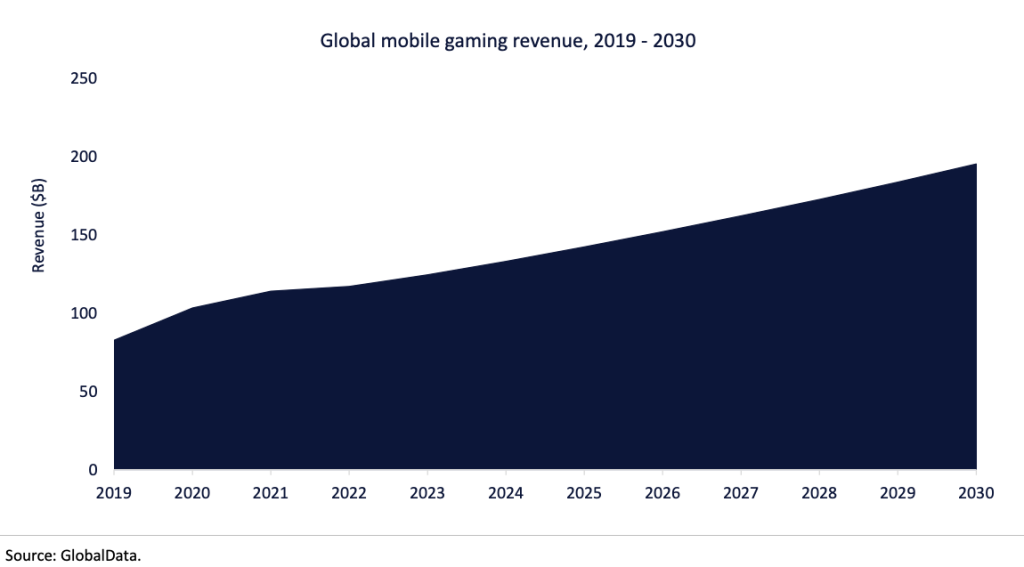

By GlobalDataAccording to GlobalData’s Thematic Research: Mobile Gaming 2024 report, the global mobile gaming market will grow to $195bn in revenue by 2030, a significant increase from $124bn in 2023.

The mobile gaming market grew strongly during the COVID-19 pandemic in 2020 and 2021. Revenue grew by 25% in 2020 compared to the previous year and a further 10% in 2021.

But the momentum shifted in 2022, with annual growth dropping to just 3% as rising inflation hit consumer spending.

However, this was a much smaller downturn than the rest of the industry and started to show signs of recovery in 2023, with revenue increasing by 6% compared to the previous year.