Chinese chip foundry Hua Hong Semiconductor has received approval for a 18bn yuan ($2.6bn) second listing on Shanghai Stock Exchange.

In an announcement, Hua Hong said the listing committee of the Shanghai Stock Exchange has approved the share sale.

The listing, which could be the biggest in China so far this year, is yet to receive approval from the China Securities Regulatory Commission.

Hua Hong’s announcement comes as Beijing tries to achieve self-sufficiency due to escalating tensions with Washington over technology.

The US has imposed sweeping sanctions to restrict Chinese companies’ access to technologies crucial for developing semiconductors.

According to Reuters, Hua Hong plans to use the proceeds to upgrade and expand production.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThis year, over a dozen Chinese chipmakers, including Lontium Semiconductor and Skyverse Technology, have sold shares in the open market on the mainland, the news agency added.

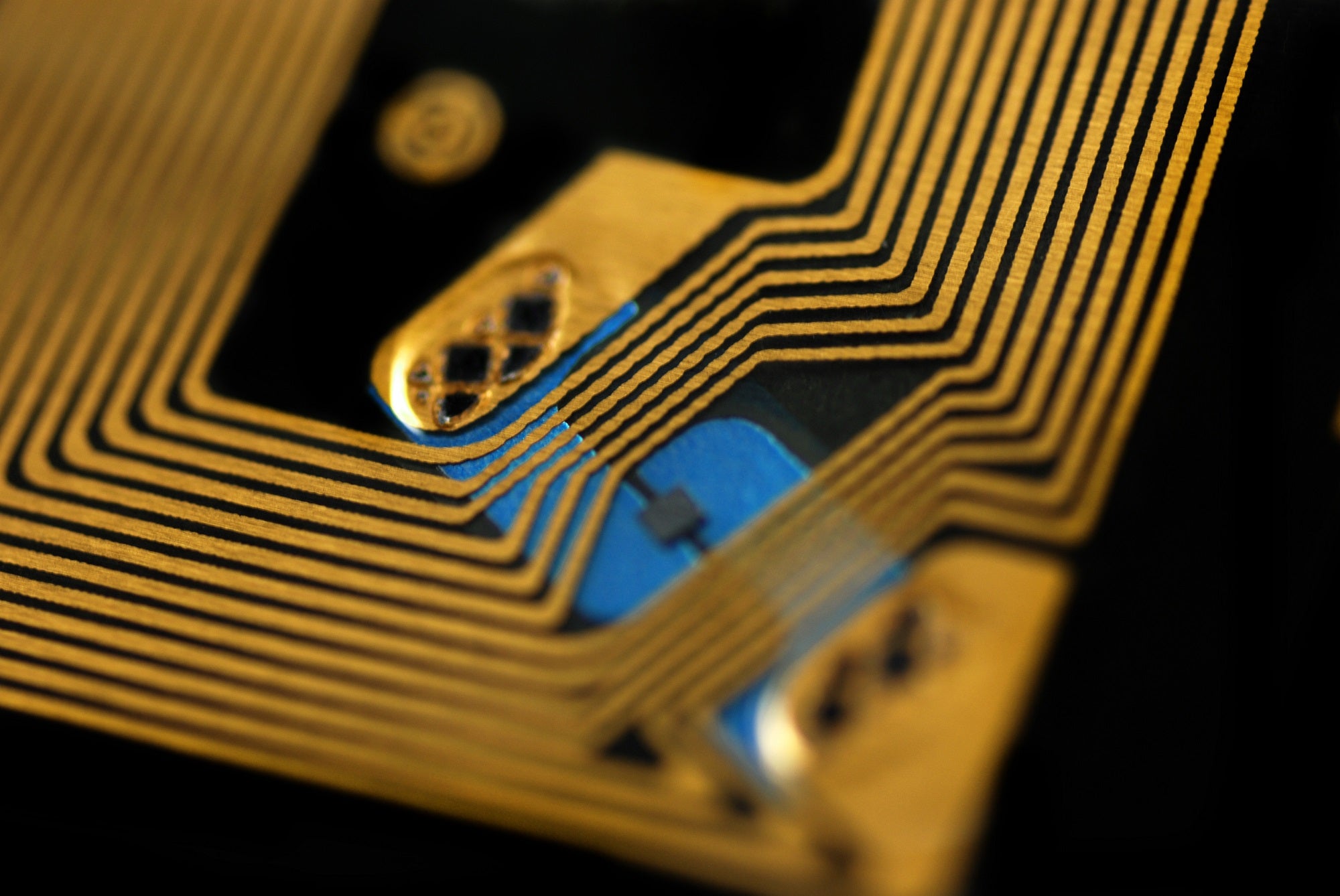

Based in Shanghai, Hua Hong specialises in producing semiconductors on 200mm wafers for various industries such as consumer electronics, communications, and computing.

In its Hong Kong initial public offering, the company raised approximately HK$2.6bn ($332m), according to Bloomberg.

Earlier this year, Hua Hong secured state support to set up a $6.7bn wafer fabrication plant in eastern Wuxi.

The new plant which will be Hua Hong’s second 12-inch manufacturing facility in the city, will manufacture chips using mature tech nodes such as 65nm, 55nm, and 40nm.