Mumbai, known as the financial capital of India, has faced mixed fortunes since the start of the Covid-19 pandemic, due in no small part to its gargantuan size. The city, located on India’s west coast, is home to nearly 13 million people, making it the country’s most populous metropolis. Unsurprisingly, therefore, it was hit hard by Covid-19.

On the flip side, Mumbai’s scale means it has a vast economy that has proved capable of rapid recovery across certain sectors. As the capital of Maharashtra, India’s third-largest region (geographically speaking), Mumbai has a renowned industrial prowess – it is widely seen as India’s automobile manufacturing hub.

For more than two decades, Maharashtra has been, more often than not, the leading state for foreign direct investment (FDI) across India. In the financial year 2020–21, only Gujarat received more FDI than Maharashtra, although Maharashtra still attracted 28% of the country’s inflows.

Despite the impact of Covid-19, 2020 saw India attract its highest ever inflow of FDI, valued at $64bn (Rs475.9bn), according to data from the United Nations Conference on Trade and Development (UNCTAD). This comes against a backdrop that saw global FDI flows drop by 42% in 2020.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThat said, Mumbai and Maharashtra have also felt the economic blow of the pandemic – and severely in certain sectors. Other than the city’s thriving tourism industry, which like all parts of India was devastated last year (see above chart), the state's automotive sector has also been dealt an enormous battering, with global and national demand failing to recover like other sectors.

Similarly, in pre-Covid times, Maharashtra was one of India’s tourism hotspots, offering a wide variety of caves, mountains, monuments and other historic sites – plus all the glories of Mumbai. In the years before the pandemic, the state was seeing an average of five million international arrivals per annum.

A rough ride for Maharashtra's automotive FDI

While Mumbai’s region is by no means the only automotive hub in India, it is the country’s largest and arguably most established.

Over the past five years, the Indian government has poured a huge amount of money (and policy) into the industry, with the Automotive Mission Plan 2016–26 (AMP) at front and centre. Attracting FDI is a key part of India’s overall growth strategy, which is one of the main reasons why so many sectors offer a welcoming business environment to multinationals.

Maharashtra accounts for a massive 35% of the country’s automobile output, by value, thanks to a combination of domestic and foreign manufacturers and component suppliers (more specifically: Ashok Leyland, Bajaj Auto, Bharat Forge, FIAT, Eicher, John Deere, Mahindra and Mahindra, Mercedes Benz, Renault Nissan, Skoda, Tata Hitachi West, Tata Motors, Volkswagen and Volvo Eicher). It is worth noting, however, that India’s auto components industry is highly fragmented and dominated by local players.

To put the car industry in perspective, it is important to remember that India’s annual automobile manufacturing capacity stood at 22.65 million vehicles in the financial year of 2020–21, of which 4.13 million accounted for exports. The sector makes up 7.1% of India’s GDP, employing 37 million people.

Major foreign players have not missed the opportunities on offer in India's automotive industry, with the likes of Kia Motors and Volkswagen customising their products to cater to the country's large middle-class population. However, many auto manufacturers in Maharashtra now face a very trying time. Economic recovery in the sector is being led by demand for small, affordable cars (globally, but in India especially) – a segment that is dominated by home-grown giants.

This is particularly problematic for Maharashtra, since it is home to most of India’s more upmarket names, such as Volkswagen, Mercedes, Volvo, Renault Nissan and others. According to Reuters, some of the largest foreign names affected by this dynamic are now questioning their ability to undertake added or new investments, while others are assessing their survival in India – not least as they face the dual headwinds of a global semiconductor shortage.

Falling back on Maharashtra’s other gems

While the tourism and upmarket car industry convalesce, foreign investment to Mumbai will now be focused on its other big opportunities: infrastructure, construction, textiles, food processing, information technology (IT) and pharma/biotech.

A developing country the size of India is always going to have a huge need for infrastructure investment, but all the more so due to the government's ongoing revamp of the National Infrastructure Pipeline that seeks to leverage the expertise of foreign investors through its National Monetisation Pipeline.

Maharashtra, due to its highly strategic location, is set to benefit from this immensely. This is evidenced by the government’s impressive FDI database that shows detailed information about all investment opportunities across the country, updated daily. In Maharashtra alone, the website lists 1,680 opportunities worth $190bn.

One-third of those projects are in transport, mainly roads and bridges. The next largest category is materials, which makes up 225 of the total project count due to numerous opportunities in mining/metal, construction materials and chemicals/petroleum. The next sectors with the most opportunity are water and sanitation and real estate, which is no surprise considering how fast Mumbai is growing.

Maharashtra’s high levels of connectivity – the region is often ranked in first place in the country’s Export Preparedness Index – have turned it into one of India’s top export locations. In fact, it recorded $65bn-worth of exports in the 2019–20 financial year, contributing about 21% to India's net outward trade.

When in Mumbai, companies have access to India's largest sea ports, Mumbai Port and JNPT, as well as 53 other ports that (all together) facilitate approximately 22% of the total cargo transport in India. The state is also well connected to the Indian market, with seven domestic airports, more than 309,000km of road network and 6,210km of rail network.

From this transport hub, Maharashtra exports its leading commodities: bamboo, bananas, cashew nuts, cotton, crude oil, pulses, silk and sugarcane. To accommodate these well-established segments, the state provides 24 textiles parks, three wine parks, eight food parks and three floriculture parks. In these domains, McCain and Coca-Cola are the flagship foreign investors.

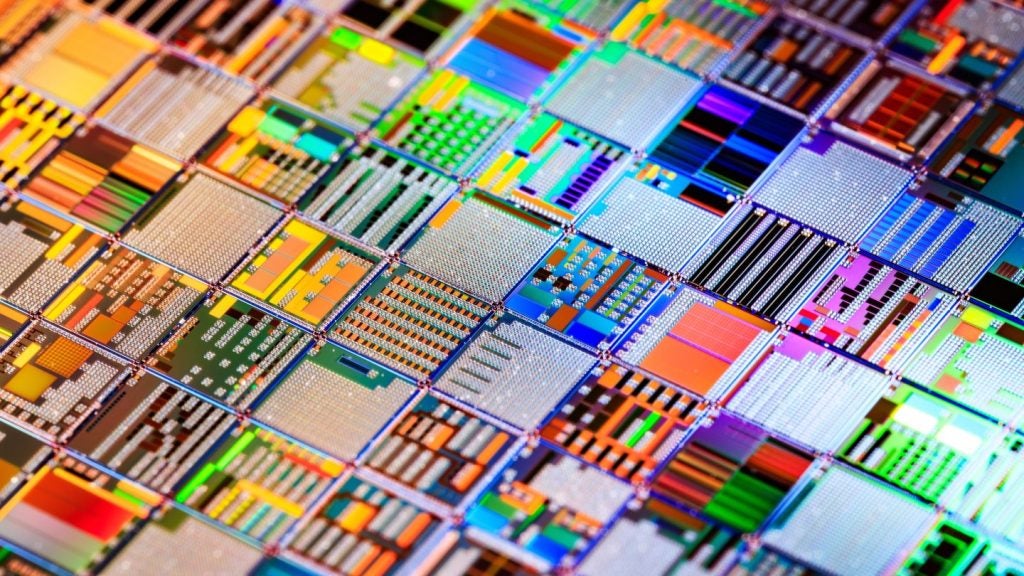

Another of Maharashtra’s fortes is electronic system design and manufacturing, with the region accounting for 30% of India’s industrial output – a success story that has attracted major investments from HP, Cisco and Schindler. The region’s tech credentials also extend to IT, with Maharashtra accounting for more than 20% of India’s software exports, although Pune is more of the regional hub for this than Mumbai.

Lastly, Maharashtra has one of the highest numbers of pharmaceutical manufacturing units in India, contributing to 20% of the country's pharmaceutical output. Mumbai is very much part of this ecosystem, with well-developed infrastructure, especially in hazardous waste treatment plants. This is why the region has attracted the likes of Pfizer, Haffkine and GSK.

India’s pharma industry saw FDI balloon in 2020 thanks to Covid-19 and, more specifically, the country’s production of Covid-19 vaccines. Foreign investment also rose in Indian tech, which accounted for 58% of all FDI to the country between April and December.

The aforementioned snapshot is clear: Mumbai’s economic diversity, linked inextricably to that of Maharashtra, has spared it the difficulties faced in the tourism, upmarket automotives and clothing sectors. This has drawn more attention to the location’s other strengths, some of which have been boosted by the pandemic.

This is the first article in Investment Monitor's 'Future of Indian Cities' series. In the coming weeks we will feature Delhi, Chennai, Kolkota, Hyderabad and Bangalore.