The world’s leading 25 private wealth managers saw their assets under management increase by 14% in 2017, in what was a very good year for the wealth management industry.

Growth increases substantially last year, new research conducted by GlobalData and Private Banker International has found.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The industry achieved average growth of 5% throughout 2016, as industry leaders struggled. However, they bounced back in 2017 to put more distance between them and their competitions.

Bartosz Golba, head of wealth management content at GlobalData, said:

“On average, the top five competitors increased their assets in 2017 faster than the rest of the players included in the ranking.

“This is a significant improvement on their 2016 performance, which proved to be a difficult year for the leaders. Now they are back on the right track, widening the gap between them and the chasing pack,”

GlobalData Strategic Intelligence

GlobalData Strategic IntelligenceUS Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

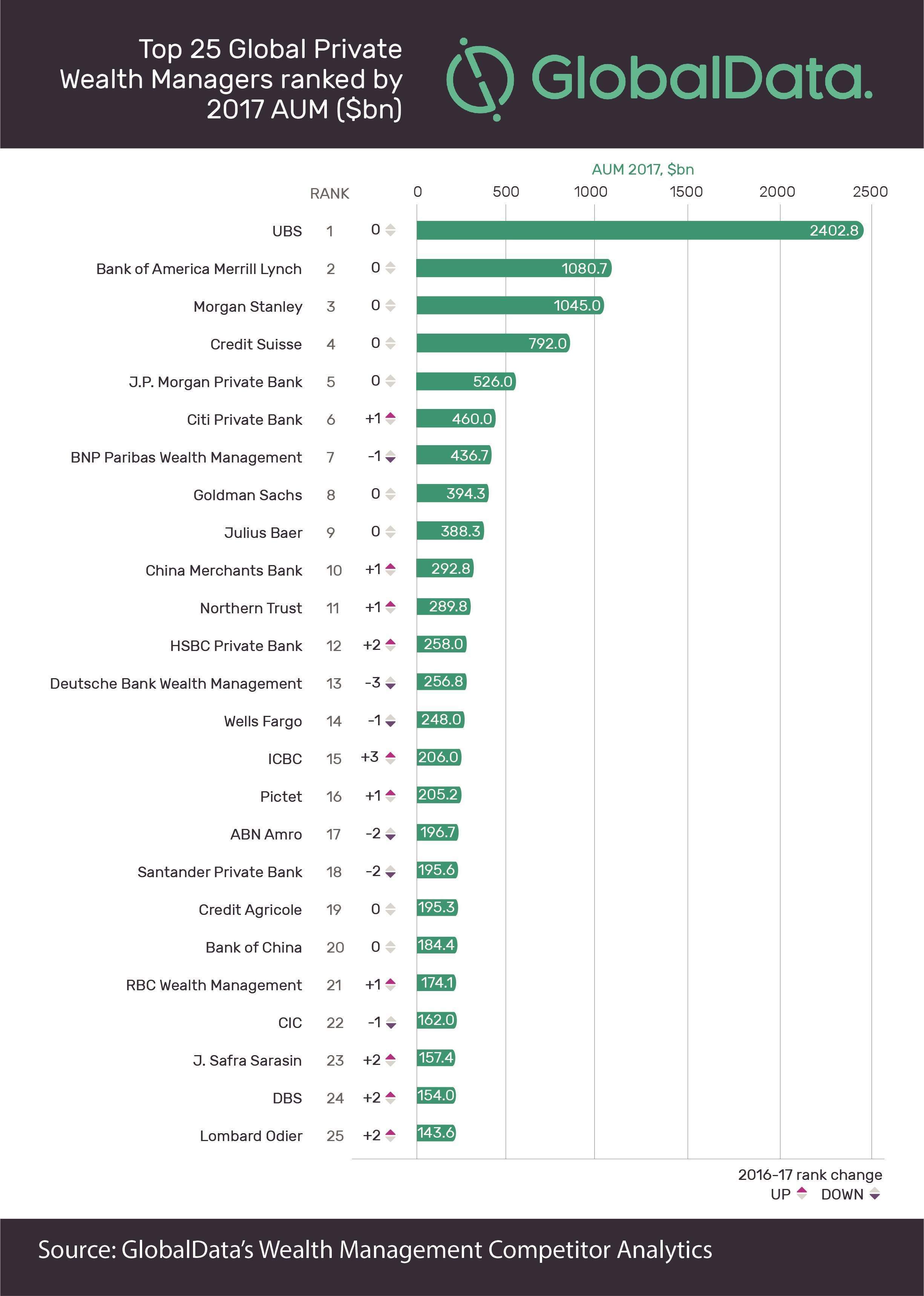

All of 2016’s top five private wealth managers held on to their spots in this year’s ranking.

However, there has been some movement lower down the list. Citi Private Bank climbed above BNP Paribas Wealth Management. Likewise, Deutsche Bank Wealth Management fell out of the top ten. They were replaced by China Merchants Bank, the first Chinese wealth manager to enter the top ten.

According to Andrew Haslip, Head of Financial Content for Asia Pacific at GlobalData, this switch can be attributed to increasing wealth in the Asia Pacific region.

Haslip said:

“The six Asia Pacific-based banks we track – Bank of China, China Merchants Bank, DBS, ICBC, OCBC, and Standard Chartered – are hungry for growth and expanded their AUM by 17.4% in 2017, almost 3.5 percentage points higher than the rest of the top wealth managers.

“A lot of this growth is organic and the result of greater wealth across the Asia Pacific region as well as increased uptake of professional management by the high net worth individuals of Asia.”

The top 10 private wealth managers of 2017

1. UBS

Swiss investment bank UBS provides global wealth management, personal & corporate banking and asset management advice and services to wealthy individuals and corporations around the world. UBS is popular for its strict bank-client confidentiality.

Assets under management: $2,402.8bn

2. Bank of America Merrill Lynch

As the Bank of America’s investment arm, Bank of America Merrill Lynch connects individuals with experienced financial advisors who help to develop personalised strategies for clients that help them to grow, preserve, transfer and structure their wealth.

Assets under management: $1080.7bn

3. Morgan Stanley

American investment bank and financial service provider Morgan Stanley has been helping businesses, families and individuals to manage their wealth for over 80 years. Advisors and tech solutions help clients to make better investment decisions and grow their assets.

Assets under management: $1,045bn

4. Credit Suisse

Credit Suisse is a Swiss investment bank focused on building long-term relationships with its clients. The bank helps wealthy individuals and families to build, manage and transfer their wealth, with tailored solutions designed to achieve specific goals.

Assets under management: $792bn

5. J.P. Morgan Private Bank

Part of leading multinational investment bank JPMorgan Chase & Co, the Private Bank division provides valuable intelligence and insight to wealthy individuals and families across the globe. J.P. Morgan Private Bank provides tailored strategies to help you enjoy life today without putting your wealth at risk.

Assets under management: $526bn

6. Citi Private Bank

Part of Citigroup, Citi Private Bank works with the banking conglomerate’s ultra-high net worth clients, such as entrepreneurs and senior executives, to ensure that their wealth continues to flourish and grow.

Assets under management: $460bn

7. BNP Paribas Wealth Management

The wealth management division of the world’s 8th largest bank has been committed to protecting the finances of its high net worth clients for 150 years. BNP Paribas Wealth Management’s 6,800 professionals offer bespoke advice and solutions fit for the digital age.

Assets under management: $436.7bn

8. Goldman Sachs

Goldman Sachs’ private wealth management services offer carefully considered strategies to high-net-worth individuals, families and foundations. The private wealth manager promises to help clients to grow their wealth, identifying investment opportunities while also taking care to protect a client’s money.

Assets under management: $394.3bn

9. Julius Baer

Swiss private bank Julius Baer’s wealth management division promises to make informed decisions based on the highest standards of quality and expertise in the wealth management field. Julius Baer hopes to build lasting relationships with its high net worth clients by keeping them informed at every step of the way.

Assets under management: $388.3bn

10. China Merchants Bank

China Merchants Bank becomes the first Chinese private wealth manager to enter the top ten, having attracted clients with the offer of detailed wealth management plans and solutions tailored to each individual’s specific needs.

Assets under management: $292.8bn