Magnus Larsson is used to people crying in his office. “They’re crying because we’re able to open a bank account for them,” he says. “This means they can do simple things like order from DoorDash or get an Uber, things they haven’t been able to do before.”

Larsson is the CEO and co-founder of Majority, the neobank that helps immigrants access financial services in the States. Many people who move to the US don’t have a social security number, which turns opening an account at most traditional banks into an almost kafkaesque exercise. That, in turn, makes accessing other services that most people take for granted a challenge for expats.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Majority cuts through that. Instead of a social security number or US documentation, prospective customers only require an international government-issued ID and some proof of US residence to open an account.

Larsson won’t disclose how many customers Majority has, saying he doesn’t like “vanity metrics” like user numbers, but claims that the neobank has enjoyed “significant” uptake in the last year. It now aims to grow to support the rest of the some 50 million immigrants in the US.

To that end, the company has just secured $37.5m in a Series B round. Majority declined to disclose what its valuation is following the raise. The new capital injection comes only nine months after Majority’s Series A round and brings the company’s total funding to date to $83.5m.

The Series B round is led by Peter Thiel’s Valar Ventures, marking its third commitment to the fintech following its lead investments in Majority’s previous two rounds. Thiel, who’s nurtured an extraordinary penchant for outlandish projects like bringing back the mammoth, has also backed startups like Facebook and, more recently, the Republican dating app The Right Stuff.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataValar is, by the way, named after godlike creatures in The Lord of the Rings, which may seem ironic given Thiel’s fellow PayPal Mafia member Elon Musk’s recent panning of the new Rings of Power series on Amazon Prime.

Anyway, back to Majority. The Series B raise comprises $30m equity from Valar and participating insider, Heartcore Capital, as well as $7.5m debt financing from a “leading US-based commercial bank”.

The new funds will be used to enhance Majority’s library of essential services on the back of Majority opening three new locations in Florida – in Miami, Hialeah and Orlando – as well as a new location in Houston, Texas.

How will the drop in fintech funding affect minority-focused neobanks like Majority?

Larsson says that Majority didn’t plan to raise more money until some time in 2023. However, the turmoil in the world economy made the team reconsider.

Since the start of the year, tech stocks have tumbled and investors have grown cautious about where they put their money. Some market watchers are even talking about another bubble busting.

The fintech sector hasn’t been immune to the market slowdown. Investment is running dry in the industry. As of September 13, venture capitalists (VC) have injected $32.5bn into the fintech industry across 1,161 deals in 2022, according to data from GlobalData. That is a far cry from the $84.5bn raised in 2021.

The market volatility has already had palpable consequences. Buy-now-pay-later poster child Klarna hasn't just tripled its losses in the last year, but also suffered a down round that sliced its valuation from $45.6bn to $6.7bn. Fintech companies have also been forced lay off staff and, in some cases, to close shop entirely.

It's against this backdrop that Majority decided to top up its coffers to better weather the storm.

"It creates a lot of runway," Larsson says. "In this kind of uncertainty, it's fantastic [to be] in a place where most companies are downsizing and to be able to continue to build value."

However, Majority isn't the only minority-focused neobank out there. Challenger banks like Purple, Pride Bank, First Boulevard, Greenwood and Paybby have launched over the past few years in order to support minorities like the LGBTQ+ community, people of colour and people with disabilities.

These ventures have so far enjoyed limited success when it comes to raising capital. This is partly down to how much traditional VC deals rely on personal networks and the fact that most investors are white, straight and male – it's essentially the same reason why female fintech founders are underrepresented. With funding running low, minority-focused challenger banks could struggle even more to raise capital.

"Investors will evaluate if the product is differentiated enough to retain and monetise a more targeted customer base, compared to larger competitors," Patrick Kavanagh, one of the first angel investors in Robinhood and co-founder of Atlantic Money, tells Verdict. "They will also scrutinise the available revenue pool within the minority demographic for various products like lending and card interchange."

Larsson argues: "The banks that will survive in this space that will be the banks that actually solve a real problem."

Getting started

Swedish-born Larsson first got the idea for Majority eight years ago when he moved to the US with his family.

He was shocked by the amount of red tape he had to cut through in order to set up bank accounts and how costly it was.

"And we come from one of the richest containers in the world and we speak fairly good English," Larsson says, recognising this that people without those privileges or personal financial reserves would have an even harder time.

When he and his co-founders started to look into the problem they realised that there were roughly 300 million migrants in the world, but no clear bank that provided services to them.

Larsson also wanted to change the negative narrative around immigrants, whipped up by far-right populist forces across the world.

"If you think about it, actually, every word connected to immigration, more or less has a negative connotation: non-resident, aliens, immigrants, migrants, etcetera," he says.

The Majority founding team decided to change that, especially when their due diligence showed what immigrants' motives and drives were.

"When we did our research [we realised] that it doesn't matter where you come from – everyone who migrates shares the same values," he says. "They see themselves as hardworking, ambitious and want a better life."

He adds: "That is a delightful, positive force. The other complexities don't matter, we all have the same common foundation."

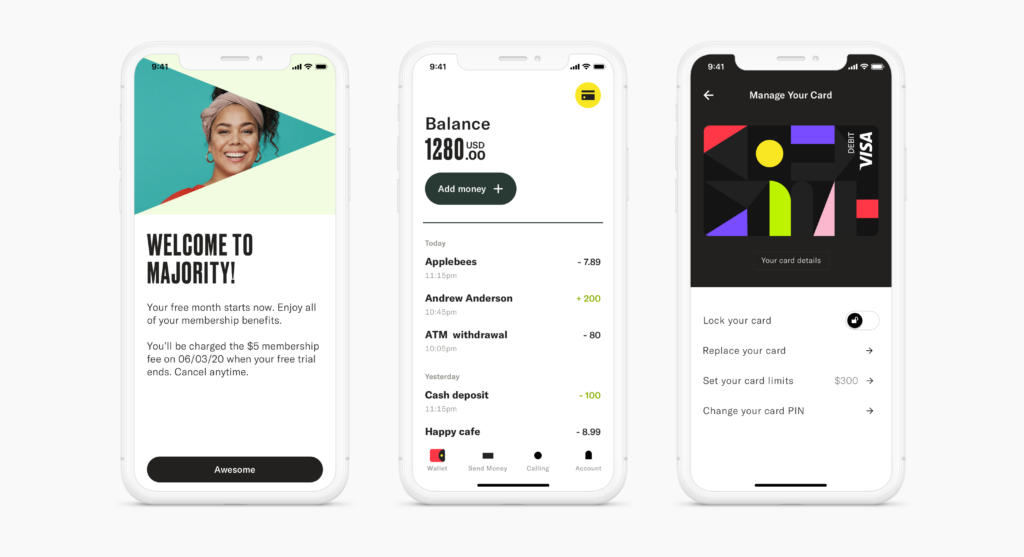

Today, Majority offers a membership that costs $5.99 per month. It includes a variety of different immigrant-focused services including a bank account and debit card, community discounts, free international money transfer and discounted international calling.

When asked why traditional banks and other challenger banks like Revolut and Chime haven't provided these type of services before, Larsson suggests it is because it is a technically complex issue to tackle and that they have instead focused on mass-adoption.

With $37.5m worth of fresh capital in its accounts, Majority hopes that it is equipped to tackle this complex problem.

GlobalData is the parent company of Verdict and its sister publications.