Michael Saylor’s MicroStrategy has been accumulating Bitcoin enthusiastically since adopting it as its primary reserve asset in August 2020.

Since then, its market capitalisation has grown from $1bn to more than $80bn, dwarfing its traditional software and business intelligence operations.

The company has the largest corporate holding of Bitcoin. Through a combination of debt and equity sales, MicroStrategy amassed more than 478,000 Bitcoins worth $47bn, making its shares attractive to traders and investors looking for exposure to Bitcoin.

Before its earnings call on 5 February 2025, MicroStrategy dropped the “Micro” and rebranded to Strategy, taking orange as its primary colour and including a stylised “B” in its logo. This change reflects that its software and business intelligence functions have taken a back seat in favour of its Bitcoin treasury strategy.

How does MicroStrategy keep accumulating Bitcoin?

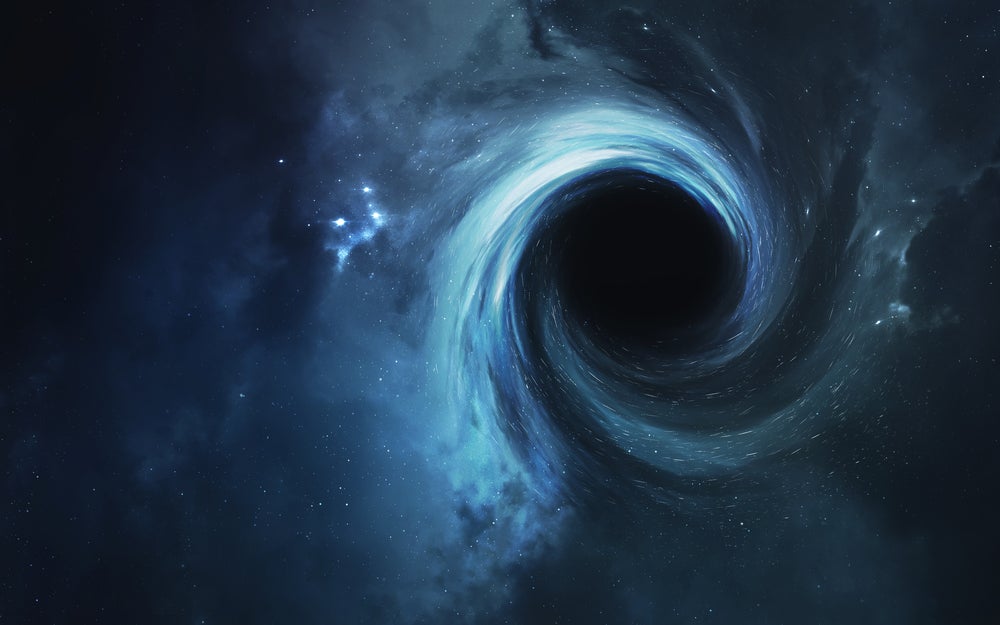

MicroStrategy’s market capitalisation of more than $80bn is significantly higher than the value of its Bitcoin holdings. This premium to net asset value (NAV) is the key to how it accumulates more Bitcoin.

Typically, when a publicly traded company sells newly issued shares to raise money (known as an at-the-market or ATM offering), existing shareholders are diluted because the number of shares in circulation (the float) has increased. However; because of MicroStrategy’s premium to NAV, when it raises money via ATM to buy more Bitcoin, the Bitcoin-per-share actually increases. The generated “Bitcoin yield” justifies its premium to investors and creates a positive feedback loop.

MicroStrategy achieved a Bitcoin yield of 74% across 2024 and is targeting a minimum of 15% for 2025.

Put concisely by Michael Saylor on CNBC: “We sold $1.5 billion worth of stock backed by $500 million worth of Bitcoin. We bought back $1.5 billion of Bitcoin. We captured nearly a billion-dollar gain in the arbitrage.”

Intelligent leverage

In addition to selling equity, MicroStrategy also borrows money to fund its Bitcoin purchases, typically with low or 0% interest rates. MicroStrategy does this by issuing convertible bonds, which can be converted to shares at a predetermined conversion price.

Investing in MicroStrategy is not for the faint of heart—it is a leveraged play on an already very volatile asset. While its shares have outperformed every stock in the S&P 500, its shares are also more volatile than any stock in the S&P 500.

However, high volatility makes the convertible bonds more attractive to some investors. It increases the chance that the stock price will rise above the conversion price. The convertible bond holders get some exposure to the upside (sometimes even outperforming Bitcoin) but with better protection to the downside.

STRK: convertible preferred stock

On 6 February 2025, MicroStrategy’s latest security began trading on the Nasdaq under the ticker STRK. Designed to appeal to investors with a lower risk appetite than holders of both its common stock and convertible bonds, STRK is preferred stock offered at $80 a share that pays a fixed dividend yield of 8%, and convertible to common stock at a 10:1 conversion ratio. Net proceeds from the offering were approximately $560m.

Bitcoin strategy risks

There are significant risks associated with MicroStrategy’s Bitcoin strategy. If the premium to NAV disappears, shareholders could lose out compared to simply buying Bitcoin, and MicroStrategy’s capacity to generate Bitcoin yield could evaporate.

In addition, mismanagement of leverage could leave the company unable to service its debt obligations, especially during a sharp drop in Bitcoin’s price—as seen in 2022—potentially leading to bankruptcy.

Looking forward: potential S&P 500 inclusion

On the upside, a key development to watch is whether MicroStrategy will be added to the S&P 500 index. While the company qualifies based on market capitalisation, it has yet to meet the requirement of four consecutive quarters of profitability. However, this could soon change due to new rules from the Financial Accounting Standards Board (FASB) that came into effect in 2025, allowing companies to recognise “fair value” changes in their crypto holdings.

On 1 January 2025, MicroStrategy adopted fair value accounting, meaning unrealised gains on its Bitcoin holdings will now be reflected in its net income.

MicroStrategy employs complex financial engineering that can make it challenging for investors to value its securities.

In its Q3 2024 earnings presentation, Michael Saylor likened MicroStrategy to an oil refinery, which takes raw crude oil and refines it into products with varying levels of volatility – such as jet fuel compared to bitumen. In the same way, MicroStrategy taps into Bitcoin and issues “refined” securities—common stock tends to be more volatile, while convertible bonds and preferred stock are designed to be comparatively stable.