Lightspark was founded in 2022 by David Marcus, the former president of PayPal and head of Diem, Meta’s cryptocurrency project.

Lightspark is a payments company leveraging the Bitcoin Lightning Network for global settlements in any currency. With fees as low as 0.15%, Lightspark offers a cheaper alternative to traditional remittance payments and even competes with credit and debit card payments.

What is the Lightning Network

The Lightning Network is a payment protocol built on top of Bitcoin that enables near-instant settlements with minimal fees. In contrast, standard Bitcoin transactions can take hours to confirm and come with high fees. In 2023, these fees reached a peak of $40, making Bitcoin impractical for everyday transactions.

Lightspark’s innovative feature: Universal Money Addresses

Released in late 2023 by Lightspark, Universal Money Addresses (UMAs) resemble email addresses and are used to receive payments, replacing cumbersome sort codes and account numbers. Unlike PayPal or Venmo usernames, which only work between users of the same payment provider, UMAs are interoperable.

Because UMA is an open-source standard, any bank, exchange, or digital wallet can adopt the standard, enabling its users to send funds to a recipient using a different financial services provider that has adopted the standard.

UMA relies on the Lightning Network’s real-time settlement capabilities and Bitcoin’s global liquidity profile. When sending to a UMA, the sender’s currency is traded for bitcoin and sent over the Lightning Network to the recipient’s bank or exchange, where it is then converted to the recipient’s desired currency. This takes place in seconds and with minimal fees.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataBringing Universal Money Address to the US

Lightspark has made progress in getting UMA adopted among crypto-native players, but until recently it has not been widely accessible in the US. Currently, UMA is available on a handful of cryptocurrency exchanges worldwide and one bank, Xapo.

Announced in August, the company’s latest feature, Lightspark Extend, brings UMA to over 99% of US banks that accept real-time payments. Rather than wait for their bank to adopt the standard, users can sign up for a UMA address with Lightspark Extend and link it to their bank account.

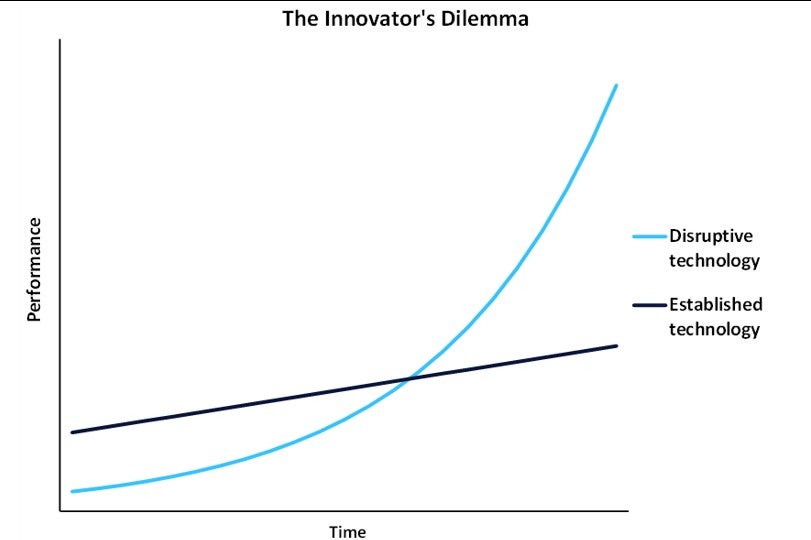

The Innovator’s Dilemma

For cryptocurrencies to succeed as a form of money, they must be usable for transactions, just like any other currency. However, cryptocurrencies have struggled to compete against centralised fintech services on both fees and user experience. Additionally, merchants are reluctant to accept a volatile cryptocurrency when their overheads are denominated in dollars or pounds.

The Innovator’s Dilemma, a concept coined by Clayton Christensen in his 1997 book of the same name, explains how incumbent companies fail by focusing too heavily on incremental improvements to their existing products and neglecting disruptive innovations. The graph below illustrates how a disruptive technology often starts with a worse performance than the established technology, but improves at a greater rate, eventually surpassing the established technology.

The Kodak example

A canonical example of the Innovator’s Dilemma is Kodak and the digital camera. Once dominant in photography and imaging, Kodak failed to recognise the disruptive potential of the digital camera.

Despite inventing the first digital camera in 1975, Kodak continued to focus on its profitable film business, refining it with minor improvements. There is a striking resemblance between the rise of cryptocurrency payments and the Innovator’s Dilemma, and traditional financial services companies risk being displaced if they do not take the threat seriously.

Related Company Profiles

PayPal Holdings Inc