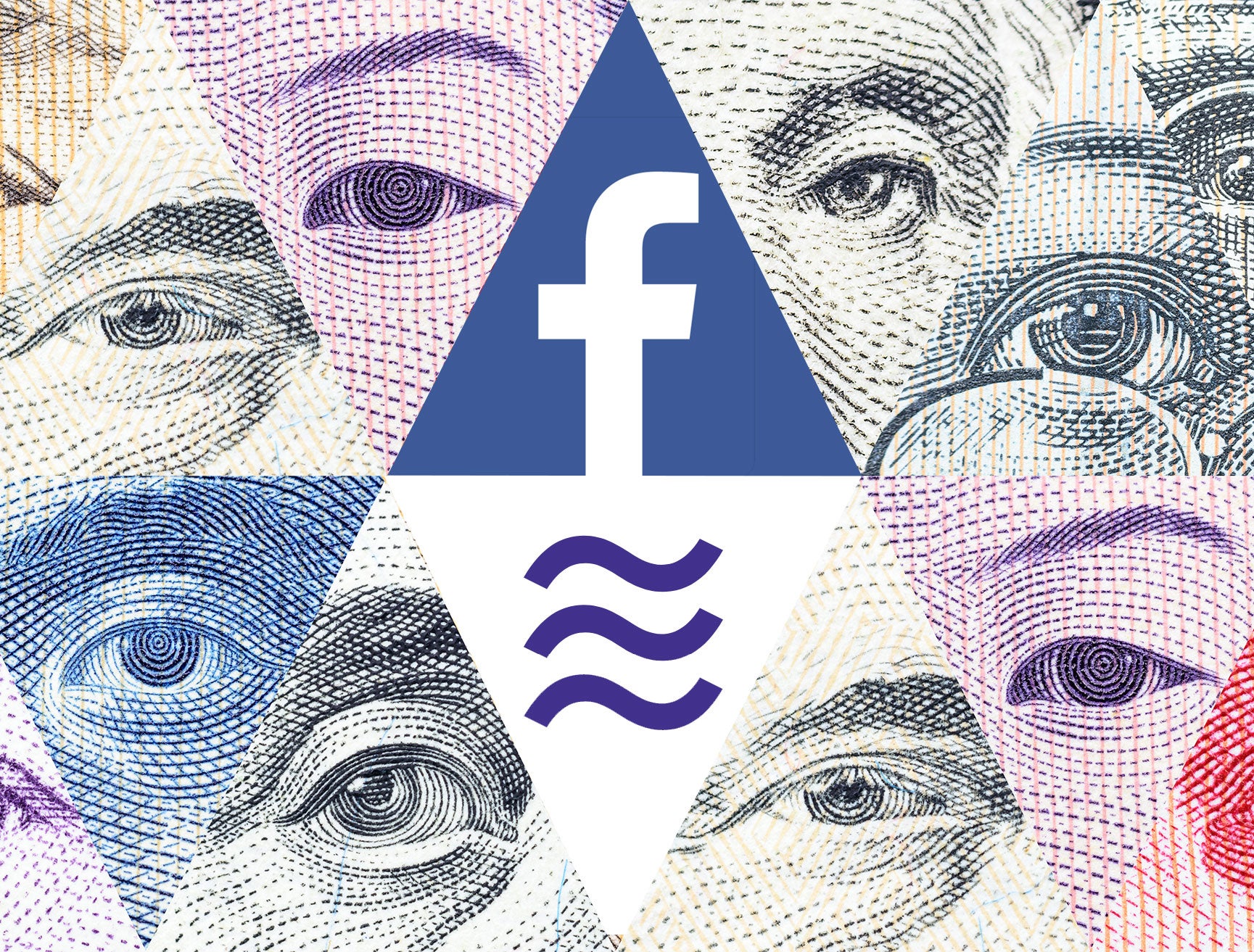

Facebook has unveiled its plans to launch its cryptocurrency Libra, and it’s clear that the social media giant has bold ambitions.

Characterising the cryptocurrency as “a new global currency powered by blockchain technology”, the company has designed Libra to be a robust, borderless currency backed by low-volatility assets in a pool known as the Libra Reserve.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

This, Facebook says, will allow Libra to avoid the wild fluctuations characteristic of many notable cryptocurrencies, such as Bitcoin and Ethereum, without being pegged to one currency, as is usually the case with so-called stablecoins.

Cryptocurrency for good

The social media giant has outlined a number of problems that it is aiming to solve with the cryptocurrency, all of which are focused around the idea of technology as a tool for empowerment.

Facebook sees considerable potential in the “unbanked” – people without any form of financial account, of whom there are 1.7 billion around the world, and a disproportionate number of which are women. This, the company says is a problem it is “hoping to address” with the launch of Libra.

This will be tackled by making Libra, and supporting digital wallet Calibra, easy to access, enabling instant low-cost transfers anywhere in the world – with a variety of additional financial solutions planned following the 2020 launch.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“Crypto adoption is about more than money. It’s about global and local politics and the separation of state and money,” Yoni Assia, co-founder and CEO of eToro, told Verdict.

“It can be a powerful tool – hopefully for good. Facebook’s Libra could mean greater financial inclusion and greater access to the digital economy.”

But while the company’s message is peppered with positive messages, painting the project as the very essence of tech for good, the fact remains that Facebook has not garnered a positive reputation in recent years and its bid to launch a currency with a potential userbase in the billions does raise some concerns.

Libra: Facebook seeks global domination through untapped markets

If Facebook were launching Libra as a currency specifically for western nations where the social media giant gained its earliest and most developed large-scale userbases, the reaction would likely fairly negative.

The Cambridge Analytica scandal, a host of subsequent privacy failings and Mark Zuckerberg’s often robotic apology tour have seen western public perception of the social media giant tumble over the last few years, to the point where even one in four of its own employees wouldn’t trust it with their data.

However, by positioning it first and foremost as a tool to help those – whether in the US or in developing nations – without access to traditional financial solutions, it is creating a route to market that not only has far less competition, but which is much harder to react negatively to.

If you criticise a product that is designed to give women in developing nations access to bank accounts, fewer people are going to heartily agree with you than if you say the same of a social media giant’s new cryptocurrency.

Libra’s tech for good credibility has been further bolstered by the presence of a handful of nonprofits among the founding members of the Libra Association, an independent not-for-profit being established to oversee the development and operation of the Libra Reserve and the Libra Blockchain that underpins the cryptocurrency. These include Mercy Corps, a non-governmental humanitarian aid organisation that helps people recover from crisis situations, and Women’s World Banking, a non-profit increasing women’s inclusion in financial systems.

“More than 1.7 billion people today are financially cut off from the world, with no access to a bank account – a poverty trap that could deepen as the rest of the world becomes ever-more connected. A global digital currency has the potential to spark financial inclusion for the world’s poorest and most vulnerable people, connecting them to the local, national, and global economy,” said Neal Keny-Guyer, CEO of Mercy Corps.

“Mercy Corps is committed to increasing financial access for the world’s poorest and ensuring Libra fulfils its promise of providing financial inclusion for all, with no one left behind.”

Does Libra’s empowering ambition mask a dark side?

While Facebook has positioned its cryptocurrency as an empowering force for good, there is a considerable amount to elicit unease.

The large number of commercial founding members of the Libra Alliance, which include luxury ecommerce giant Farfetch, payments leader Mastercard and tech heavyweights Paypal and eBay, speak to a dramatic ambition for Libra – and no wonder.

As of March 2019, Facebook has 2.38 billion monthly active users – equivalent to just below a third of the global population. If it can persuade even a quarter of its users to come over to Libra, it will represent a significant player in the currency market.

“Back in 2017 in his Harvard commencement speech Mark Zuckerberg talked about the need for people to have access to money in order to pursue their purpose. With two billion users, Facebook has the potential to create one of the largest financial platforms in the world,” said Assia.

However, this will also see the social media giant gain significant power in the process. Facebook’s decisions have long affected billions of people – but while algorithm changes on a social media platform have the potential to impact businesses and politics, changes made to a currency used around the world could impact entire economies.

For some, then, the announcement has not been welcomed.

“Facebook has rightly identified the potential for digital currencies to reinvent money and transform the global economy, so people can live better lives. However, a digital currency controlled by tech cartels such as Facebook, Visa and Mastercard, is not the solution,” said David Clarke, head of policy at Positive Money.

“Our money is increasingly in the hands of a small number of banks and payment companies, and we should avoid ceding further control to unaccountable corporate interests. Facebook’s plans pose alarming implications for privacy and power in the economy, and governments must respond by providing a central bank digital currency as a public alternative.”

Read more: Facebook cryptocurrency launch: Is it time to buy Bitcoin again?