Private equity company KKR has signed a deal to buy a minority stake in German space and technology company OHB.

According to the Financial Times, KKR will pay €77m ($84.7m) for a 10% stake in OHB through the issuance of new shares and will offer €44 per share for the remaining 30% of the business that the Fuchs family does not hold.

The Fuchs family will continue to keep a controlling stake in the company, while the existing management team and CEO Marco Fuchs will continue to lead OHB, which will de-list from the stock exchange.

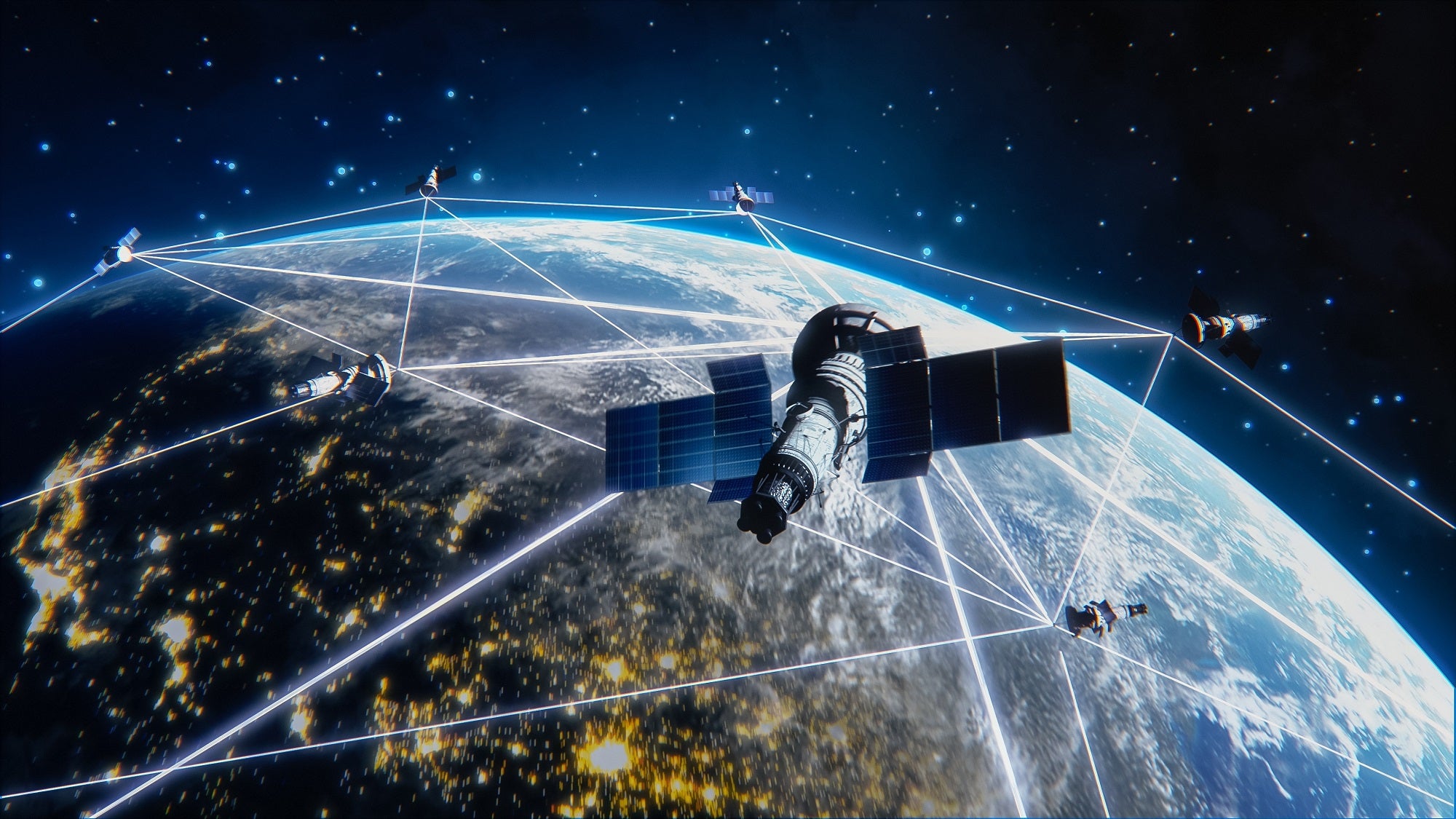

Set up in 1981, OHB has developed components for the Ariane rocket programme, satellites for the EU’s Galileo navigation system, and the Juice probe for studying Jupiter’s cold moons.

OHB plans to use the capital infusion to boost competitiveness across its three divisions—space systems, aerospace, and digital—and invest in important growth sectors.

Under the terms of the agreement, KKR is also investing €30m via a convertible loan in OHB’s portfolio company Rocket Factory Augsburg, which is developing a micro-launcher.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataOHB CEO Marco Fuchs said: “Strengthening OHB as an independent, European company and partner for governments and institutions strengthens European security and sovereignty in space.

“In addition, we can expand our leading technological positions in our core competencies as an infrastructure partner and in the service sector, while also opening up new perspectives for customers and partners.”

KKR partner and head of the DACH region Christian Ollig said: “We see great potential in Europe and are convinced that with additional investments in Research and Development OHB is ideally positioned to achieve long-term sustainable growth.”