Over the last six months, acquisitions and technology partnerships enhanced the value of IT Service Providers offering IoT solutions, adding capabilities in adjacent technologies to IoT such as AI, machine learning, and digital twins, as well as gaining expertise (and new customers) in relevant verticals such as manufacturing, warehousing and supply chain management.

Vendor activity

All the ITSPs profiled in GlobalData’s report (see IT Services Provider IoT Services Competitive Landscape Assessment, February 8, 2023) made public announcements that affected their position in the market, their technology and services portfolios and/or their rankings in the report. For the last 6-month period, GlobalData ranked Atos as the Leader in ITSP IoT Services, with Accenture, Capgemini as Very Strong, and Infosys, IBM, and Cognizant as Strong. As IBM has left the IoT platform market (as have Google and Ericsson) but continues to offer IoT solutions and professional services, its ranking has dropped but it remains in the report.

H2 2022 IT service public announcements

Cognizant agreed to acquire Mobica, an IoT software engineering services provider headquartered in the UK. It will boost Cognizant’s IoT embedded software engineering capabilities and provide clients with a deeper and broader set of capabilities for digital transformation

Accenture expanded its digital supply chain capabilities with the acquisition of Inspirage, an integrated Oracle Cloud firm specializing in supply chain management. The deal helps Accenture deliver touchless supply chain, digital twins, blockchain, and IoT to boost supply chain efficiency.

Though not confirmed through official channels, IBM has advised its Watson clients to seek alternative platform providers as it is sunsetting its Watson IoT cloud management platform, with access to the platforms’ APIs revoked on 1st December 2022. Accenture collaborated with American food manufacturing giant Mars to roll out digital twin technology by marrying IoT sensor outputs with AI analytics inputs in an edge/cloud dashboard to reduce instances of over-filling packages in food production.

Capgemini struck a deal with Microsoft to deliver a cloud-native, server-less Azure-based digital twin platform, called Reflect. It is built on a data model that can be customized for different industries or organizations, leveraging Azure Digital Twins and Azure IoT. Atos and BT collaborated for a Digital Vision project to use AI to interpret computer video feeds and take automated actions to help manufacturing and logistics companies.

Recent trends

IoT use cases that achieved popularity in the Covid-19 era, such as temperature sensing, room occupancy measurement, and remote equipment monitoring enhanced traction, and new environmental sustainability initiatives are increasingly dependent on IoT sensor measurement and analysis. IoT also benefits from the growing momentum behind 5G/edge and Private Wireless Networks.

However, it has also been difficult for some IoT ecosystem vendors to generate substantial revenues, with security breaches, supplier fragmentation, supply chain delays, and high solution costs listed by enterprises as barriers to adoption, along with unclear or difficult to prove ROIs. This was especially evident in 2022, as IoT platform providers Google, Ericsson, and IBM sold their connectivity or application enablement platforms or left the IoT market altogether, citing low or non-existent margins.

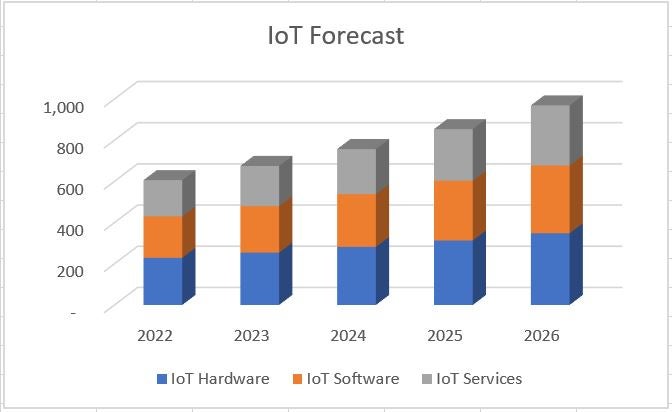

IoT services forecasts

According to GlobalData forecasts, See GlobalData Market Opportunity Forecasts Internet of Things) the Global IoT market reached approximately $606 billion in 2022 and will grow by 2026 to $970 billion, with an CAGR of 12% from 2021 to 2026. The forecast includes hardware, software, and services, the latter of which includes connectivity as well as professional and consulting services.

The largest verticals by revenue in 2026 will include manufacturing, public sector (including segments such as education, federal and smart cities) and energy.