Russia’s cuts in natural gas supplies to EU countries are a wake-up call: the EU can no longer kid itself about the Kremlin’s playbook and must speedily phase out Russian gas in Europe.

While patting itself on the back for imposing embargoes on Russian oil and coal to protest the invasion of Ukraine, the EU wrongly assumed it could set the timetable for scaling back reliance on gas from Russia. Instead, President Vladimir Putin is wielding his most potent economic weapon in a bid to undermine Europe’s unity on sanctions.

The EU’s just-approved plan for coping with possible further disruptions to EU imports of Russian gas is evidence more of political panic than of a clear-headed strategy for marginalising Putin. The initiative, released on 20 July and approved by member states on 26 July – with multiple derogations – seeks to lower EU demand for gas by 15% by the end of March 2023 and bolster national cooperation should an emergency be declared.

So far, 12 EU nations have faced halts to – or reductions in – deliveries of Russian gas. With European attention increasingly on the challenges of getting through this winter, Putin will relish any opportunity to keep the EU on the defensive.

Turning the tables on Russia

The EU’s first obligation is a political one: accept sharp economic pain in the months ahead. Putin has tightened the gas screws yet again, with Nord Stream 1 now running at 20% of its capacity. The EU’s pledge to lower consumption of Russian gas by two-thirds this year now looks inadequate in the face of the ever more real possibility of a complete gas cut imposed by Russia.

For the EU, taking matters into its own hands is preferable to hoping that Putin will show some mercy over gas deliveries. This is important not just for the EU’s immediate foreign policy objectives but also for the bloc’s longer-term geopolitical and climate goals.

A recession in 2023 is a real possibility for Europe, which needs to grit its teeth in return for the ultimate rewards of sidelining Russia and protecting EU interests. As in Putin’s favourite sport, judo, Europe needs to knock the Kremlin off balance by accelerating the phase-out of Russian gas.

For now, the Kremlin’s gas revenues are unchanged and Gazprom appears to be calling the shots.

To chart ways out of the Russian gas trap, EU countries need to be honest about how they got into it. This applies above all to Germany and Italy, which so far have faced reductions in Russian supplies but no outright cut-offs.

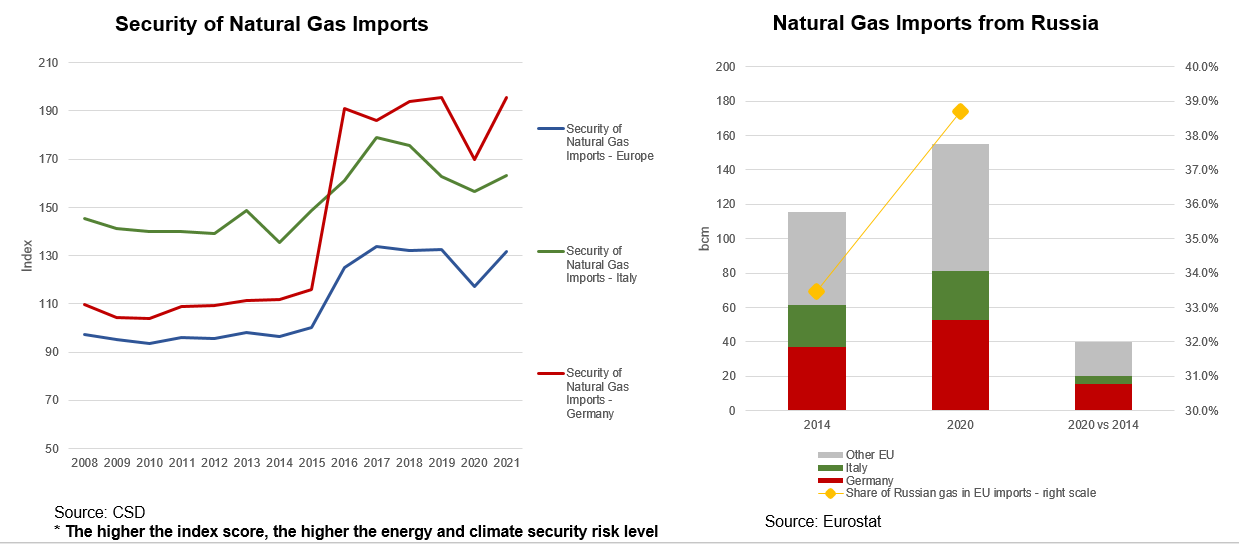

The two are the most vulnerable EU member states for reasons of their own making. Both countries have roughly doubled their dependence on Russian gas since Putin’s annexation of Crimea in 2014, dragging all of Europe into a corner.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataGermany's over-reliance on Russian gas to power a manufacturing boom means that a cut-off could trigger a domino effect of business defaults. In Italy, doubling the rate of gas burn to generate electricity since 2014 has raised the spectre of rolling outages across the country this winter and, by extension, rocked the foundations of the whole European power market.

To be sure, Germany and Italy have gone on a buying spree to ink long-term deals with liquefied natural gas (LNG) suppliers, including the US, Qatar and Algeria. Spain, Greece and the Baltic countries have followed suit, importing record amounts of LNG.

Yet Europe is far from being out of the woods, because finding alternative supplies is insufficient.

Russian gas in Europe: An oversimplified plan

There is no way around a slew of steps within EU countries to lower demand for gas. These range from setting limits on energy use in buildings to compensating industrial users for forgoing some of their contracted supplies.

Energy savings promise immediate and broad rewards. Besides reducing Russia's capacity to weaponise gas, such actions enhance the EU's geopolitical independence, fight climate change and help consumers' finances.

Yet the new EU plan offers no guarantee that savings will be made. Demand cuts will depend initially on voluntary steps by EU countries, while a potential mandatory curtailment would come too late to prevent a full-blown crisis. The initiative is framed as an equal punishment for all EU countries for the sins of a few – especially Germany – and shows a glaring lack of understanding of the European gas and energy markets.

[Keep up with Energy Monitor: Subscribe to our weekly newsletter]

Instead, the EU should be tackling big loopholes in mechanisms already in place to foster greater national policy cooperation and market integration. For example, although “solidarity” arrangements between EU countries are part of 2017 European gas legislation, precious little progress has been made on this front. Only six bilateral agreements under the solidarity gas mechanism have been signed so far. Germany has signed one with Denmark and one with Austria, while Italy, which is among the most vulnerable countries to a gas supply cut, has just one – with Slovenia, a marginal gas supplier.

Instead of focusing on centralised gas demand cuts, the EU could back a Greek proposal for continent-wide demand response tenders where the industry would receive compensation for slashing production.

Europe should also accelerate the phase-out of gas in power generation by further boosting the uptake of renewable energy, with a focus on offshore wind and biomass that could provide reliable supply with a baseload-like generation profile. Europe should also work on removing regulatory and technical bottlenecks that prevent alternative LNG supplies from the Iberian Peninsula and France from reaching central Europe.

What's next: Calling the Russian bluff

With determination, the EU can turn its current weaknesses vis-à-vis Russian gas into strengths at home and abroad.

For all its high-handedness, Gazprom lacks an alternative to the European market. Russia's gas exports to Europe represent more than half the country's gas sales abroad. Moreover, deliveries are almost exclusively via pipelines and cannot be easily redirected to other markets. Gazprom’s brazen geopolitical games are destroying its reputation along with the Kremlin’s long-standing narrative that Russia is a reliable gas supplier.

Europe has traditionally strengthened itself through crises. Russia's efforts to turn the EU into a gas hostage is the latest major test for the bloc. Now is no time to give in to this blackmail. It is high time to call the Kremlin’s bluff.