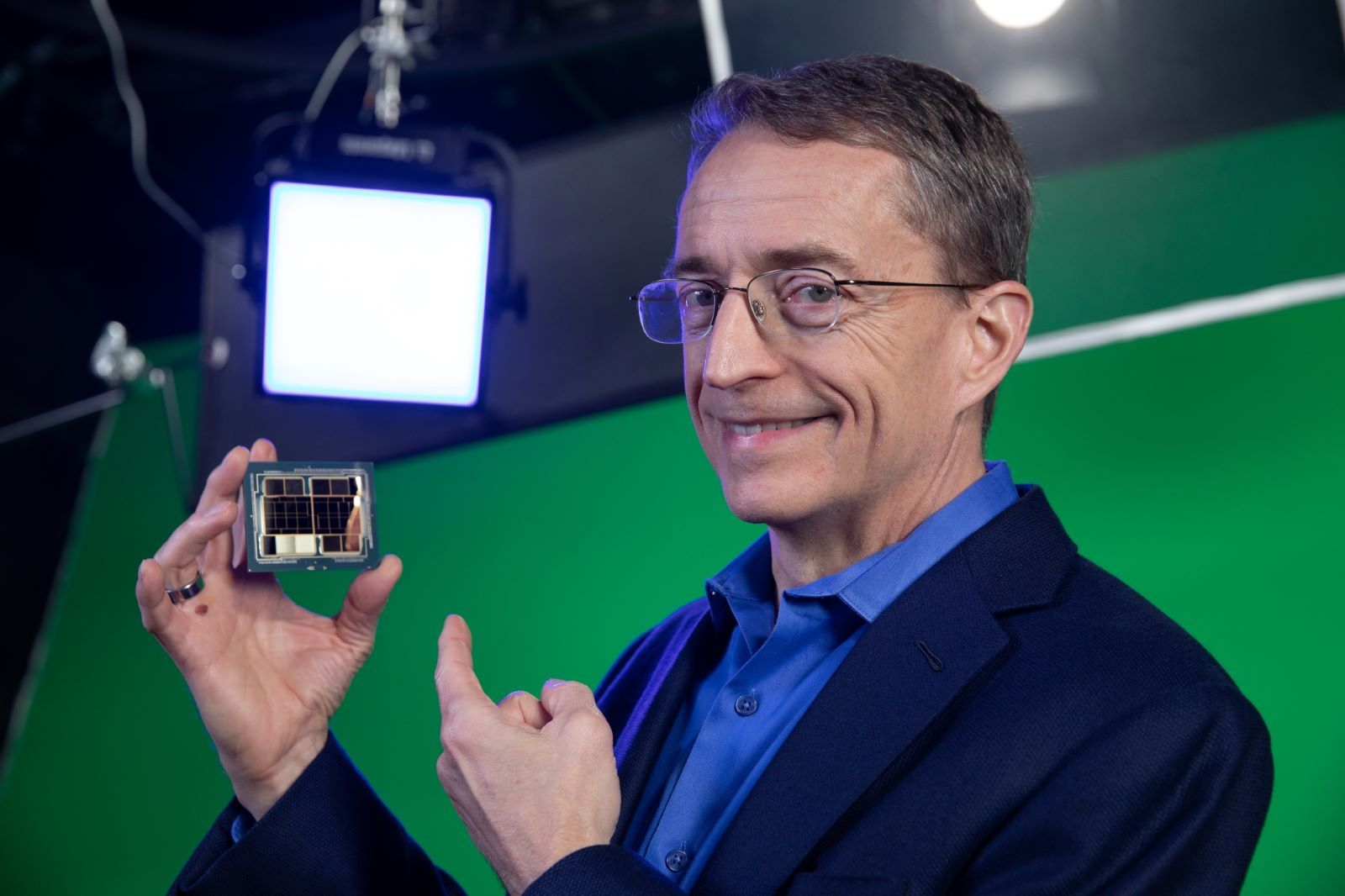

US chip giant Intel announced today (2 December) that CEO Pat Gelsinger will step down, as the company’s share price rallied upon the news.

Intel senior leaders, David Zinsner and Michelle Johnston Holthaus, were announced as interim co-CEOs while the board of directors conducts a search for a new chief executive.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Zinsner is executive vice president and chief financial officer, and Holthaus has been appointed to the newly created position of CEO of Intel Products, a group that encompasses the company’s Client Computing Group, Data Centre and AI Group and Network and Edge Group.

Frank Yeary, independent chair of Intel’s board, will become interim executive chair during the period of transition. Intel Foundry leadership structure remains unchanged.

Upon the announcement, Yeary said: “As a leader, Pat helped launch and revitalise process manufacturing by investing in state-of-the-art semiconductor manufacturing, while working tirelessly to drive innovation throughout the company.

“While we have made significant progress in regaining manufacturing competitiveness and building the capabilities to be a world-class foundry, we know that we have much more work to do at the company and are committed to restoring investor confidence. As a board, we know first and foremost that we must put our product group at the center of all we do. Our customers demand this from us, and we will deliver for them.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAt base, Intel has considerable strengths, but Gelsinger was judged to have gambled too radically, at too high a cost to the bottom line, while losing investor confidence in the process, according to GlobalData senior consultant analyst Mike Orme.

“He may be judged to have focused too much on the foundry business, which he aimed to float off, at the expense of the core products business. And, of course, Intel missed the AI bus,” said Orme.

Michelle Johnston Holthaus’ permanent elevation to CEO of Intel Products, along with her interim co-CEO role of Intel, is a signal from the Intel board that the product group will have the resources needed to deliver on its mission to serve customers with its flagship products.

The board clearly wants a more acceptable figure to Wall Street at the helm, according to Orme. Intel’s share price has plummeted throughout 2024, although they had risen modestly over the last three months, and have moved into positive territory, today, upon the news of Gelsinger’s departure.

Though much has been reported about Intel’s failure to anticipate the AI boom, its loss of market share and tumbing stock price, there are still reasons to be positive. Intel’s foundry business has orders from hyperscalers including Amazon and Microsoft who judge the company a good bet for making Big Tech custom AI chips.

“This still stands,” according to Orme who suspects Intel’s board, and possibly input from active investors, has prompted the leadership reshuffle in a desperate attempt to, “get Intel’s shares out of the doldrums” with Gelsinger as the sacrifice.

“And remember a month or two back QUALCOMM and SoftBank both separately sounded Intel out on a friendly acquisition,” he added.

On 27 November, the US Department of Commerce finalised $7.86bn in direct funding to Intel for semiconductor manufacturing in the US. Already allocated under the CHIPS and Science Act, the award was implemented in the last days of the Biden administration, at roughly $600m lower than the $8.5bn pledged after the act was passed in 2022.

A new Trump administration raises questions around the CHIPS and Science Act and what government support Intel may expect going forward. “Intel is of such strategic importance to Washington as the only American company able to make leading edge chips onshore while being a key supplier to the Pentagon. It will be involved in one way or another in what happens now,” said Orme.

The Biden era funding will support the development of semiconductor manufacturing facilities in Arizona, New Mexico, Ohio, and Oregon. Intel has committed to invest more than $90bn by the end of the decade in chip making and advanced packaging capacity in the US. However, Gelsinger’s ousting may now signal a corresponding focus on the company’s core products business.