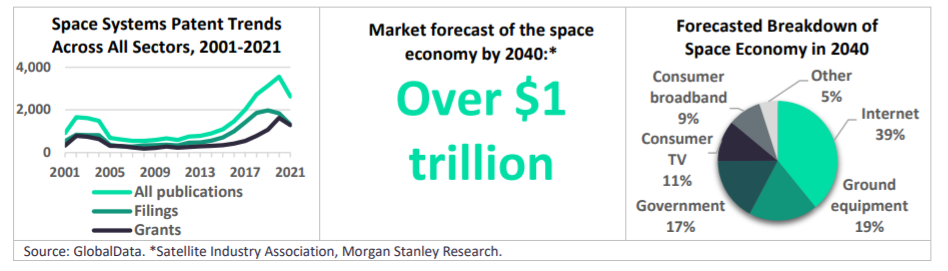

According to research from analytics firm GlobalData, the aerospace, defence & security (ADS) sector recorded the second highest growth in deal value in the third financial quarter (Q3) of 2021. The space economy was a key theme in the quarter, and is predicted to be worth over $1tn by 2040.

The space economy includes space systems tech such as satellites, and subsystems including radio frequency systems, antenna design, synthetic aperture radar processing, radiation-hardened electronics, and mapping software. It also includes ground control, rocketry and system integration.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

According to predictions from GlobalData, the future space economy will expand to include space debris, space mining, space exploration, space tourism and space infrastructure manufacturing.

Satellites will provide up to 70% of the space economy’s growth in the near term, facilitated mainly by the widespread adoption of reusable launches in the SpaceX vein. This burgeoning sector will disrupt many industries, from internet provision to mining and construction.

By 2040, the space economy will be broken down into the following sectors: Internet (39%), ground equipment (19%), government (17%), consumer TV (11%), consumer broadband (9%) and other (5%).

Satellites in 2022

The top two deals in the space economy in Q3 2021 were satellite-based: Hanwha Systems’ stake acquisition in OneWeb, and the merger of Virgin Orbit with NextGen Acquisition Corp II.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn August, South Korea-based defence electronics company Hanwha Systems acquired an 8.8% stake in UK-based OneWeb (Network Access Associates) for $300m. OneWeb is a low-Earth orbit (LEO) satellite communications company. The deal will bolster Hanwha Systems’ communications capabilities in areas without internet provided by fibre optics.

Also in August, space solutions company Virgin Orbit merged with NextGen Acquisition Corp II, a special purpose acquisition company (SPAC). Virgin Orbit provides launch services for small satellites and “Satellites-as-a-Service” The aim of the merger is for Virgin Orbit to become a publicly traded company. The deal was worth $483m.

More companies will jump on the small-sat bandwagon in 2022, as innovation and economies of scale have enabled LEO constellations and fuelled satellite internet aspirations.

SpaceX dominates the LEO satellite market, with the Starlink constellation constituting 51% of commercial satellites. By 2030 there will be at least 10,000 commercial satellites.

Inmarsat will launch a constellation combining the properties of LEO and higher altitude satellites to create a seamless network, while China’s Geely plans to build a satellite constellation to guide its autonomous vehicles.

China has been increasingly testing space technologies and is viewing space as a critical domain. This investment will continue throughout 2022 with an increased focus on satellites for missile detection likely. According to Euroconsult, China could claim a decent share of the emerging mini-satellite business, which it forecasts to reach $15bn in revenues by 2027.

In space, no-one will clear debris

Growing demand for satellite and space debris tracking technology will also spur investment from the defence market in 2022.

As the number of satellites increases, so does the problem of space pollution. NASA estimates that there are currently 6,000 tons of waste material occupying LEO, in the 500–2,000km range. Data from the Union of Concerned Scientists (UCS) satellite database meanwhile reveals that 55% of the active satellites currently orbiting the planet were launched in the last two years.

The increasing commercialisation of space due to reduced launch costs has led to growth in LEO satellites so that they now constitute 83% of all active satellites.

LEO is already littered with the debris from anti-satellite tests with up to 5,000 smaller, un-trackable fragments posing a collision risk. The addition of LEO satellite constellations will only worsen the situation, increasing the potential for numerous space collisions.

Both SpaceX and its prospective competitors have thousands more LEO satellites in the pipeline and the rapid acceleration of satellite launches shows no signs of slowing.

If the space economy is to continue its upward trajectory, strong regulation, the rapid development of space debris tracking and space debris removal technology will be required.

Work will be done in 2022 to attempt to tackle the issue: SpaceX has tested a number of measures such as painting satellites black as well as obtaining permission to place satellites in lower orbits to reduce deorbit times and therefore the amount of space debris.

Space debris removal tech is already advancing. UK start-up Lumi Space has developed a commercial satellite laser ranging (SLR) service, which promises to track space debris with centimetre precision.

Last summer saw Japan’s Astroscale successfully demonstrate how their dual satellite mission uses a system of magnets to collect space debris and then combust on re-entry.

The company raised $109mn in a Series F round of financing in November 2021, bringing its total funding raised to date to $300mn.

Meanwhile LeoLabs, a provider of data services to track space debris and prevent collisions in LEO, has so far raised $82m in funding according to the GlobalData deals database.

Space economy tourism in 2022

The next phase of the space economy will see commercial bodies adopt an increasing role in space infrastructure. For example, Blue Origin plans to launch a commercial space station following similar announcements from Lockheed Martin and Voyager Space Holdings.

Axiom Space’s award of exclusive access to a module of the International Space Station (ISS) by 2024 is another example of commercial actors having a sustained presence in space. This will continue in 2022.

Hefty price tags will continue to hamper space tourism, though. High-profile commercial flights have led some to dub the current phase of the space economy the “billionaires’ space race”. The launch of Richard Branson and Jeff Bezos on their respective Virgin Galactic and Blue Origin missions highlighted the potential for space tourism.

However, the scrapping of Space Adventures’ Crew Dragon mission demonstrated that price, timing and the experience currently offered are stifling customers’ appetites. Although space tourism will be restricted to the few, new actors such as Space Perspective can be expected to enter the market offering lower-cost alternatives.

“Timely and accurate intelligence and communication is the lifeblood of military operations, and space-based capability is essential,” reports GlobalData.

“The commercialization of space is a key driver in the contemporary space systems market, with technological advances not only improving the capabilities of satellites but reducing costs throughout the supply chain.

“It is likely that space will increasingly become a theatre in which contests are fought between commercial adversaries.”