Ride-hailing service Uber has provided drivers in the UK’s capital city with a £5k electric vehicle (EV) grant as sharing economy venture capital activity remains below pre-pandemic levels.

The grant is available to Uber drivers located in London and can be used towards the purchase or lease of new EVs.

Uber has also partnered with charging infrastructure supplier BP Pulse to provide its drivers with £250 worth of free charging for the first three months of EV ownership.

Andrew Brem, Uber’s UK manager, stated that now was the time for Uber to make progress with its electrification ambitions.

“Uber drivers can be the catalyst for accelerating electrification across the transport sector, but collaboration will be crucial to combat air pollution and work towards a more sustainable future,” he said.

The sharing economy market generated roughly $200bn in revenue in 2022. It

is expected to reach over $1trn in revenue by 2031, according to forecasts from research and analysis company GlobalData.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

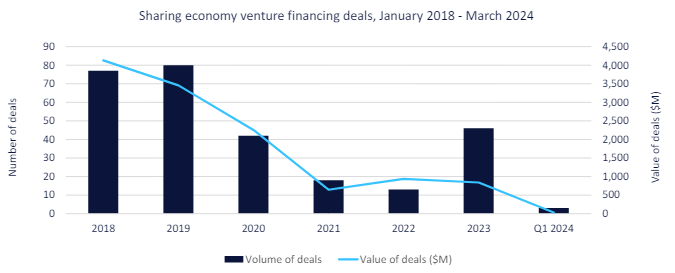

By GlobalDataDespite this projected growth, GlobalData reported that VC activity in the sharing economy has not yet returned to pre-pandemic levels.

GlobalData’s 2024 thematic intelligence report into the sharing economy posited that VC investors were grappling with liquidity issues and high interest rates and that this may explain some of the decline in activity.

Despite this decline, ride-hailing services remained the top companies securing the most VC investment in 2023 and 2024. This was despite them experiencing the sharpest decline in 2020 and 2021 due to widespread global lockdowns during the COVID-19 Pandemic.

Bolt, Didi Chuxing and Grab were the ride-hailers who received the most investment.

Bike and scooter rental platforms are also experiencing growth, which GlobalData explained highlighted an expanding need for shared mobility.