Google has signed a clean energy agreement with Japanese raw materials company Itochu to help achieve Google’s Japanese ESG commitments as regulatory pressure increases worldwide.

According to the agreement, Itochu-owned Clean Energy Connect will provide Google with solar power in 2026.

Google Japan’s vice-president, Shinji Okuyama, stated that the partnership was in direct response to consumer needs for cleaner energy.

“We have set an ambitious 2030 goal to run on 24/7 carbon-free energy on every grid where we operate and this power purchase agreement brings us one step closer to achieving it,” he said.

“Through this project we are enabling an aggregated network of small-scale solar plants across multiple grid regions to support our Inzai Data Center and our growth in Japan,” Okuyama added.

In its 2024 ESG sentiment polls, research and analysis company GlobalData noted that businesses worldwide were under tighter regulatory pressure than ever before to deliver on their ESG commitments.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

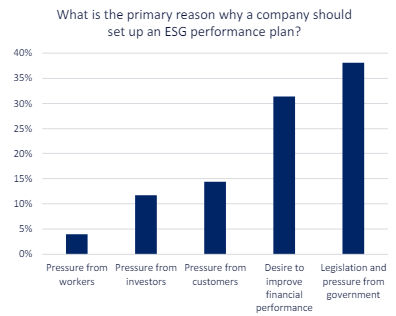

By GlobalDataGovernmental pressure was the primary reason given for introducing ESG policies, according to the businesses who took part in the survey.

Around 38% of respondents named governmental pressure as the reason for their ESG commitments in the first quarter (Q1) of 2024, an increase from just 18% in Q4 2023.

Pressure from customers and financial success were the other largest drives behind the introduction of ESG commitments, while pressure from investors and workers remained low.

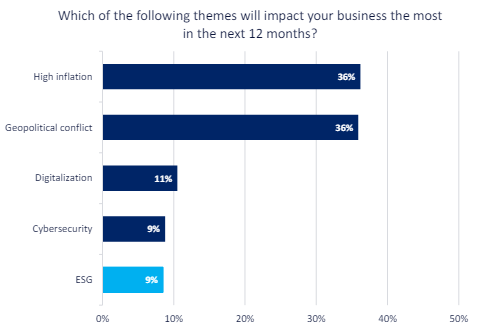

Despite rising regulatory pressure, businesses continue to not see ESG as a major short-term concern for their performance.

High inflation and geopolitical concerns were tied as the biggest concerns, with each theme being named as the top priority by 36% of respondents.

In comparison, only 9% of businesses named ESG as their top concern in the next 12 months. GlobalData noted that, while low, this had increased from just 4% in Q4 2023.