According to research from analytics firm GlobalData, the robotics industry was worth $45.3bn in 2020. Researchers forecast a compound annual growth rate of 29% and expansion to $568bn in the year 2030. But where does UK automation fit into this picture? And how important to it is grocery tech company Ocado, rated by GlobalData as the leading British brand for robotics in a recent report on robotics?

One piece of data behind the robotics boom is declining fertility rates, which is definitely a relevant issue for the UK. Data from the International Federation of Robotics (IFR) shows the top 20 countries for robot density in manufacturing industry in the pre-Covid normality of 2019, as led by Singapore. Robots here of course refers to machines one can mainly find in workspaces of the industrial sort, such as the grocery packing robots in Ocado warehouses. It doesn’t involve any robots which are confined to labs, theme parks and company keynote product hype .

Using statistical data from the World Bank, one can see all the top 20 countries for robotics have a fertility rate below 2.1, the baseline needed to ensure a broadly stable population.

The trend doesn’t show more robots in the labour force where there are lower rates of birth, which one might find a plausible notion. Singapore, for example, has a higher fertility rate (1.14) than the second-highest nation in the rankings, South Korea (0.92), with 988 robots per 10,000 employees compared to Korea’s 855.

It remains clear though that birth rates are low for the twenty leaders with an average fertility rate of 1.4. A recent robotics report by GlobalData posits that robotics can help address future shortages in the workforce, which is likely to come with ageing populations. This is already a worldwide trend, and as such it’s interesting to examine countries which have low birth rates but are not in the top 20 IFR list.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataWhere are all the British robots?

The UK is one such example, recording a fertility rate of 1.65 in 2019. And yet the country doesn’t rank highly for robotics, despite sharing similar GDP, immigration and sector profiles to countries on the IFR top-20 list. In other words, Ocado remains an outlier in UK industry.

Consider Norway for example, a country also missing from the list whilst also sharing similarities with others in the chart, and which recorded an even lesser fertility rate of 1.53 in 2019. According to a study from the same year in Wiley journal New Technology Work and Employment, the absence of robots in Norway can be put down to strong workers' rights.

According to the study, Norway has "strong tripartite concertation, multi-level collective bargaining (covering 70 per cent of the workforce), a high and relatively flat wage structure, and extensive co-determination and collective voice mechanisms at the workplace.

"High labour costs may encourage economic activity to transfer into more productive sectors and workplaces in Norway...whereas the UK has a ‘long tail’ of low productivity companies," the study reports as a reason for low robot density in the UK, whilst acknowledging the academic advantage the country has over Norway when it comes to robotics.

“The list tells us where there is a high number of robots in industry per 10,000 human employees,” says Antonio Espingardeiro, IEEE member and software and robotics expert, talking to Verdict. “However, the numbers refer only to robots and technology already installed in manufacturing settings. This does not represent research and development in robotics per country.

“I believe the UK is doing well in technologies such as machine learning with breakthrough: consider the research coming from national universities at the moment. These advancements are definitely influencing the future of robotics and indeed, industry in general.”

Espingardeiro touches here on artificial intelligence (AI), another driver in the boom of robotics that has been covered by Verdict previously. Based at Salford University, the robotics expert points to medical robotics work from Imperial College London and Birmingham University as worth highlighting, along with tactile robotics research at Bristol Robotics Lab and Cambridge University's autonomous vehicle work.

“There are of course many more, but one thing is for certain, what these institutions are studying and working on will inevitably influence the future.”

Away from academia and into the commercial world one can find more downbeat views on British robotics. One such is offered by Peter Schroder, chief technology officer at Karakuri, a leading food service robot maker based in London which last year had a £6.5 million ($8.73 million) funding round led by Ocado.

“UK-based manufacturing businesses often find it difficult to raise the capital required to invest in automation,” Schroder explains. Recent ONS numbers bear this out, with the Wiley study noting investment in R&D and capital is "relatively low" in the UK at 1.7 per cent and 16.5 per cent of GDP, respectively, in 2017. In spite of its weaker labour laws, it may be that human jobs are, rather ironically, safer in the UK due to low investment preventing robot infiltration in the workplace.

“Other countries at the top of this list have very strong sustained strategic support from their governments to facilitate and fund large scale capital investments in robotics,” Schroder adds.

Why Ocado is a leader in UK automation

In a possible harbinger of things to come for an aged population with a diminished labour force, recent supply chain woes in Britain have seen, among other things, empty supermarket shelves, with warnings that the troubles may last until 2023.

One brand may have got the jump on others in the grocery space, though: Ocado. The online grocery technology company is primarily a logistics business that licenses its robot technology to grocery retailers around the world, hence its heavy investments in robotic disruptors such as Karakuri.

"We are proud to be ranked as the best UK company for robotics by GlobalData," says Alex Harvey, Chief of Advanced Technology at Ocado Technology, "(and) we are committed to developing our robotic capabilities to change the way the world shops... solving some of the most complex challenges in automating online grocery such as automated robotic picking and packing."

Harvey adds that the company's capabilities in AI and robotics enable it to achieve " fresher food, greater convenience and choice (and) lowest rates of food waste" for Ocado's retail partners.

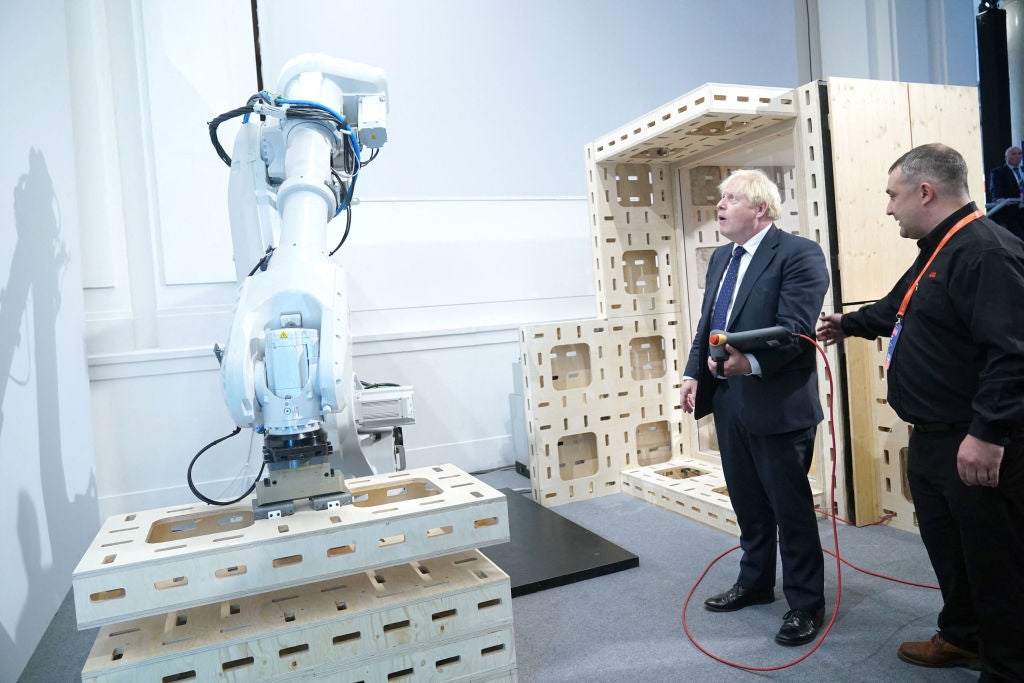

The company’s grocery-sorting robotic arms are an example of the logistics robot segment. This sector of service robots, focused on logistics, packing, warehousing and deliveries, is a key emerging area for robotics.

As GlobalData reports, retail logistics' increasing reliance on robotics was highlighted in 2021 when a fire caused by a robot collision at one of Ocado’s customer fulfilment centres forced it to cancel thousands of orders and caused its share price to drop by nearly 5% in one day. Ocado's report for the third quarter (Q3) during which the fire occurred notes revenue declined by 19% in its aftermath, with an estimated loss of £35m in orders.

This wasn’t the first Ocado robot mishap, either; a previous fire saw one of its warehouses burnt to a crisp. The culprit? An electrical fault in a battery charging station for its robots.

Despite the incidents, Ocado Retail's Q3 report forecasts strong revenue growth in 2022. The company also remains one of the top 20 companies in GlobalData’s Industrial Automation thematic scorecard.

The analytics firm uses a scorecard approach to predict future leading companies within each sector, and Ocado is one of only three UK/Irish brands in the top 20 for automation, ranking at 17 between AVEVA (8) and Accenture (19).

“Robotics is not one of the top 10 themes in ecommerce,” explains Filipe Oliveira, senior thematic analyst for GlobalData. “This doesn’t mean that robotics isn’t not important for retail, just that it didn’t make the top 10 themes for that sector.”

The analyst also doesn’t think safety concerns with robots will put off investors, hence Ocado’s perfect and intact score of 5 from GlobalData in the robotics theme, as based on a scale of 1–5. These scores represent GlobalData analysts’ assessments of the competitiveness of each company regarding a particular theme. They are then weighted based on their importance and used to create the final industry ranking in the scorecard.

“Of the three incidents in Ocado warehouses in the last two years, two have been linked to batteries so they can be an issue. But batteries can catch fire in smartphones too and we use them regardless. There are risks but big incidents are rare.

“Ocado processes 15,000 orders a day," Oliveira elaborates. "If each order has an average of 10 items (a conservative estimate given that the average basket size is between £100 and £150 depending on the time of the year), then robots move at least 150,000 items daily. That’s a lot of robots moving around in Ocado’s hive every day. And yet there have been few incidents.”

Ocado also ranks well due to the current paradigm defined by the dual-headed impacts of 2020 upon UK business: pandemic and exit from the EU. When it comes to resilience towards Covid and its positioning in a more automated future of work, Ocado scores 4 for both themes.

“Robotics can fill some of the gaps and Ocado was ahead of the curve,” Oliveira adds. “Even without (the accelerators of) Brexit or Covid, there would be shortages. In terms of food supply chains, robotics can fill gaps in warehouses but also at other points in the supply chain, for example in fruit picking, an area that is also seeing shortages due to Brexit and Covid.

“In terms of shortages, we can see it from the demographics perspective or the economic perspective. There’s a shortage of workers but also for the first time in a while the cost of labour is increasing. Companies looking at increasing productivity might consider investing in technology instead of hiring the cheap labour that they were used to finding easily pre-pandemic and pre-Brexit.”

Ocado cake challenge

Ocado therefore may have an advantage in offering such technology to clients. But Oliveira reckons Ocado, a brand which defines itself as a tech company opposed to an online supermarket, may at some point need to stop having its cake and eating it.

“Amazon has 350,000 warehouse robots (200,000 in 2019 and only 15,000 in 2014) but actually doesn’t sell them. It can be risky to divert intention from the ecommerce side of the business.

“I’m not aware of anyone else doing it and at some point Ocado will probably have to choose between being a supplier of technology or an online retailer. On the other hand, Amazon is not focused at all and yet it is a very successful company.”

Away from its robotics side and into its retail division, Ocado's Q3 report predicts a £5m impact on overall financials due to the rising costs of labour, particularly for LGV and delivery drivers. In other words, the retail side of Ocado and the humans that make it possible remain important, as its technology chief tells Verdict. After all, while a robot can pick the right goods, it still can't get those goods to the customer alone.

"Customers will become more discerning about the service they receive: looking for accurate, on-time deliveries, a wide range of products, minimal substitutions, delivery in a way that is convenient to them, and offering value," says Harvey.

Looking closer at the GlobalData scorecard, Ocado has the chance to go all-in on the technology side. While it may rank lower than AVEVA for industrial automation as a whole, it ranks higher for robotics with its score of 5. The advantages AVEVA has are in the themes of cybersecurity, virtual reality, edge computing and digital twin technologies. Ocado would only need to improve in these areas to be a higher leader in industrial automation, but for now it already stands strong in not just robotics but AI, the industrial internet and wearable tech themes.

Compared to Ireland’s Accenture, which scores just 2 on robotics, it’s clear Ocado has few competitors across the British Isles. This could be both blessing and curse, though. Competition always drives innovation. Schroder suggests that such a lack of competition points to a lack of investment in UK automation as a whole.

“Strategic direction from the government is needed to make the UK a world leader in robotics and automation,” says the Karakuri CTO. “The current labour crisis for low skilled workers shows the opportunity for automation if the government seizes the moment to support the investment.”

UK automation therefore needs more than just an army of Ocado robots to survive a winter of discontent and a bleak future of skewed demographics.

Find out more in the GlobalData Robotics: Thematic research report and GlobalData’s Industrial Automation thematic scorecard.